TMTB Morning Wrap

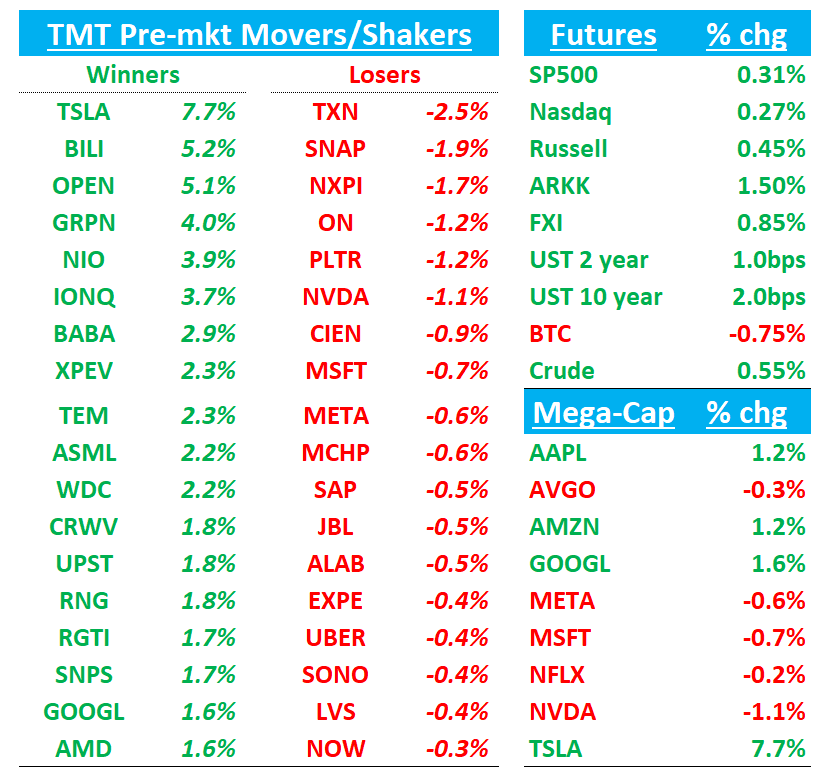

Good morning. QQQs +20bps as China headlines weighing on NVDA/analogs ahead of US gov’t meetings with China. TSLA +7% as Musk bought $1B of stock. Trump saying “a deal was also reached on [TikTok] that young people want". ORCL +2% / META - 50bps.

We get analyst days from MDB, INTU, CRWD, MNDY, WDAY; META Connect; & DUOL’s conference. BTC -75bps; China +85bps. Yields flattish.

Let’s get straight to it…

TSLA +8%: Tesla CEO Elon Musk purchased 2.57M shares, first since 2020 and biggest since TSLA went public

In a regulatory filing, Tesla CEO Elon Musk disclosed his purchase on Friday, September 12, of 2,568,732 shares of Tesla stock in a series of purchases with prices ranging from $371.90 to $396.36.

TSLA: Barclays sees Tesla's Q3 deliveries topping consensus expectations

Barclays expects Tesla Q3 deliveries of 465,000 units, flat year-over-year and above the consensus estimate of 430,000. Tesla is experiencing a flow of positive data points which will likely support the stock's recent strength, the analyst tells investors in a research note. The firm sees potential for the share strength to continue with a Q3 deliveries beat. However, Barclays believes investors may also look to Tesla's weaker expected volume outlook for Q4 and beyond, especially in the U.S. where the firm says electric vehicle demand will see a significant decline after the expiration of the EV tax credit. It keeps an Equal Weight rating Tesla with a $275 price target.

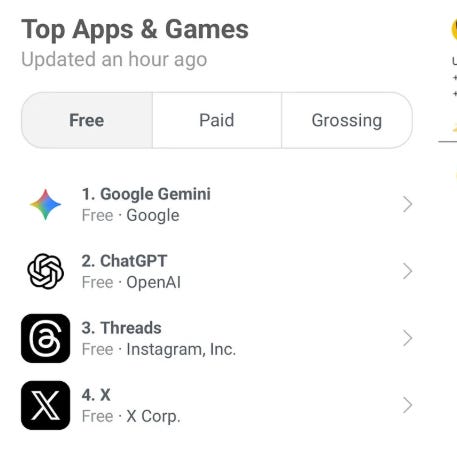

GOOGL: Gemini reaches top of app store helped by NanoBanana

NVDA: China Targets Nvidia Over 2020 Deal, Raising Trade-Talk Stakes

China ruled that Nvidia Corp. violated anti-monopoly laws with a high-profile 2020 deal, ratcheting up the pressure on Washington during sensitive trade negotiations.

The US chipmaker was found in violation of antitrust regulations after the acquisition of networking gear maker Mellanox Technologies Ltd., the State Administration for Market Regulation said after concluding a preliminary investigation. Nvidia’s shares fell about 2% in pre-market trading, while US stock index futures pared gains.

The surprise announcement emerged with US and Chinese officials heading into a second day of wide-ranging negotiations in Madrid over tariffs, which could shape the relationship between the world’s two largest economies.

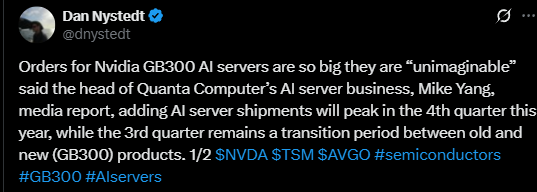

NVDA:

DCs/AMZN: Cowen Highlights Data Center Demand Acceleration

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.