TMTB MORNING WRAP

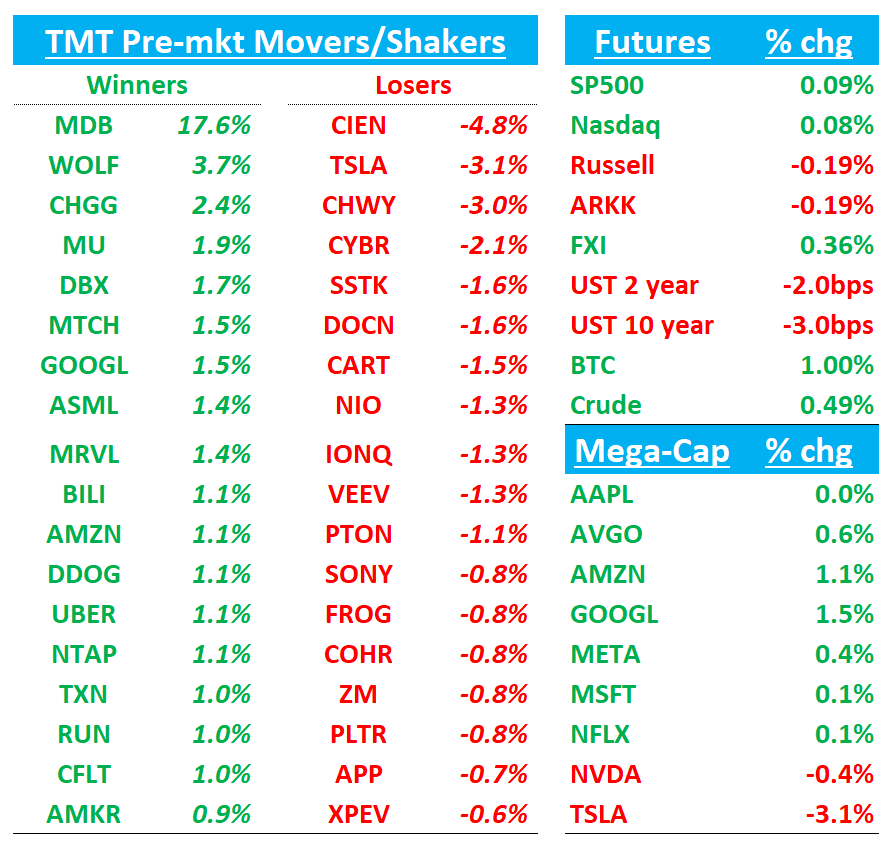

QQQs +10bps. BTC +1%; Yields ticking down slightly.

Lots to get to so let’s get straight to it - Earnings first then Tech/Research…

MDB +17%: Not much to dislike as Atlas acceleration and better operating margins drive the beat and raise vs. very low expectations

Q1 out-performed on every headline metric: revenue +4 % vs Street, Atlas +26 % y/y and re-accelerating vs street at 24% and bogeys at 25%+, non-GAAP EPS +51 % vs Street, and free cash flow almost 50 % above consensus. Margins were the other bright spot: Q1 operating margin of 15.9% was ~500bps ahead of consensus, far ahead of the high-end of original guidance of 10-11% and up over 860 bps YoY. Atlas is an accel vs 24% last quarter on a 2ppt easier comp. The comp gets 5ppts easier next q and guide only implies 23%, so bulls can now focus on a potential accel to high 20s.

Q2 revenue is guided to $548–553 m (mid point slightla head) with EPS of $0.64 at the mid-point versus $0.59 consensus; implied Atlas growth ~23 % while EA is set to fall high-single digits. FY26 revenue is now $2.25–2.29 bn, effectively matching the Street, but EPS guidance rises to $3.03 at the mid-point versus $2.61. FY26 operating income guidance of $277m higher than street by 20%+. Mgmt authorized $800M share buyback

Management flagged accelerating Atlas adoption, AI-driven workloads and the “highest net customer adds since 2019”. NRR ticked up to 119%. Customer momentum strongest in six years: total customers 57,100 (+2,600 q/q) beat by ~5 %; Atlas customers 55,800 (+4.7 % vs. Street)

Management said the April dip in usage was broad-based and linked to external economic and tariff uncertainty; May’s rebound underpins their view that secular drivers (app modernisation, AI-centric workloads) remain intact, but they kept a conservative stance on EA timing and overall consumption given the unpredictable macro backdrop. They only flowed through 10M of the 20M beat.

Bull-vs-bear narrative

Bulls argue that the first real re-acceleration of Atlas since FY22, record customer adds, and a swift margin reset under new CFO Mike Berry show MongoDB can sustain >20 % cloud growth and generate expanding cash flow even while EA declines. Atlas will likely accelerate again next few quarters given easier comps and better consumption reaching close to 30%. Guide looks very conservative given mgmt commentary. They’ll argue this print is good enough for a re-rate to 7/8x sales, which is $250-$280.

Bears counter that headline revenue guidance barely budged, implying management itself expects only mid-teens growth; EA still drags and could mask Atlas momentum if macro softens again. They remain skeptical that Postgres-based rivals—and hyperscaler native databases—will cap MDB share gains in the future, and they note that the stock’s ~6–8× EV/Sales multiple leaves little room for error if Atlas re-acceleration stalls.

Our view:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.