TMTB Morning Wrap

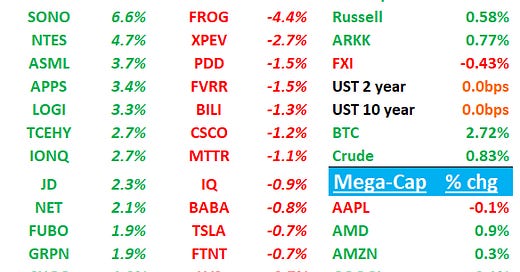

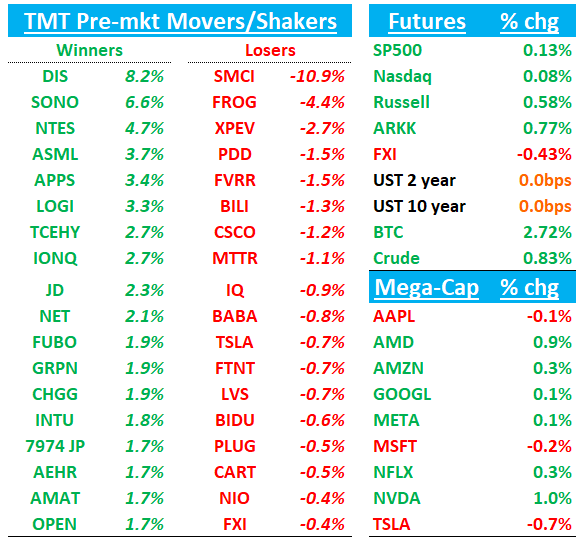

Good morning. QQQs +5bps; yields roughly flat; BTC +2.5% getting past $90k; DXY spiking another 40bps.

Let’s get straight to the recap…DIS/CSCO earnings recaps first then on to news/research…

DIS +9%: FYQ4 slight rev/eps beat and DIS+ subs beat (123M vs 120M), but big story is better 25 and 26/27 outlooks

The quarter came in slightly better with big DIS+ beat, a little better than what buyside/3p had been expecting.

The bigger positive is that DIS guided FY25 EPS to high single digit growth vs buyside something closer to 1-2% and their FY'26/27 outlook calls for low double digit EPS growth, which implies something close to about ~$6.75+ in EPS for FY27 (15x P/E). Street is closer to mid single digit growth for those two years.

Bulls will like this print as there had been some concern around initial guide and it seems like bundling strategy is paying off for DIS + and be able to feel comfortable with FY27 P/E of 15x for low double digit EPS growth, which is likely conservative. Not a ton to nitpick here for bears other than expectations were high, but quarter looked solid and guide a nice upside surprise. Bulls will say that improving DIS subs and guidance enough to get this to re-rate higher and why not pay 20x for $7 EPS power = $140. Doesn’t sound too bad to us.

DIS 2025 F/Y GUIDANCE

- Guides high-single digit adj. EPS growth (implies $5.3 - $5.4 vs buyside at $5)

