TMTB Morning Wrap

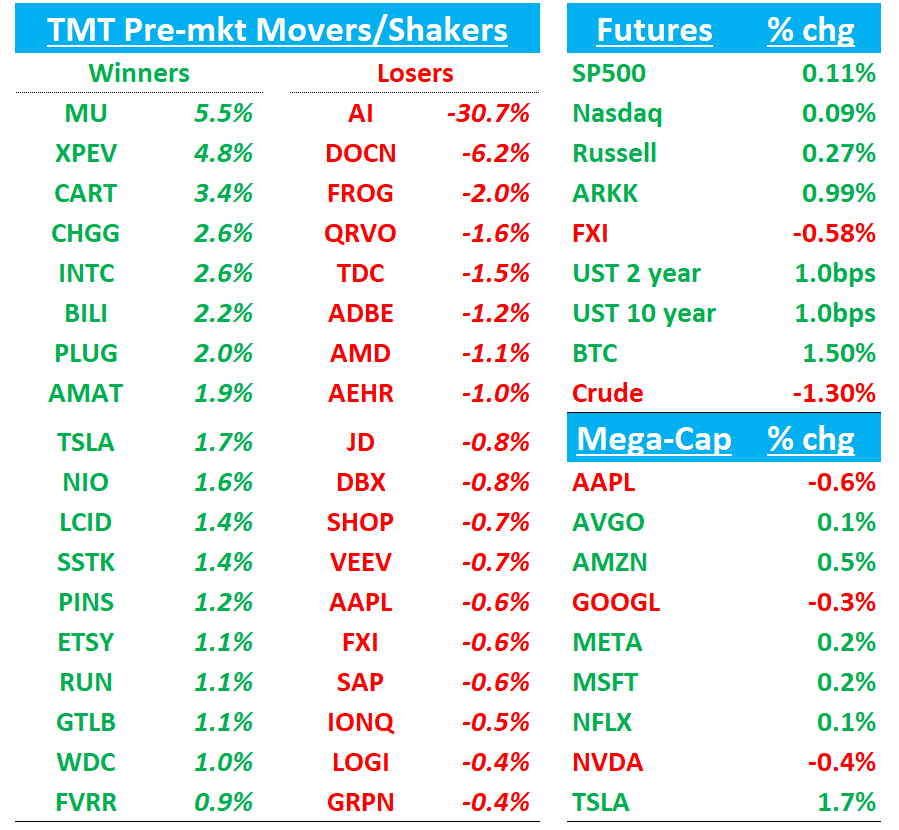

Happy Monday. Futures +20bps to start the day was BTC +1.5% getting close to new highs. China -60bps. On the macro front we get CPI tomorrow and PPI thursday.

Let’s get straight to it…

Nvidia and AMD to pay 15% of China chip sale revenues to US government

Nvidia and AMD have agreed to give the US government 15 per cent of the revenues from chip sales in China, as part of an unusual arrangement with the Trump administration to obtain export licences for the semiconductors. The two chipmakers agreed to the financial arrangement as a condition for obtaining export licences for the Chinese market that were granted last week, according to people familiar with the situation, including a US official. The US official said Nvidia agreed to share 15 per cent of the revenues from H20 chip sales in China and AMD would provide the same percentage from MI308 chip revenues. Two people familiar with the arrangement said the Trump administration had not yet determined how to use the money.

MNDY -15%: Q2 Revs skinnier beat than normal, Q3 guided in line below expects, raised by less than beat and NRR ticks down q/q for first in in 8 quarters

The 1.9% top line beat compared to 2.3% last q and 4Q average of 2.5% vs what was supposed to be a very conservative guide. Monday CRM has reached $100mn in ARR although adds only 2k vs 3.7k last q. .

Mgmt raised Fy25 guide less than the beat. - by not fully passing on beat bears will question whether street estimates for next year need to come down and whether medium term mtargets need to be adjusted down at their Sept analyst day.

PR: “As we navigate the shifting landscape, we remain focused on the factors we can control…”

Uh oh…talking about a “shifting landscape” in this software tape not the best look…Will help fuel the “MNDY is easy DIY and seat risk” AI bear case…

MU +5%: Positive pre-announced Q4 ...Q4 Revs to $11.1B - $11.3B vs $10.4B to $11B…GM to 44.5% vs prev 42%

Recall- stock was +13% last week on hopes they would do this pre announce ahead of Keybanc conference today (presentation at 11am est.). Still shorts in this name given all the neg HBM news flow + Samsung oversupply fears over last couple weeks…

On that note…Hynix CEO made some positive comments on HBM overnight,,,

Memory: SK Hynix expects AI memory market to grow 30% a year to 2030

South Korea's SK Hynix forecasts that the market for a specialized form of memory chip designed for artificial intelligence will grow 30% a year until 2030, a senior executive said in an interview with Reuters.

