TMTB Morning Wrap

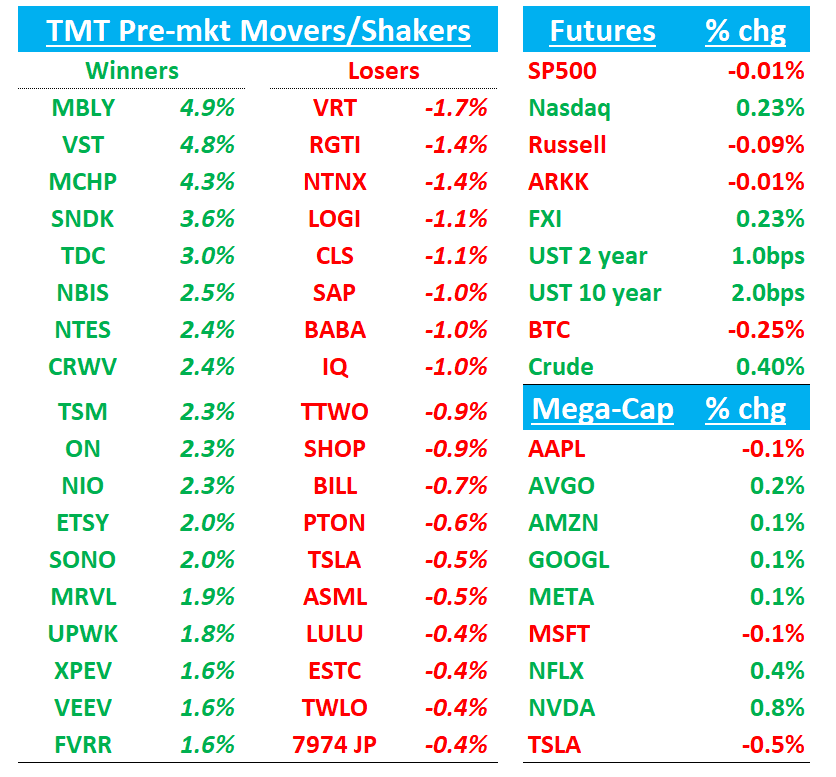

Good morning. Futures +20bps. Semis leading the way up early with SNDK +3%, TSM +2% to more new highs while analogs catching a bid after the MCHP pre-announce.

Stocks in Asia mostly up on Tuesday: TPX +1.75%, NKY +1.32%, Hang Seng +1.38%, HSCEI +1.05%, SHCOMP +1.5%, Shenzhen +1.4%, Taiwan TAIEX +1.57%, Korea KOSPI +1.52%. Softbank +2.5%. BTC -25bps. Yields up 1-2bps across the board.

CES and Jefferies Bus Tour (Agenda here) continues today. Some CES links below:

Official CES videos here: Official Stream: https://www.youtube.com/@CES/streams

Official CES Schedule: https://www.ces.tech/schedule/

The following are live blogging CES:

https://www.wired.com/live/ces-2026-live-blog/

https://www.techradar.com/news/live/ces-2026-live-all-the-latest-news-from-the-worlds-biggest-tech-show

https://www.tomsguide.com/news/live/ces-2026-live-latest-news

Lots of companies hosting 1x1 meetings with investors over the coming two days, including NVDA, MU, SWKS, ON, INTC, MRVL, ADI, SLAB CRUS, QCOM, SNDK, DELL, HPQ, CRDO

JPM fireside chat with NVDA today -link here … MRVL also fireside chat

Let’s get to it…

NVDA/AMD/INTC CES Recaps

Not a ton or market moving but overall all 3 sounded positive.

NVDA: management said Vera Rubin is in “full production” and still on track for a C2H26 ramp (with the usual “could still see technical/supply hiccups” caveat, though the ecosystem is further along vs Blackwell). They also leaned harder into “physical AI” as the next leg (e.g., Alpamayo for AV reasoning stacks; AV opportunity framed well north of $10B by 2030) and argued co-design across compute/networking/storage is the durability moat—even as AI ASICs keep gaining share on TCO.

AMD: Lisa sounded bullish with demand message very positive —exploding inference/token growth has customers compute-constrained, and AMD highlighted strong interest in its Helios MI455X rack-scale platform with launch still “exactly” on track for later this year (JPM estimates C3Q26) and MI500 still tracking for 2027. OpenAI’s Greg Brockman appeared and emphasized the supply-demand squeeze (OpenAI has been tripling compute but remains constrained), read-through a validation signal for AMD’s expanding hyperscaler/AI-lab engagement.

INTC: Intel’s key takeaway was “executing on the PC/edge AI roadmap”: Core Ultra 3 Series (Panther Lake) on 18A (RibbonFET + PowerVIA), with claimed 60% perf uplift vs Lunar Lake and up to 180 TOPS—enough to run a ~70B-parameter model—backed by a big OEM funnel (200+ PC designs) and push into embedded/industrial edge + handheld gaming. The broader thesis is that privacy/security/cost/data-control concerns make local compute increasingly compelling vs cloud for many AI workloads.

MCHP +4%: Positively pre announces for second time this quarter

TXN/ADI/ON. +1%, IFX+4%, STM+3%, ON+2.5%, NXPI+3% in sympathy

After the close, MCHP raised its F3Q26 revenue outlook to about $1.185B, up from the prior $1.149B, marking the second upward revision this quarter. The update implies roughly +4% Q/Q growth versus the prior ~+1%, reflecting a broad-based demand recovery as channel inventories normalize and earlier design wins move into production. Management noted strong December bookings despite seasonal headwinds, with the March quarter starting with a higher backlog than December. Improving factory utilization should also support gross margins into the March quarter.

APP: Citi Flags Softer eCommerce Client Trends Behind Recent Weakness

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.