- Guides CAPEX about $8B

- Targets $3B in buybacks

- Guides experiences operating income +6% to +8% y/y

2026 F/Y GUIDANCE

- Guides double-digit adj. EPS growth

- Guides double-digit growth in cash from operations

2027 F/Y GUIDANCE

- Guides double-digit adj. EPS growth

RESULTS: Q4

- ADJ EPS $1.14 vs. $0.82 y/y, EST $1.10

- Revenue $22.57B, +6.3% y/y, EST $22.47B

- Entertainment revenue $10.83B, +14% y/y, EST $10.66B

- Sports revenue $3.91B, +0.1% y/y, EST $3.95B

- Experiences revenue $8.24B, +1% y/y, EST $8.2B

- Total segment operating income $3.66B, +23% y/y, EST $3.71B

- Entertainment operating income $1.07B vs. $236M y/y, EST $1.16B

- Sports operating income $929M, -5.3% y/y, EST $904.4M

- Experiences operating income $1.66B, -5.7% y/y, EST $1.66B

- Disney+ Core subscribers 122.7M, EST 119.85M

- Disney+ Hotstar subscribers 35.9M, EST 35.63M

- Total Hulu subscribers 52M, EST 51.93M

- Hulu & Live TV subscribers 4.6M, EST 4.58M

- Disney+ Core ARPU $7.30, EST $7.34

- Disney+ Hotstar ARPU $0.78, EST $0.88

- Hulu SVOD ARPU $12.54, EST $12.82

- Hulu Live TV + SVOD ARPU $95.82, EST $95.83

CSCO - 1.5%: Solid quarter and better guide but concerns over order growth and weaker networking keep lid on stock

Overall, several puts and takes in the quarter. Stock was near highs and this print won’t shake bulls conviction of continued enterprise, networking and AI tailwinds as mgmt sounded confident in all of those, but not surprising to see stock down given big run up and several things for the bears to point to.

Bears will point to weaker orders (9% ex SPLK with tough comps ahead), security and observability #s which seem to imply SPLK revs were flat to down on a y/y basis, weaker Federal commentary (although mgmt said that is likely to come back), and GMs that were helped by a one time benefit. They’ll say unexciting for a mid single digit top line grower at 15x P/E.

No strong view on the stock here at TMTB

More details…

The positives:

Gross Margin rose +240bps to its highest in >20 years helped by Splunk, product mix, productivity enhancements) but they also called out it was helped by a one-time material benefit.

Cisco continues to highlight gains in both front-end and back-end cloud networks with webscale orders up triple digits and $300M in AI orders booked in the quarter (well positioned to exceed $1.0B orders for FY25).

Mgmt sounded good on the call talking up rev trends at cloud giants, allowing mgmt to feel comfortable with LT growth of 4-6%.

Total software revenue grew 25% and software subscription revenues were up 35% Y/Y. Enterprise orders were up 33% and Service Provider and Cloud orders were up 28% due to triple-digit growth for webscale, and public sector orders were up 2%. The telco environment remains muted but management mentioned a few points of growth, and also highlighted seeing early signs of enterprise refresh as these customers prepare to upgrade infrastructure.

Concerns/nitpicks:

GMs guided down to 68-69% next quarter

Overall product growth only 9% ex SPLK weaker as buyside wanted something in the 10s, especially as tough comps loom ahead.

