TMTB Morning Wrap

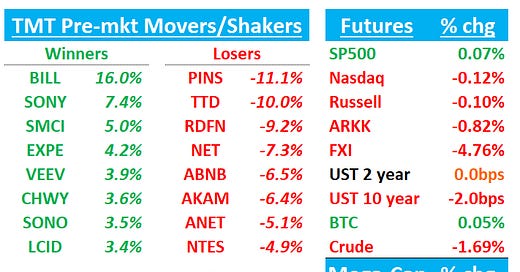

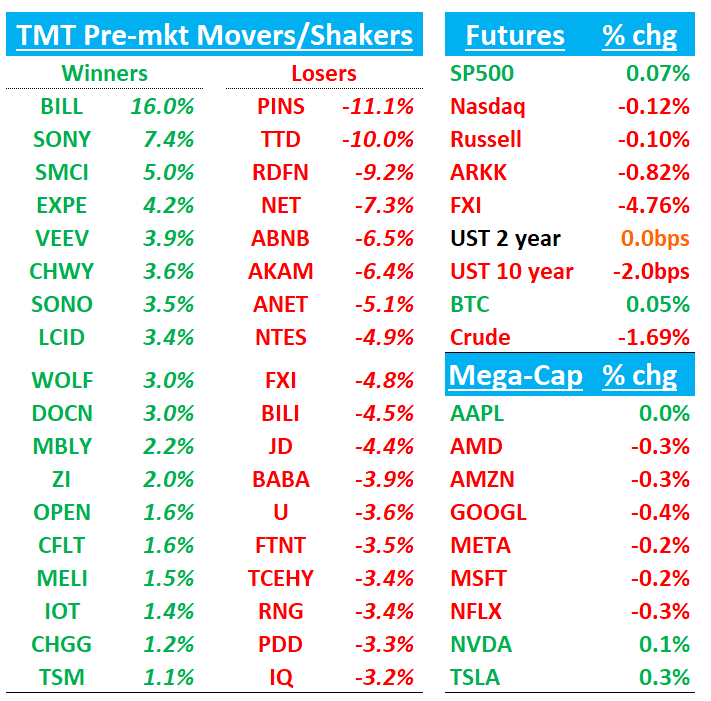

Happy Friday! QQQs -11bps. China -4.5% announcing a $1.4 trillion program to allow local governments to refinance debt, finally putting an amount on long-anticipated stimulus. Markets weren’t impressed: The offshore yuan, bond yields and commodities all fell. Big inflows the last 2 days into stocks (obviously!): US stocks drew $20 billion on Wednesday, the biggest daily inflow since June, BofA strategists said. Small-caps attracted $3.8 billion, the largest since March.

We’ll recap ABNB TTD EXPE PINS ANET earnings first then move onto research/news, probably the most important being TSM with a nice Oct print and AMZN looking to invest more in Anthropic along with some key 3p releases. Let’s get to it…

ABNB -7%: with rev/nights beat and guide for better room night growth but EBITDA guide and ‘25 commentary around spend causing sell off

GBV and nights came in better, but mgmt downticked on Q4 EBITDA margins talking up spend. The implied Q4 guide is 27% vs street at 30% due to investments in marketing and product development as ABNB works to reaccel its biz to DD% levels from the current HSD% levels. On the call, mgmt refrained from setting specific expectations for 2025 as ABNB has not completed planning, but noted incremental investment in geo expansion and upcoming service launches, offset by continuing operating efficiencies. Bears will be all over this and question why ABNB has gone from outgrowing EXPE/BKNG to falling behind in growth and now needing to invest heavily while both EXPE/BKNG are expanding margins. The valuation gap is become starker with EXPE only trading at 10x FY26 P/E growing room nights close to 10% while ABNB trades closer to 30x with similar room night growth but declining margins. Bulls will try to argue that ABNB has plenty of room to expand adjacent opportunities like advertising, but given the level of spend and downtick in margins, this seems like a show me story now despite top line/room night numbers that were ok.

3Q GBV $20.1bn vs. Street $19.803bn

3Q Nights and Experience Booked 122.8 vs. street est. 121 and inline/above bogeys

3Q Revenue $3.732bn vs. Street est. $3.718bn (guide $3.67-$3.73bn)

3Q Adj EBTIDA $1.958bn vs.Street est. $1.860bn

4Q Revenue guide $2.39bn-$2.44bn vs.Street $2.423bn(held back by a 200 bps headwind on the comp of Q423 one-time benefit from gift card breakage (not previously mentioned)

4Q Nights growth guide higher y/y growth vs. Q3 in line with street

2024 Adj EBITDA guide 35.5% vs. Street est. 35.3%

TTD -10%: Disappointing e with Q3 above but magnitude of beat smaller than previous quarters for Revs and EBITDA and guide raised less than beat

Q3 Revs beat by 1.5%, slightly below average while EBITDA had its smallest eat in 4 years (1.8% vs average ~10%+). The Q4 guide is above the street but less than what they beat by and implies low to mid single digit contribution from political spend (they noted political spend came in strong and as expected). Given the large run up in stock and expectations and fears of political spend slowing down in Q4, not surprising to see this one giving back some of its recent gains (stock was up 6% yesterday).

Bulls will say that TTD is best in class operator with CTV tailwinds still intact and partnerships like NFLX yet to ramp up. Bears will say that momentum is slowing, comp gets a lot tougher in Q1 then they have to comp tougher political spend comps in 2H’25 (likely to see growth decel to low to mid 20s from mid to high 20s in 2024), a Trump DOJ might benefit GOOGL in its ad case, and magnitude of beats is declining. Even bears will acknowledge tailwinds and best in class mgmt team, but with the backdrop of the above and a valuation of 60x+ fy25 even on bullish #s, set up here does not seem that exciting.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.