TMTB Morning Wrap

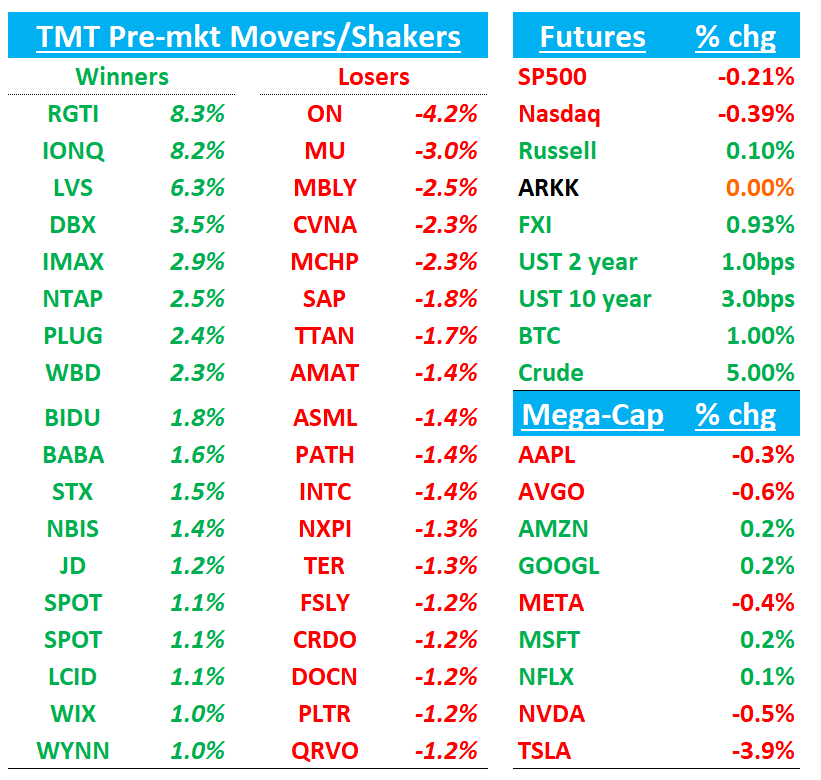

Futures -40bps. Stocks in Asia Mixed: TPX -0.39%, NKY -1.35%, Hang Seng +0.72%, HSCEI +0.83%, SHCOMP +0.22%, Shenzhen +0.22%, Taiwan TAIEX -0.42%, Korea KOSPI -0.98%. BTC +1%. Yields up 2-3bps across the curve. Oil spiking 5% as Trump imposed substantial new sanctions on Russia Oil Giants (WSJ). China’s plenum finished with Beijing pledging to “firmly meet annual economic targets” and “vigorously boost consumption” while achieving a “big increase” in tech self-sufficiency. (VK)

We’ll hit Earnings recaps first then move onto the usual…

TSLA -3%: Revenue beat, EPS miss; sequential gross margin improvement and record FCF; Elon leaned hard into autonomy/AI and energy while flagging tariffs and higher opex. Optimus prototype in Q1

Revenue was $28.1B vs $27.3B Street with GAAP gross margin 18.0% vs 17.3% Street; non‑GAAP EPS $0.50 vs $0.59 (opex + a $238M restructuring charge drove the miss). FCF was $3.99B vs $1.49B Street, helped by inventory/working‑capital tailwinds; Auto GM ex‑credits 15.4% vs 15.6% Street, while Energy GM 31.4% surprised to the upside. Management highlighted clarity on unsupervised FSD, Austin safety‑driver removal by YE, expansion to 8–10 metros, Cybercab SOP in Q2’26, and capacity aiming for ~3M annualized within ~24 months.

Other key takeaways:

On autonomy, Elon said they now have “clarity on achieving unsupervised FSD,” intend to remove the safety driver in parts of Austin by YE and expand Robotaxi to 8–10 metros depending on approvals; FSD v14 is out broadly and a HW3 “v14 light” is planned. Musk said it now makes sense to expand production “as fast as reasonably possible”; aspiration is ~3M annualized within ~24 months; Cybercab SOP targeted for Q2’26

Tesla discussed AI5 (in‑house inference/edge chip), dual sourcing (Samsung & TSMC) in the U.S., and an explicit goal to “oversupply” AI chips, with excess usable in Tesla data centers alongside NVIDIA

U.S. pre‑buy ahead of the $7.5k IRA credit expiry aided Q3; Q4 deliveries likely down q/q but China seasonality should help. Tariff headwinds >$400M in Q3 (roughly half auto/half energy) and expected to continue flowing through

Megapack demand remains strong, with AI/data centers a “remarkable” new demand vector

Optimus V3 unveil Q1’26; early production ramp targeted into late ’26 (heavier lift on hand/vertical‑integration

FSD (paid) take‑rate ~12% of flee

Opex was $3.4B vs $3.0B Street and is expected to remain elevated given AI hiring and performance equity awards; FY25 capex ~$9B (reiterated), rising “substantially” in 2026 for AV/Optimus and factories.

