TMTB Morning Wrap

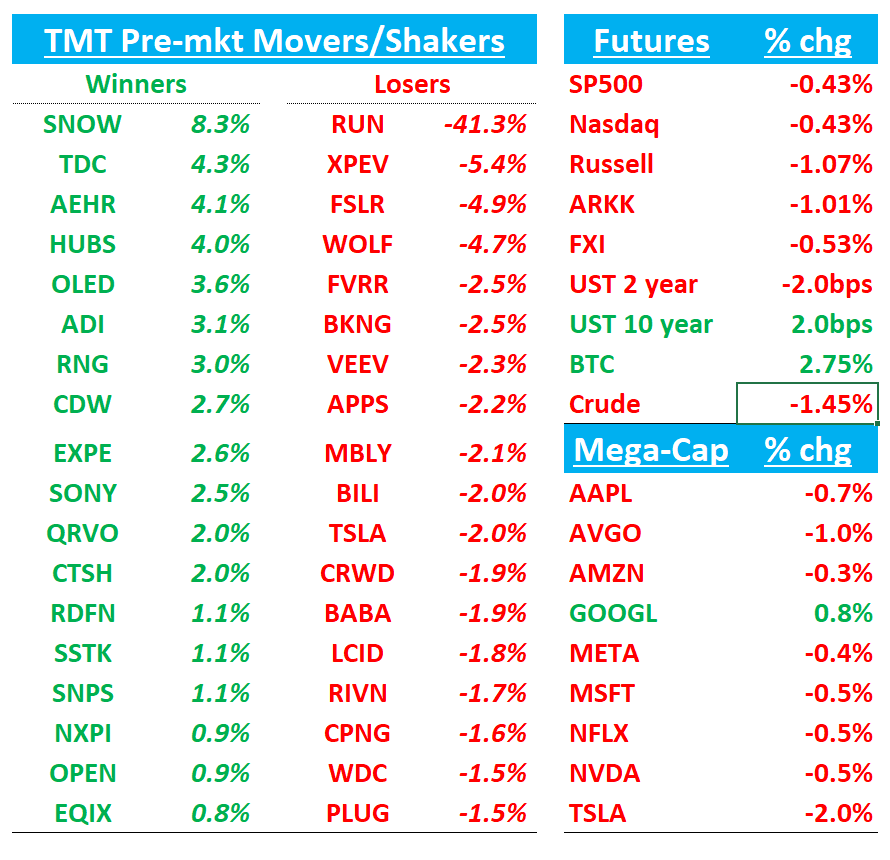

Good morning. QQQs - 40bps continuing weakness from yesterday. LT yields continue to break out with 10 year +2bps and 30 year +5bps. More macro sensitive 2 years yields dn 2bps.

BTC continues to rip making new ATHs +3%. Risk on → good for BTC. Risk off/yield worries → good for BTC. That’s been the playbook for a couple months now.

We’ll hit up SNOW, ZM, ADI Earnings recaps first then dive into the usual.

Let’s get to it…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.