TMTB Morning Wrap

After a long couple months in the markets, we’re taking a 3 day weekend for some R&R. We’ll be back on Monday. Have a great weekend!

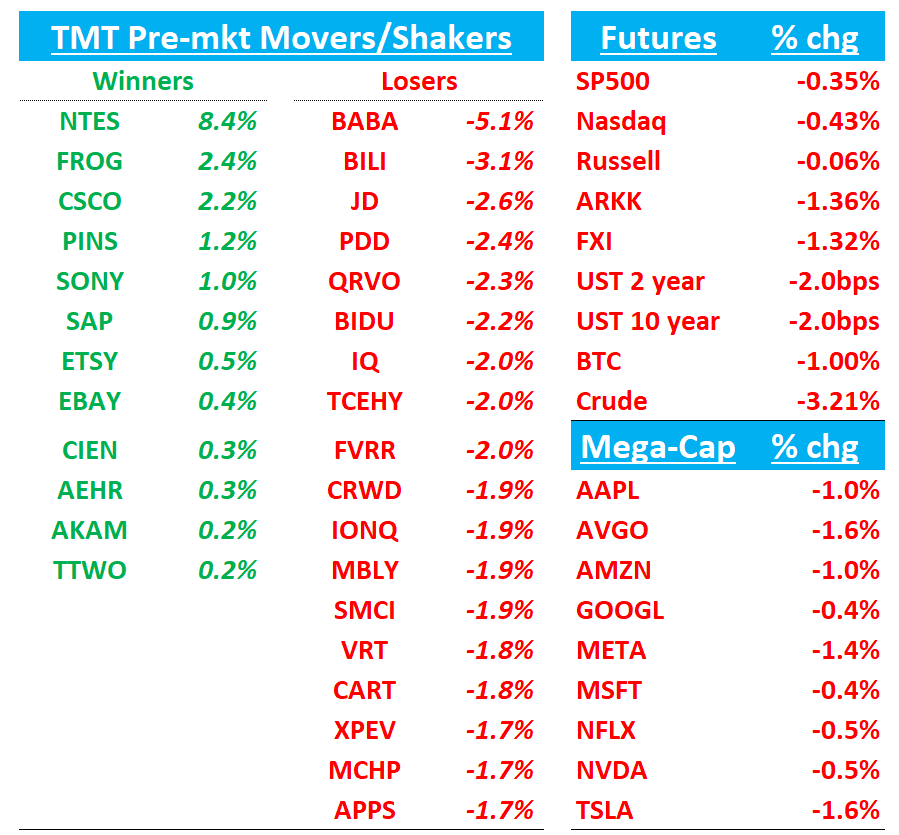

QQQ -60bps. Oil -3% as Trump said the US is getting closer to a deal on Iran’s nuclear program. Safety (telco/cable) getting a bid this morning while beta names pressured early. Yields ticking down slightly. China -1.3%. BTC -1%.

Let’s get straight to it…We’ll hit up CRWV, CSCO, BABA earnings first, then dive into Tech Research/News/3p

EARNINGS

CRWV -2%: Big revenue beat, inline-ish RPO. Q2 rev guide better / margin guide worse.

Headline says it all: decent results with a few things to pick at…print does nothing to change bull vs. bear debate…

Results:

Q1 Revenue $982 million (+420 % y/y) vs Street at $851 million (~15 % beat).

Q1 RPO $14.7 billion (-3 % q/q) vs 4Q24 $15.1 billion; total backlog incl. OpenAI $25.9 billion (+63 % y/y) bs bogeys of $26-$27B…Mgmt said they will be reporting backlog as well as RPO moving forward and investors should focus on the $29B backlog number for 2Q

Q1 Non-GAAP operating income $163 million vs Street ≈ $151 million (~8 % beat).

Operating margin 16.6 % vs Street 17.7 % (-110 bp).

Q1 CapEx $1.9 billion vs Street ≈ $2.6 billion (timing-driven underspend)

2Q revenue guide $1.08 billion midpoint vs Street ≈ $0.98 billion; FY-25 revenue guide $5.0 billion midpoint vs Street ≈ $4.6 billion.

2Q non-GAAP operating-margin guide ~14.5 % vs Street ~19 % (investment drag).