Bull vs Bear debate:

The bull narrative is shifting decisively from “EV OEM” to “Physical AI platform” (autonomy + energy + robotics). Bulls argue Tesla’s clarity on unsupervised FSD plus driver‑out in Austin and 8–10 metros by YE validate the software stack and unlock step‑function monetization (Robotaxi, higher FSD attach, and advertising/ride‑hail‑like economics). Energy’s strength (31% GM in Q3) and new AI/data‑center demand for Megapack expand the TAM and improve profit mix. With capex funded by record FCF and $41.6B cash, Tesla can scale AV, Optimus and factories without external capital. Quarter‑specific ammo for bulls: revenue/GM/FCF upside; autonomy timelines held (Cybercab Q2’26; driver‑out by YE; 8–10 metros); AI5 roadmap (U.S. Samsung/TSMC) deepens the moat.

Bears focus on auto fundamentals: Auto GM ex‑credits (15.4%) still below historical levels; price pressure and competition (particularly China) persist; tariffs >$400M are a real cost headwind; and opex is structurally higher as Tesla hires and awards equity to AI teams. They also stress execution/credibility risk around timelines (Robotaxi metrics sparse, no cost/mile targets; Optimus faces manufacturing/supply‑chain unknowns) and U.S. demand normalization post‑IRA pre‑buy into a softer Q4. Quarter‑specific ammo for bears: EPS miss on opex, auto GM miss vs Street, and limited Robotaxi KPIs.

SAP -1.5%: Mixed as EPS/OM beat and FCF up, cloud revenue in‑line but FY25 cloud guide nudged to the low end, while CCB +27% (cc) and Q4 pipeline commentary was constructive.

Cloud ERP Suite strong (+31% cc) with cloud gross margin 75.1%, helping non‑IFRS OM to 28.3% and EPS to €1.59 (both ahead). Management raised FY25 operating profit (to the high end) and FCF (to €8.0–€8.2B), but steered cloud revenue to the low end of the prior range given 1H deal slippage; they pointed to a strong, AI‑driven Q4 pipeline and U.S. public sector momentum

FQ3’25:

Revenue €9.076B, +11% y/y (cc) (last q +12% cc) vs Street €9.083B.

Cloud revenue €5.290B, +27% y/y (cc) vs Street €5.315B; growth in‑line with Street’s ~27% cc.

Current Cloud Backlog (CCB) €18.839B, +27% y/y (cc) (in‑line with Street).

Non‑IFRS Operating Margin 28.3% vs Street 27.9%.

FY25 Guidance:

Cloud revenue (cc) €21.6–€21.9B (26–28%) — toward low end; vs Street (reported) ~€21.2B.

Operating profit (non‑IFRS, cc, incl. SBC) €10.3–€10.6B — toward high end; vs Street ~€10.31B.

Cloud & Software revenue (cc) €33.1–€33.6B (11–13%); vs Street ~€32.86B

Free Cash Flow (reported) €8.0–€8.2B (raised from ~€8.0B); vs Street ~€8.0B.

CCB (Q4 exit, cc) ~26% target; FY25 “slight” decel vs 2024 (WalkMe comp in base)

Bull vs. Bear Narrative

Bulls argue SAP has a durable re‑acceleration path: the RISE/S/4HANA migration cycle (ECC end‑of‑life in 2027) and AI‑enabled “land‑and‑expand” motion should sustain mid‑20s cloud growth and double‑digit total revenue growth through 2027, with cloud GM >75% and operating leverage from transformation, pushing non‑IFRS OM toward ~30% over the medium term. The quarter reinforced this: Cloud ERP Suite +31% cc, CCB +27% cc, constructive Q4 pipeline (some 2026 RISE pulled into Q4), U.S. public sector momentum (U.S. Army), and proactive hyperscaler partnerships/sovereign options that broaden TAM without capex drag.

