TMTB Morning Wrap

This will be the last day of posts until Jan 2nd. Thank you for a great year and I look forward to lots more in 2025!

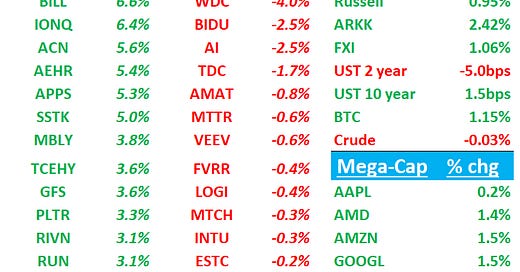

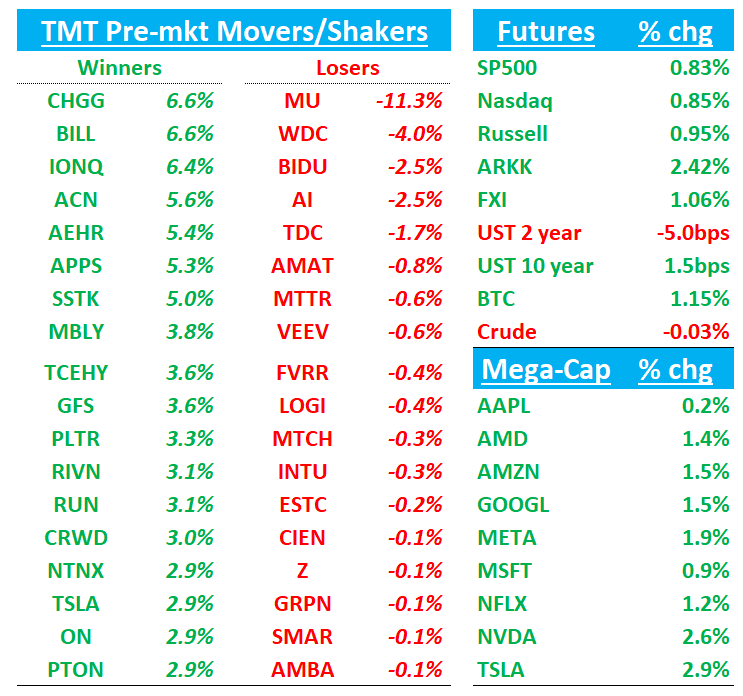

Good morning. QQQs +80bps grabbing some gains back after yesterday afternoon’s plummet. 2 year down 5bps while 10 year up 1bp. BTC +1%; China +1%. Let’s get straight to it…

MU: Inline Q1 and much worse Q2 guide on eSSD and DRAM weakness overshadow positive AI commentary

Q1 results showed inline revenue with slight EPS beat, driven by strong DRAM shipments and pricing offsetting NAND weakness. Datacenter revenue (HBM, server DRAM, enterprise SSD) grew 40% sequentially to over 50% of total revenue. Q2 guidance disappoints with 9% sequential decline on consumer market weakness, though margins guided down only 100bps to 38.5% on favorable mix and improving HBM yields.

Mgmt sounded positive on HBM momentum as expected calling out acceleration with doubled sequential revenue, accretive margins, expanded customer base and raised market forecasts ($30B+ 2025, $65B 2028, $100B+ 2030). Company expects to achieve overall DRAM market share in HBM by H2'25, with expanded NVDA platform presence. FY25 $14B capex focused on DRAM/HBM expansion while moderating NAND investment.Mid-teens DRAM bit demand growth projected for 2025, while NAND lowered to low-teens with reduced utilization.

Bulls will say hang in: MU trading a trough P/E multiples, DRAM inventory correction should finish by 1H’25 as it has been occurring for several months and DRAM companies are lowering capex and production along with higher DRAM content in IPhone 17, and that once we get into 2H focus will completely shift to HBM where mgmt was actually more bullish than expected and accretive margins will help drive EPS close to $14 in FY’26.

Bears will say GMs worse than expected, NAND weakness continues unabated while sequential decline in DRAM is worrisome as there no line of sight for end demand to get better as of now. Bears will also say waiting for 2H in memory cycle terms is a long time and stock trades at 2x book, not particularly cheap historically for MU.

Gets a downgrade this morning at BAML to neutral as the firm, whose estimates were below consensus heading into Q1 results, is reducing estimates again as gross margin is expected to stay weak in Q2 and even Q3.

What’s our take?

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.