TMTB Morning Wrap

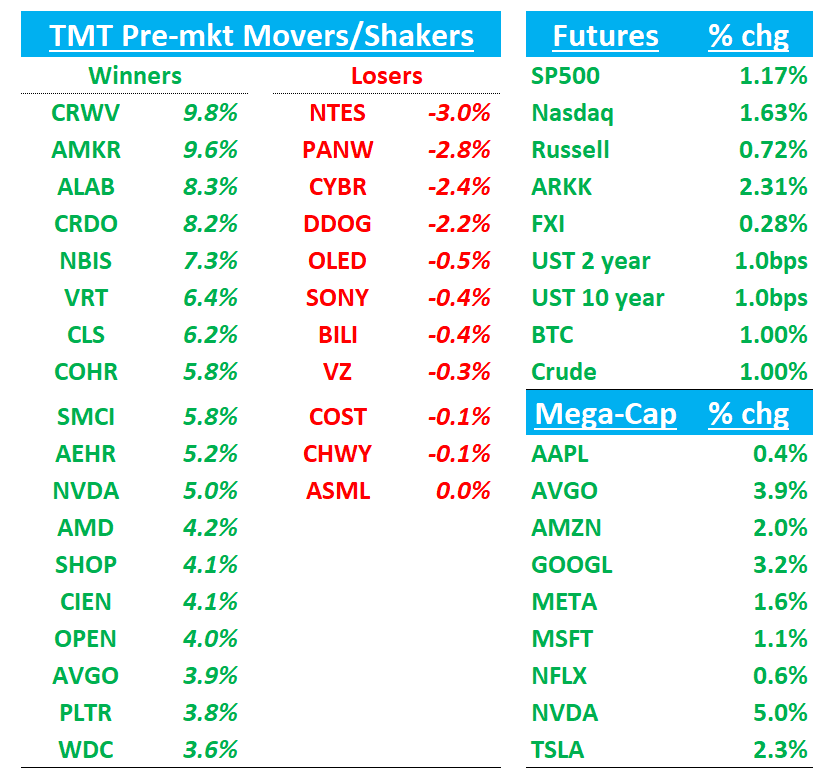

Futures +1.7% as Jensen proving again why he’s the best in the biz with another stellar NVDA +5% print. AI complex up early across the board with CRWV +10% NBIS +7% ALAB +8% AMD +5% … GOOGL +3% following through early as well

Asia saw gains with China the main underperformer: TPX +1.66%, NKY +2.65%, Hang Seng +0.02%, HSCEI -0.08%, Taiwan TAIEX +3.18%, Korea KOSPI +1.92%…BTC +1%

All eyes on NFP jobs # this morning in a few minutes. We’ll hit NVDA and PANW EPS First then get to the usual. Let’s get to it…

NVDA: Great Q in-line with bogeys while guidance above and sees upside to $500B target

Another great quarter by Jensen and co and the call was bullish as well. We don’t think buyside numbers move up too much and they still sit at $9+ for CY26, with some sitting as high as $9.5+. We’re at $9 and at 25x = $225, at 30x = $270. The numbers get to $300+ if we roll to ‘27 at 25x. This q likely doesn’t answer some of the floating questions around AI that have arisen recently (see below) but at least for today they will, and while we’re unsure of the near-term trajectory, what we do know is that under $200, we think the r/r is very attractive and there are no signs of GPU demand slowing any time soon - we stay the course.

The #s:

3Q Revs $57B vs. bogeys of $57B and street at $55B and guide at $54B

3Q GM of 73.6% vs. 74% vs street at 73.6% and guide of 73,5%

3Q DC Revenue of $51B, +66%

4Q Rev guide $65B +/- 2% vs. bogeys of $64B and street at $62B

4Q GM 75% vs bogeys of 75% and street at 74.5%

FY27 Margin: Company aims to hold GMs in the mid-70s range for CY26 despite rising input costs—> what are implications her eto ODM’s and server OEMs — recall we’ve been mentioned rumors of NVDA doing in-house server production. Do we see more of this?

GB300 has crossed over GB200 and contributed 2/3 of Blackwell revs this Q

Have received Rubin chip back from supply chain and on track for 2H ramp

Key quotes:

On $500B Revenue visibility through CY’26 and likely upside:

Mgmt confirmed to analysts that the $500B Blackwell+Rubin figure includes networking

So we shipped $50 billion this quarter, but we would be not finished if we didn’t say that we’ll probably be taking more orders. For example, just even today, our announcements with KSA, and that agreement in itself is 400,000 to 600,000 more GPUs over three years. Anthropic is also net new. So there’s definitely an opportunity for us to have more on top of the $500 billion thatwe announced.

On Depreciation and useful Life:

The long useful life of NVIDIA’s CUDA GPUs is a significant TCO advantage over accelerators. CUDA’s compatibility and our massive installed base extend the life of NVIDIA systems well beyond their original estimated useful life.Thanks to CUDA, the A100 GPUs we shipped six years ago are still running at full utilization today, powered by vastly improved software stack.

On $ per GW increasing every generation:

And Hopper generation was probably something along the lines of $20 billion some odd, $20 billion to $25 billion. Blackwell generation, Grace Blackwell particularly, is probably $30 billion to -- say, $30 billion plus or minus. And then Rubin is probably higher than that.

META ROI:

Meta’s GEM, a foundation model for ad recommendations trained on large-scale GPU clusters, exemplifies this shift. In Q2, Meta reported over a 5% increase in ad conversions on Instagram and 3% gain on Facebook feed, driven by generative AI-based GEM. Transitioning to generative AI represents substantial revenue gains for hyperscalers.

What are bears saying? Does this print lift the questions around the AI trade that have arisen recently? At least for today they do, but we suspect they stay lingering around. What are those questions….Vital Knowledge sums it up:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.