Bears focus on decelerating CCB vs 2024 peaks and the FY25 cloud guide to the low end, fearing a tougher macro/industrial and public sector backdrop, FX headwinds into Q4, and persistent transactional softness (Concur) that keeps reported growth and visibility constrained. They also flag regulatory noise (EU maintenance probe) and competitive noise (Oracle’s ERP momentum, OCI adjacency) as potential overhangs until CCB growth stabilizes and we see Q4 signings upside delivered.

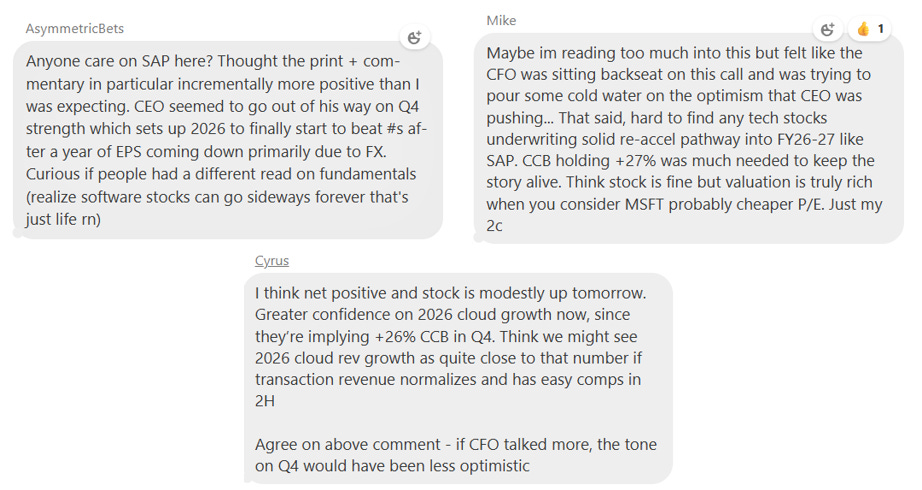

Feedback from TMTB chat:

IBM -7%: Mixed as headline numbers ok but Red Hat, consulting signings, TP growth disappoints

Headline numbers were ok: Q3 revenue/EPS of $16.3B/$2.65 beat the Street’s $16.1B/$2.44–$2.45; FCF also beat. IBM lifted FY25 FCF to ~$14B (from $13.5B+) and reiterated “>5%” CC revenue growth with >1pt y/y PTI margin expansion.. Red Hat decelerated to +12% y/y from 14% (street was at 14%) with bookings ~+20%; RHEL reverted to ~6% growth after abnormally high comps; mgmt still expects mid‑teens FY growth (low end) and double‑digit Q4 growth, with acceleration into ’26. Consulting returned to ~+2% growth but signings were -5%. IBM Z posted its highest Q3 revenue in nearly two decades, +59% y/y, and z17 program‑to‑program MIPS are ~130% of z16 two quarters in.

IBM guided FY25 revenue growth to “>5%” CC, raised FCF to ~$14B, and said it is “comfortable with consensus” for Q4 growth/profitability.

Bull vs Bear Debate

Bulls argue IBM’s mix shift (Software/Consulting annuities), the outsized z17 cycle, and tangible AI adoption (>$9.5B GenAI backlog; ~2 pts of SW growth from GenAI already) underpin durable MSD revenue growth with rising margins and strong FCF. They see Red Hat re‑accelerating (mid‑teens FY, double‑digit Q4; OpenShift ARR +30% to $1.8B) and HashiCorp synergies sustaining 20%+ Automation growth, while Consulting’s digital workers and GenAI attach support a margin step‑up. On this view, IBM can do ~$15B+ FCF in CY26 with continued >1pt y/y PTI expansion. A bull multiple of ~30–32× CY26 GAAP EPS gets to ~$300–$320/share, assuming ~$12.3–$12.5 CY26 EPS and continued execution on AI/mainframe/Red Hat. Oh yeah and bulls will say “Quantum”

Bears focus on the software quality of growth—RHEL normalization to ~6% and consumption‑based services softness—plus TP drag as customers prioritize mainframe capex, and signings down 5% (book‑to‑bill sub‑1) risking Consulting visibility. They also argue the stock is already re‑rated (near/beyond market P/E on consensus) and that AI “book of business” definitions are inclusive, making incremental revenue realization uncertain. On this view, LSD‑MSD revenue and modest margin gains warrant ~20× CY26 GAAP EPS, implying sub ~$250, with risk to downside if Red Hat re‑acceleration slips or the z17 cycle fades sooner than modeled.