Key takeaways:

• Demand picture: management is seeing “broad-based acceleration” in inference workloads as enterprises move from experimentation to production, while training demand remains robust. No macro slowdown despite geopolitical noise; tariff-related cost pressure called “marginal.”

• Deal momentum: new $11.2 billion OpenAI contract (accounting keeps it out of RPO for now) and $4 billion expansion with a large AI enterprise signed early 2Q; an additional hyperscaler logo joined the platform. These wins pushed contracted power to 1.6 GW (+300 MW q/q).

• CapEx ramps hard from here: FY-25 spend raised to $20-23 billion (~ +17 % vs Street), with $3-3.5 billion slated for 2Q, as CoreWeave pulls forward Blackwell deployments and data-center build-outs to meet demand…CapEx will materially be financed with debt which will also increase interest expense.

• Margins: interest-expense step-up and IPO-related G&A drove the EPS miss; management flagged further margin dilution near term as opex and interest scale ahead of revenue.

• Leverage (including leases) sits near 5× but is expected to climb with the debt-financed CapEx surge.

A little something for both the bulls and bears although this print won’t change many minds…

Bulls will say CRWV is the pure-play AI hyperscaler—able to stand up large GPU clusters faster than hyperscalers, now layering acquired software on top of best-of-breed infrastructure. They point to unprecedented backlog visibility, accelerating inference demand, first-mover scale in Blackwell, and a path to expanding ROIC as deployed power catches up to spend.

Bears counter that the model is capital-intensive and increasingly leveraged, with margins pressured by skyrocketing interest expense and front-loaded opex (that is: higher interest expense lower than ROA). Customer concentration (OpenAI/Microsoft-linked) and the risk that hyperscalers insource inference, or custom ASICs erode GPU demand, could flatten growth just as debt peaks. RPO nuances and weaker cash conversion raise questions on revenue quality, and the stock already trades at premium.

Morgan Stanley sums up the quarter well: CoreWeave's first quarter out of the gate "gave new talking points to both the bulls and bears," as the company responds to an "acceleration of customer to demand" with a faster pace of build out of their GenAI infrastructure, Keith Weiss wrote. While accelerated build-out enabled a large revenue beat in Q1, it also increases interest expense and capex expectations for FY25, pressuring near-term free cash flow, says the analyst, who calls CoreWeave "a solid [long-term] play on an emerging GPU economy."

DA Davidson cuts CoreWeave to Underperform, says 'not a business worth scaling'

The first detailed earnings report, with updated actuals and guidance, confirms the firm's concern that CoreWeave is "not a business worth scaling, and we question the value of the equity," the analyst tells investors. The firm believes CoreWeave is a business not worth scaling if it can only generate 5% returns on its assets and has to pay 12.5% interest on the debt necessary to acquire those assets, arguing that the notion that "this destruction of capital is a matter of scale does not hold up" for a company at a $4B revenue run rate already operating 33 data centers.

CSCO +2.4%: Very solid beat and raise + AI beats as mgmt sounds v bullish on AI opportunity. Better networking vs lower security + observability

Sentiment was mixed to positive heading in, but another solid print should continue to support bulls’ contention that CSCO is a significant beneficiary from AI (hit their $1B tgt a quarter early).

Key Takeaways:

• Demand & macro: Management said they see “no meaningful change” in enterprise or public-sector spending and little evidence of tariff-related pull-forwards or macro pause; if tariffs stick, Cisco can raise prices but hasn’t yet….Americas performing best (+14% Y/Y) followed by EMEA (+8%) and APJC (+9%)

• AI momentum accelerating. Web-scale AI switch/optic orders topped $600 million in the quarter, lifting YTD to $1.3 billion; Cisco now points to inference workloads and sovereign/Tier-2 hyperscalers as the next leg of growth, with HUMAIN and G42 (Saudi) flagged as pipeline examples…Cisco's orders at three out of the six largest hyperscalers grew triple-digits year-over-year in Q3 and it saw acceleration across all six customers

• Mix shift to recurring. Software revenue jumped 25 % Y/Y and subscriptions are more than half of sales, boosting visibility and RPO to $41.7 billion (+7 % Y/Y).

• Security still lagging. Legacy firewall drag left Security and Observability below expectations; new offerings (XDR, Hypershield) are growing but cannibalisation and long sales cycles temper inflection.

