TMTB Morning Wrap

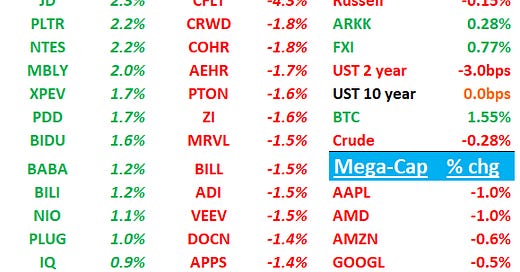

Futures starting the day down this morning with QQQs - 80bps and Spoos -58bps as Powell’s hawkish comments late afternoon shifted probability of a cut to only 65%. Tech is being weighed down by AMAT print (stock -8%). Yields flat to down. BTC +1.5%.

AMZN: Bezos done selling (for now); NFLX: Paul v Tyson tonight. TSLA: Ron Baron was on CNBC this morning (link). 13-Fs: LucknowCapital on X has a recap of highlights from release yesterday afternoon - link

Relatively slow Friday especially after the last two weeks. We’ll hit BABA and AMAT first then onto news/research. Let’s get to it…

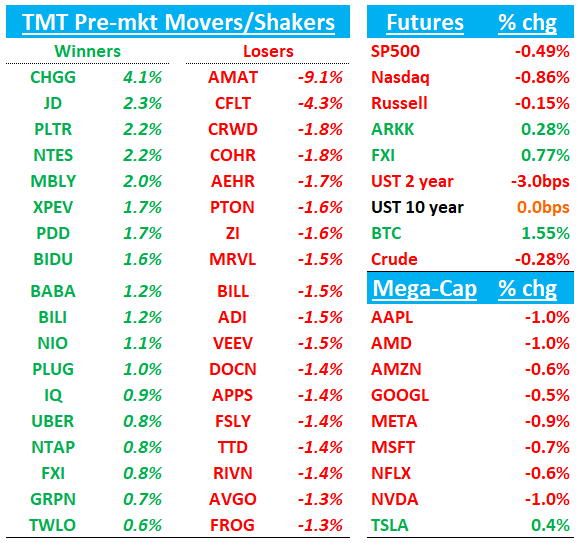

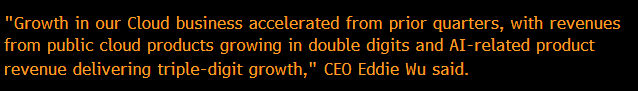

BABA +3.4%: Looks ok with slight rev miss but Cloud and Taobao inline. EBITDA slightly ahead. Call ongoing

BABA RESULTS: Q2

- Revenue 236.50B yuan, EST 239.43B yuan

- Total Taobao and Tmall Group revenue 98.99B yuan, EST 99.07B yuan

- Total Alibaba International Digital Commerce Group revenue 31.67B yuan, EST 31.3B yuan

- Local Services Group revenue 17.73B yuan, EST 17.45B yuan

- Cainiao Smart Logistics Network Limited revenue 24.65B yuan, EST 26.97B yuan

- Cloud Intelligence Group revenue 29.61B yuan, EST 29.6B yuan

- Digital Media and Entertainment Group revenue 5.69B yuan, EST 6.04B yuan

- ADJ earnings per American depositary receipts 15.06 yuan, EST 14.93 yuan

- ADJ EBITDA 47.33B yuan, EST 46.89B yuan

- ADJ net income 36.52B yuan, EST 35.62B yuan

- Other revenue 52.18B yuan, EST 48.01B yuan

AMAT-8%: Lower guide and uninspiring China commentary hitting stock

FYQ4 results were fine with EPS and Sales beating but guide going lower driven by display despite GMs looking ok (+90bps q/q and mgmt comfortable with 48%). Investors focus is on China and the outlook, as mgmt is keeping their China % of revs flat q/q while guiding below (although they did say eventually will normalize to around 15% from 18% in 2023). AMAT did reiterate they are seeing strong demand from ICAPs into the Jan q and next year but auto, industrial end markets are still weakening.

Bears will say the guide down is not the last one and street at 10% for FY25 looks too high, China #s need to come down, headwinds like Tariffs ad export controls remain and we are likely to see another cut next q until street gets closer to end market WFE growth of 6-7%. Bulls will say AMAT will benefit from GAA, DRAM/HBM as their positioning in the WFE space is great with exposure to key tech inflections which bodes well for them and stock only trading at 20x, which is below historical multiple. Seems like a near-term vs long-term debate here.

Gets a downgrade at Fubon to neutral this morning

Details:

Q1 sales guide: $6.75B to $7.55B, est. $7.25B

$AMAT RESULTS: Q4

- ADJ EPS $2.32 vs. $2.12 y/y, EST $2.19

- Net sales $7.05B, +4.8% y/y, EST $6.97B

- Semiconductor Systems net sales $5.18B, +6% y/y, EST $5.13B

- Applied Global Services net sales $1.64B, +11% y/y, EST $1.61B

- ADJ gross margin 47.5% vs. 47.3% y/y, EST 47.4%

AMZN: Looks like Bezos almost officially done after selling another 3.3M shares between Tues & Wednesday, which makes 16.35M shares sold since 11/1 and what he had remaining on his plan from July.

AMZN: Citi says Haul broadens Amazon's appeal, remains top pick

With the beta launch of Amazon Haul—Amazon's new discount storefront— Amazon now has a lower-priced, no-frills eCommerce experience, which CITI believes complements its core retail service which already offers competitively priced goods across its 300M products in 35 categories. Citi notes Haul only sells goods $20 or less and shipping is ~1-2 weeks. CITI's pricing comparison of 10 similar products across Haul, Temu and Amazon suggests pricing on Haul is in-line with Temu and both are lower than core Amazon, though it believes shipping speeds are likely a deciding factor among consumers

3P Roundup:

AMZN: Hearing 3p saying NA sales trending 2-3 ppts above street so far in Q4

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.