LRCX -2%: Beat‑and‑raise, printing record Sep‑qtr revenue/GM/EPS and guiding the Dec‑qtr above Street despite new BIS headwinds; management reiterated a stronger 2025

Dec‑qtr guidance embeds a ~$200M BIS “50% affiliate rule” hit (and ~$600M in CY26), GM easing to ~48.5% on mix/tariffs, but revenue/EPS still ahead of Street. Mgmt still sees ~$40B of NAND conversion WFE over several years; clean‑room space is a limiter and may pull forward capacity adds; upgrades remain strong through 2026.

FQ1’26 (Sep‑qtr):

Revenue $5.324B, +28% y/y (last q +34% y/y) vs Street $5.232B;

EPS $1.26 vs Street $1.22;

Non‑GAAP GM 50.6% vs 50.0%;

Non‑GAAP OM 35.0% vs 34.0%

FQ2’26 (Dec‑qtr) Guidance:

Revenue $5.20B (+~19% y/y) vs Street $4.84B;

EPS $1.15 vs Street $1.04;

Non‑GAAP GM 48.5% vs 48.2%;

Non‑GAAP OM 33.0% vs 31.4%

Bull vs. bear Debate:

Bulls argue Lam is one of the clearest structural beneficiaries of AI‑driven WFE intensity and leading‑edge inflections. Management pegs ~$8B of WFE per $100B AI datacenter capex, with >50% of that landing in memory—directly aligned to Lam’s NAND and HBM exposure. The ~$40B NAND conversion cycle is proving stickier and possibly faster as clean‑room limits push customers to upgrade first (higher Lam intensity) and then add capacity. Meanwhile, Aether dry‑resist/EUV, low‑k ALD, and halo moly ALD wins expand SAM and tilt share from low‑30s to high‑30s at the leading edge. Services (CSBG) adds resilience and margin support through the cycle. On the print, bulls point to record GM/OM, above‑consensus Dec guidance despite BIS, and 2026‑up/2H‑weighted setup.

Bears focus on quality/mix and geopolitics: near‑term upside has been China‑driven (43% of revenue), which now normalizes in 2026 with BIS‑related step‑downs and potential incremental export/tariff pressure. Dec GM guide down ~210 bps (mix + tariffs) feeds a “peak‑margin” worry; and if the NAND upgrade thesis stalls before greenfield capacity ramps, tool shipments could be lumpy. Competitive intensity in etch/dep (esp. at NAND/foundry) and any slip in Aether/ALD adoption could cap share gains. On the quarter, bears highlight the reliance on China and the tariff comment that headwinds increase into Dec.

Earnings Quick Hits

DSY -15% Cut guidance, cited macro volatility. Q3 missed, and Q4 guide below. . Q3 €1.46B/€0.29 vs €1.50B/€0.29. Q4 guide €1.697–€1.817B/€0.41–€0.45 vs €1.8B/€0.42. FY25 revenue growth cut to 4–6% (from 6–8%); non-IFRS diluted EPS growth still 7–10%.

STM −9.5%: Q4 guide light, recovery slower. Q3 beat at $3.19B/$0.29 vs $3.17B/$0.22, but Q4 rev guided to $3.28B (±350 bps) vs $3.35B and GM to 35% (±350 bps) vs 34.6%. Management cited normal seasonality (lower auto capacity-reservation fees) and continued industrial inventory digestion. GM lift comes from better manufacturing efficiency; inventories seen stable near term with a seasonal uptick in 1H’26. Industrial demand solid in power/energy and robotics; consumer remains soft; MCU inventories normalized.

BESI +2%: Orders inflect on Asia/AI; margin guide strong. Q3 €132.7M/€0.32 vs €138.4M/€0.36, but orders rose to €174.7M vs €169.8M. Q4 outlook: revenue +15–25% q/q, opex +5–10%, GM 61–63%, pointing to improving mix/utilization.

NOKIA +8%: Beat with above-seasonal Q4 setup on AI/cloud Q3 revenue/operating profit €4.83B/€435M vs €4.63B/€339.3M. FY outlook unchanged, but operating-profit guide raised to €1.7–€2.2B (from €1.6–€2.1B) due to venture-fund reporting changes rather than core trend shifts.

TECH RESEARCH/NEWS

MU: From Jefferies call last night, saying what we’ve been hearing from others that MU is struggling to even do 11Gbps for HBM4

One of the reasons we prefer Samsung over MU…See below for details from call

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.