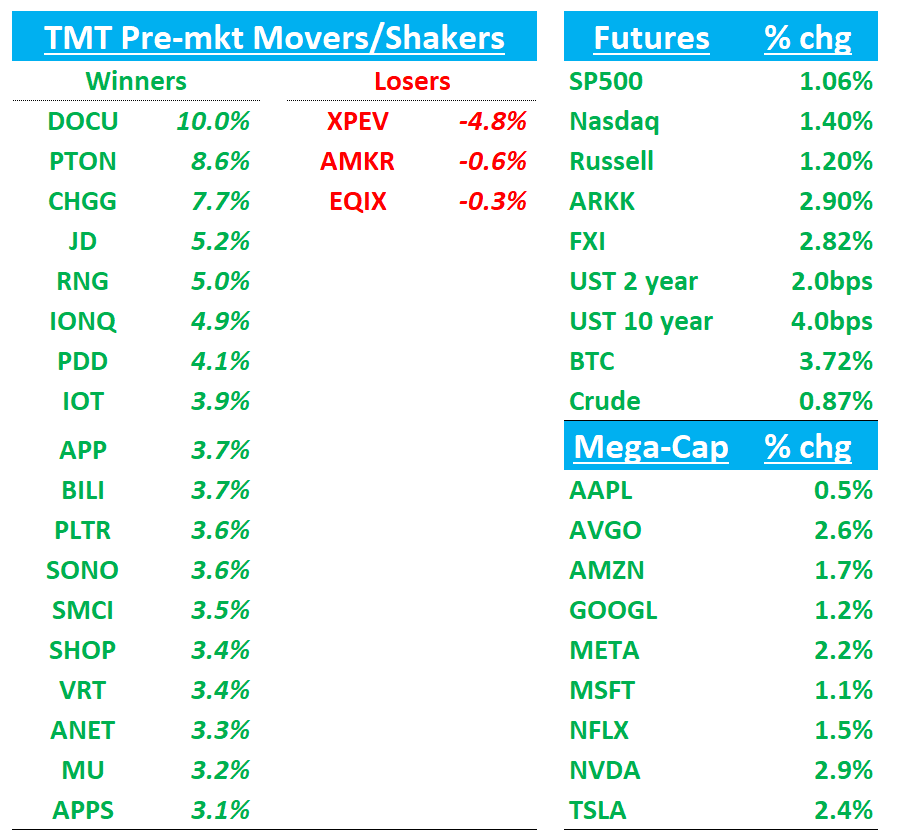

QQQs +1.4% — market bouncing today as yesterday price action began more seriously trading a recession scenario, feeling partly capitulatory near-term. Not much red on my screen pre-market. Yields up 2-4bps across the curve. BTC +4%. China +3%.

Let’s dive straight in…

MU: Warren Lau at Alethia upgrades MU

Alethia upgrades on improving memory demand-supply dynamics and Micron potentially becoming a key HBM supplier to NVIDIA and hyperscalers. Alethia notes DRAM ASP in Q2 2025 will likely exceed expectations due to solid AI server demand, robust Chinese mobile sales from subsidies, and accelerated PC shipments ahead of potential tariffs. If demand persists through H2 2025, DRAM prices could rebound starting Q3. For NAND, Alethia expects supply-demand to improve in H2 2025 following industry production cuts from Q1 2025. lethia says Micron may benefit from American manufacturing policies as it emerges as a vital HBM supplier. Alethia's research shows Micron doubling TSV capacity in FY26 and accelerating 12Hi HBM conversion by mid-2025. With successful execution, Micron could become the second-largest HBM supplier by 2026 with 25-30% share, worth $15bn (3x YoY) in FY26.

Earnings quick hits:

DOCU +11%: Solid Q4 (6% billings beat) driven by early renewal and strength from IAM and self-service in the SMB segment + solid FY26 outlook (subs revs and billings ahead at 6-8% vs street at 6%) but total rev and op mgn below street…No macro weakness seen to date.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.