TMTB Morning Wrap

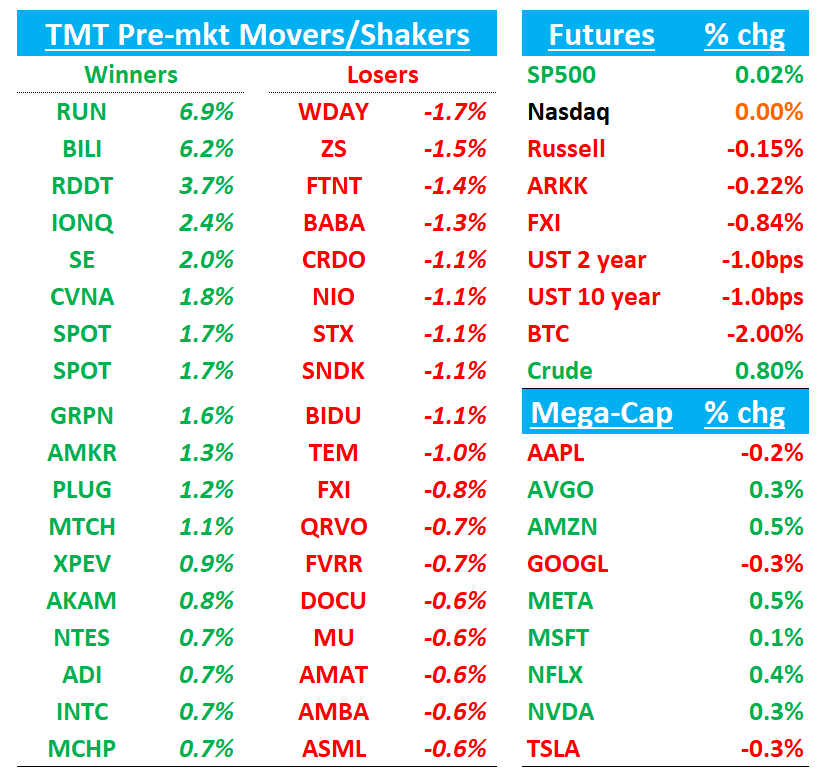

Good morning. Futures flat. BTC -2%. Yields slightly down with 10 year now belwo liberation day lows. Stocks in Asia saw gains across the board on Tuesday: TPX +0.03%, NKY +0.27%, Hang Seng +0.65%, HSCEI +0.76%, SHCOMP +1.36%, Shenzhen +1.76%, Taiwan TAIEX +0.23%, Korea KOSPI +0.24%

NFLX EPS gets things started tonight…

Let’s get to it…

RDDT: Citi Raises PT to $250, Adds 90-Day Upside Catalyst Watch on Product-Led Growth Momentum

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.