The upbeat projection for global growth in high-bandwidth memory (HBM) for use in AI brushes off concern over rising price pressures in a sector that for decades has been treated like commodities such as oil or coal.

"AI demand from the end user is pretty much, very firm and strong," said SK Hynix's Choi Joon-yong, the head of HBM business planning at SK Hynix.

The relationship between AI build-outs and HBM purchases is "very straightforward" and there is a correlation between the two, Choi said. SK Hynix's projections are conservative and include constraints such as available energy, he said.

SK Hynix expects this market for custom HBM to grow to tens of billions of dollars by 2030, Choi said.

Part of SK Hynix's optimism for future HBM market growth includes the likelihood that customers will want even further customisation than what SK Hynix already does, Choi said.

AI -33%: Negatively pre announced Q1 alongside Sales restructuring

C3.ai’s preliminary 1Q results showed revenue of $70.2–$70.4M, missing the midpoint of guidance by 33% and falling 19% year over year. The revenue shortfall more than doubled the projected non-GAAP operating loss to ($57.8M), implying an operating margin of (82.2%). Management blamed the miss on a major sales restructuring—now complete—and CEO Tom Siebel’s health issues, which limited his sales involvement. Siebel said his health has since improved significantly.

AI: C3 AI downgraded to Underperform from Neutral at DA Davidson

DA Davidson downgraded C3 AI to Underperform from Neutral with a price target of $13, down from $25. The company late Friday announced results that came in significantly below guidance and a restructured sales and services organization, bringing in new leaders across regions, the analyst tells investors in a research note. The firm says it previously lacked conviction around the durability of C3 AI's growth amid its increasing reliance on non-recurring revenue. It suspects the preliminary results reflect this trend finds it likely the business gets worse before it gets better.

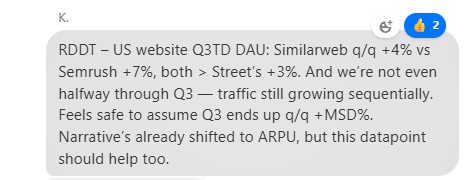

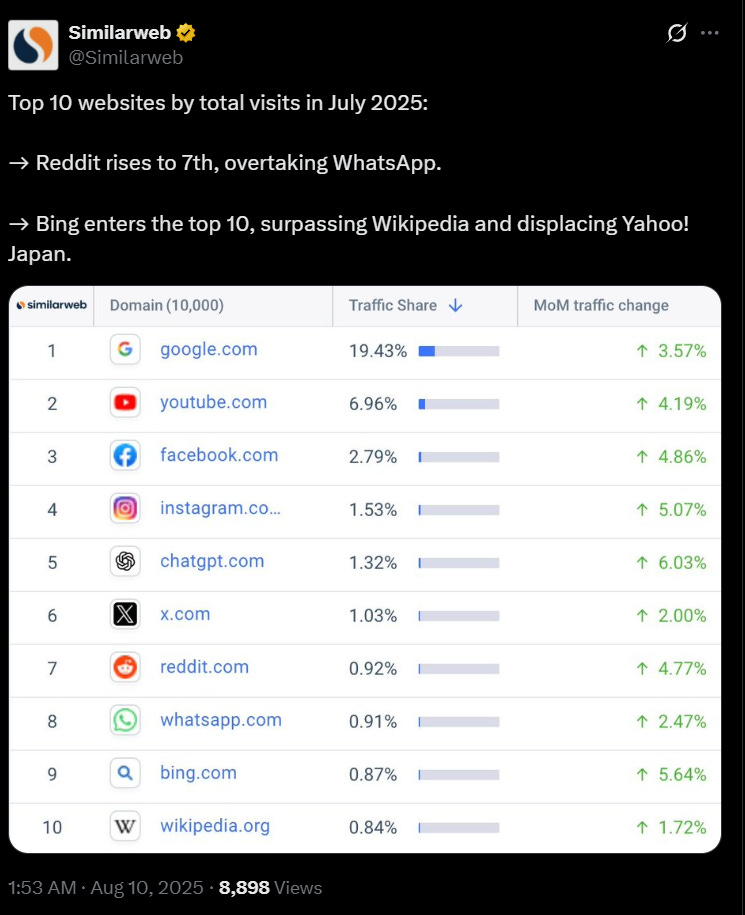

RDDT: User data tracking better than expected QTD…

Thanks to reader K. for sharing

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.