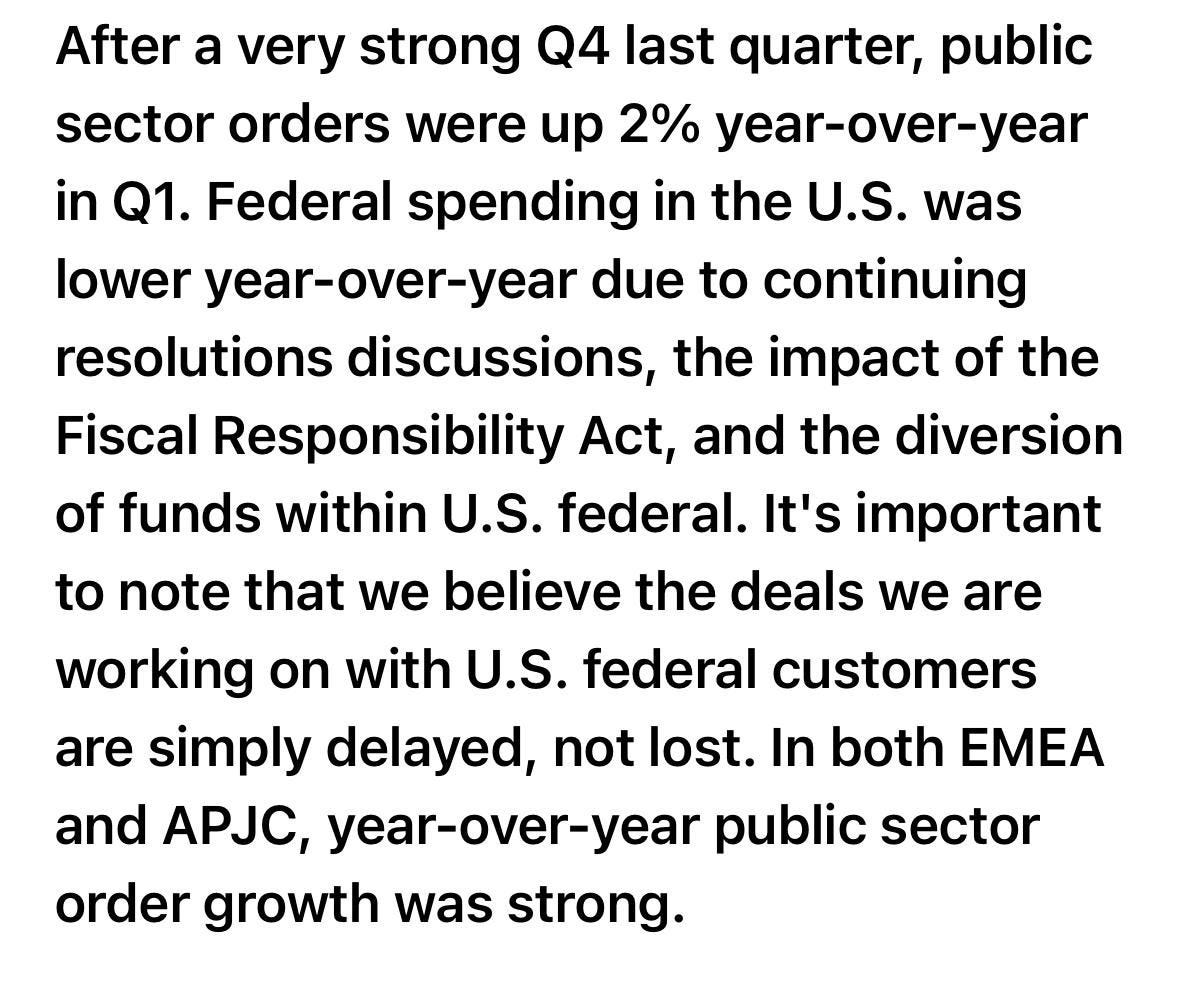

Federal spending was weaker y/y as mgmt blamed continuing resolutions discussions, the impact of the Fiscal Responsibility Act and the diversion of funds within US federal, but said orders were “simply delayed, not lost.” Key quote:

CSCO GUIDANCE: Q2

- Guides revenue $13.75B to $13.95B, EST $13.74B

- Guides ADJ EPS $0.89 to $0.91, EST $0.87

- Guides ADJ gross margin 68% to 69%, EST 67.6%

- Guides ADJ operating margin 33.5% to 34.5%, EST 32.7%

2025 F/Y GUIDANCE

- Guides revenue $55.3B to $56.3B, saw $55B to $56.2B, EST $55.88B

- Guides ADJ EPS $3.60 to $3.66, saw $3.52 to $3.58, EST $3.57

RESULTS: Q1

- Revenue $13.84B, -5.6% y/y, EST $13.77B

- Product revenue $10.11B, -9.2% y/y, EST $9.96B

- Networking revenue $6.75B, -23% y/y, EST $6.75B

- Security revenue $2.02B, +100% y/y, EST $1.84B

- Collaboration rev. $1.09B, -3% y/y, EST $1.05B

- Observability revenue $258M, +36% y/y, EST $299.7M

- Service revenue $3.73B, +6% y/y, EST $3.72B

- Remaining performance obligations $39.99B

- ADJ EPS $0.91 vs. $1.11 y/y, EST $0.87

- ADJ gross margin 69.3% vs. 67.1% y/y, EST 67.6%

- ADJ operating margin 34.1% vs. 36.6% y/y, EST 32.6%

News/Research:

NVDA: Sell-side previews this morning (Susq, opco, RJ, HSBC) as we get geared up for next week’s print. Recaps below…

We’ll have our full preview this weekend.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.