TMTB Morning Wrap

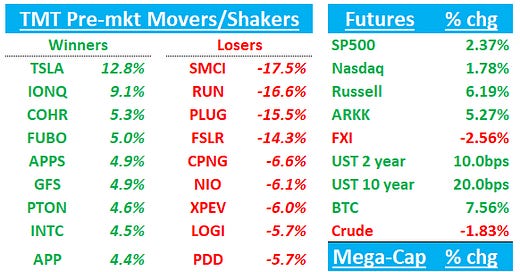

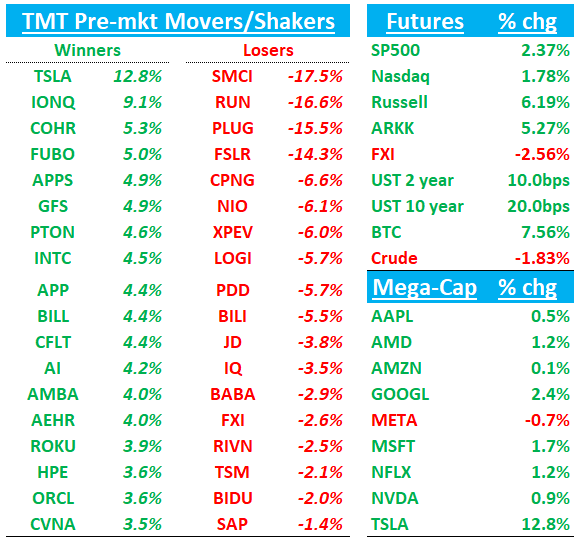

What a night. Where to start? QQQs +1.6% with lots of funky moves going on pre-market. First, the macro: yields ripping as 10 year +20bps getting close to 4.5% while the 2 year +10bps as markets anticipate a more expansionary/inflationary set of fiscal/immigration policies. Fed expectations are shifting in a hawkish direction w market now only pricing 41bps worth of cuts over the final two meetings vs 45bps worth of cuts before. The dollar is spiking +1.4%. BTC +7% as Trump seen pro Bitcoin breaking out to new highs - this one seems like it wants to keep going. China - 3% weighed down by Trump Tariff risks. IWM +5% as Trump seen as pro-cyclical.

A few names in the pre the stand out:

TSLA +12%: We’ll see what role Musk plays in a trump admin and EV credits/China Tariffs likely give TSLA advantage over competitors

Solar names down: RUN -18%; PLUG - 17%; FSLR - 14%; ENPH - 16%

META - 2% as Trump seems to dislike FB and in favor of not banning TikTok: “The thing I don’t like is that without TikTok, you can make Facebook bigger, and I consider Facebook to be an enemy of the people, along with a lot of the media,”

TSM - 2% as Trump’s comments on Rogan couple weeks ago weren’t favorable to Taiwan

Housing names weak on higher yields: OPEN - 1%; Z - 1%; RDFN-1.5%; W -8%

ORCL +3% as Larry/Trump friends. Other sw names strong as well.

KRE +10% as banks rip on higher yields

GOOGL +1.8% as Trump DOJ seen as more friendly towards GOOGL

Key question for me today is what do semis end up doing? Trump seems pretty bullish on expanding/investing in AI but also shift to cyclicals/small caps + tariff talks not great. We’ll see…

In terms of research/news, not a ton out there today. MCHP follows other analog cos with a guide down and SMCI a big rev guide down with no timetable on filings. Let’s get to it…

MCHP: Revs inline/EPS better but guide down worse than expected

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.