TMTB Morning Wrap

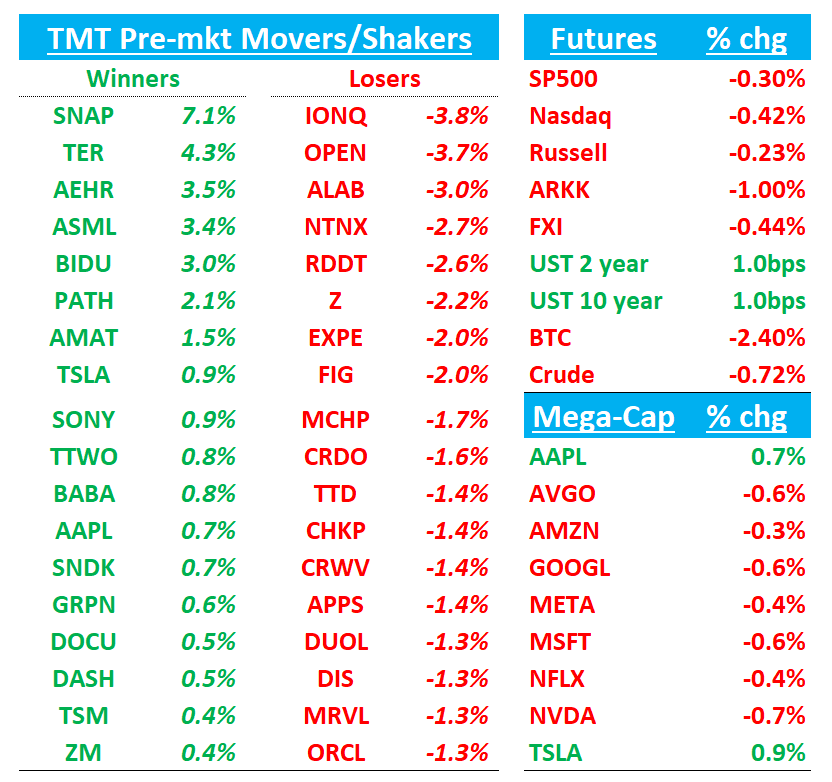

Futures down 30bps to start the week after reaching all time highs on Friday. Crypto a bit weak to start with BTC -3%. Recent speculative winners like Quantum -3% and Nuclear -2% down early as well. Samsung +5% overnight on reports they got qualified at NVDA for HBM3. Main event this week is MU earnings.

Let’s get straight to it…

TSLA: Elon and Trump sit together at Charlie Kirk’s funeral

TSLA: Tesla Wins Approval to Test Autonomous Vehicles in Arizona

Tesla has been approved to start testing autonomous vehicles with a safety monitor in Arizona, a key step as the company looks to expand its robotaxi efforts to cities and states outside of Austin.

The EV maker first reached out to the Arizona Department of Transportation in late June to begin the certification process for autonomous vehicle ride-sharing, the agency first confirmed to Bloomberg. Tesla told the agency that it aimed to launch in the Phoenix metro area.

The company had applied for permits to test and operate autonomous vehicles, both with and without a driver in late June. To give rides to any members of the public or operate as a rideshare the company will also need a transportation network license, much like any other rideshare company that operates in the state, including Uber or Lyft.

TTD: Trade Desk downgraded to Underperform from Neutral at Edgewater Research 'share loss to accelerate in 2026', take pressure already starting

Memory: MS Bullish calling on strength in NAND Orders / Upgrades Hynix and ASML, prefers SNDK, Samsung as well

The firm highlights a sharp pickup in NAND demand from U.S. hyperscalers for 2026, with orders potentially exceeding the entire 2025 eSSD market and spilling into other NAND segments. The analyst says years of underinvestment and limited wafer capacity mean these new orders could drive much better returns on capital. MS notes several surprises, including stronger-than-expected QLC eSSD demand, new AI workloads like B40 GPUs requiring GDDR7, firmer SOCAMM and RDIMM demand, and rising DRAM contract pricing into Q4. The firm now sees NAND moving into shortage while DRAM excesses rebalance, creating multiple buy signals as earnings trajectories inflect. MS upgrades SK hynix and ASML, while also boosting its South Korea tech industry view to Attractive, citing upside from a commodity upcycle in 2026. Within memory, it prefers NAND names such as Samsung, Sandisk, Kioxia, and SK hynix, and notes valuations remain compelling even after recent strength.

META: Barclays Sees $6B–$19B Incremental Ad Upside From WhatsApp and Threads

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.