• Tariffs in guidance. Q4 margin outlook bakes in ~50 bp sequential GM/OM hit from the July tariff step-up; management assumes no mitigation yet.

Results

Revenue $14.15 billion (+11 % Y/Y) vs Street ≈ $14.05 billion (~0.7 % beat)

Non-GAAP EPS $0.96 vs Street ≈ $0.92 (4 ¢ beat)

Non-GAAP gross margin 68.6 % vs Street 68.0 % (+60 bp)

Non-GAAP operating margin 34.5 % vs Street 33.8 % (+70 bp)

AI infrastructure orders $600 million in Q3; $1.3 billion YTD vs FY-25 target $1 billion (hit a quarter early)

Product order growth +20 % Y/Y (+9 % ex-Splunk); subscription revenue +15 % Y/Y (56 % of total)

Next quarter (F4Q FY-25) guide

Revenue $14.5 – $14.7 billion (midpoint $14.6 billion) vs Street ≈ $14.5 billion

Non-GAAP gross margin 67.5 % – 68.5 % (midpoint ≈ in-line with Street 68 %)

Non-GAAP operating margin 33.5 % – 34.5 % (mid-point ~50 bp below Street)

Non-GAAP EPS $0.96 – $0.98 vs Street ≈ $0.96

FY-25 revenue guide midpoint $56.6 billion vs Street ≈ $56.4 billion; non-GAAP EPS guide $3.77-3.79 vs Street ≈ $3.73

Bulls will like this print, which supports medium/long term bull case…

Bulls argue CSCO is pivoting from low-growth hardware to an AI-centric, software-heavy model: AI orders are scaling fast, Silicon One is winning share as hyperscalers diversify chips, recurring software now anchors more than half of revenue, and valuation (≈15× FY-26 EPS) still lags networking peers despite better growth and FCF.

Bears counter that the AI tailwind masks stubborn challenges: core security growth trails best-of-breed vendors, tariff-driven margin erosion could persist, legacy campus switching faces intensified price competition, and the stock’s multiple already bakes in flawless AI execution while cash conversion wanes when inventory builds. Persistent macro uncertainty and potential CIO budget pressure keep downside risk to orders.

Wells Fargo analyst Aaron Rakers upgrades Buy from Equal Weight with a price target of $75, up from $72, following the fiscal Q3 report. The firm cites the company's accelerating artificial intelligence momentum for the upgrade. Cisco's orders at three out of the six largest hyperscalers grew triple-digits year-over-year in Q3 and it saw acceleration across all six customers, the analyst tells investors in a research note. In addition to webscale momentum, Cisco appears to be a visible player in large-scale sovereign AI opportunity, contends wells. With increasing confidence in a normalizing order growth recovery, Wells sees Cisco as presenting a continued earnings upside and "value re-rate story."

BABA -4%: Looks mixed with inline revs (better Taobao/Tmall + Cloud) but slightly lower EBTIDA

Call ongoing…

Total revenue +7 % YoY to RMB 236 bn, in-line with consensus

Adjusted EBITA +36 % YoY to RMB 32.6 bn, ≈ RMB 0.5 bn below Street (Cainiao and Local Services still loss-making)

Non-GAAP net income RMB 30 bn, essentially in-line

Capex RMB 24.6 bn vs RMB 31.8 bn prior quarter

Segment highlights

Taobao & Tmall (TTG): revenue +9 % YoY; core-marketing revs +12 % (Street +8 %); adjusted EBITA +8 %, margin roughly 41 % (-1 ppt YoY)

International Digital Commerce (AIDC): revenue +22 % YoY (Street expected +27 %); growth cooled but losses narrowed

Local Services: revenue +10 % YoY vs Street +12 %; business remains loss-making and weighed on group EBITA

Cainiao: revenue -12 % YoY (Street flattish); volume softness and operating loss led to EBITA miss

Cloud Intelligence: revenue +18 % YoY vs Street +17 %; adjusted EBITA margin 8 % (Street 9 %), showing solid top-line but lighter profitability

Digital Media & Entertainment: revenue +12 % YoY (Street +5 %); small contributor yet above-consensus growth

TECH RESEARCH/NEWS

Third Party Data Update

RBLX: Yipit said Hours Engaged tracking close to ~mid 50s QTD vs street at 24%

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.