TMTB Morning Wrap

Futures off 1%+ to start the day. Global stocks also lower with EurTech -150bps and HK Tech -125bps. Yields up 3-6bps across the curve.

September is starting as you’d expect given seasonality: over the last 10 years, Sept has been down on average 2.5%, which is 200bps+ lower than the 2nd worst month.

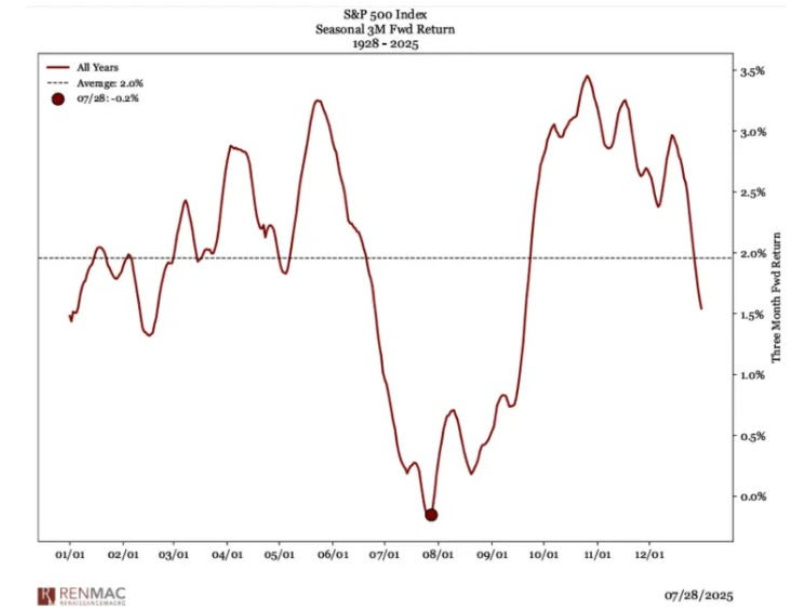

Market still facing seasonal headwinds:

We have a busy week ahead of us - the fun never stops in TMT land.

On the earnings front, we have ZS today, GTLB, CRM, CRDO, HPE, FIG tomorrow, and CIEN, IOT, PATH, AVGO, TTAN, and DOCU on Thursday.

If that wasn’t enough for you, the Citi TMT Conference and BofA’s Media and Communications Conference start tomorrow. Both have packed schedules and should be our first good read-troughs for how QTD trends are going since most companies reported late July/early August. In semis, we’ll get some updates on how the analog space is doing (ON, MCHP, TXN) and potentially some pre’s from storage (STX, WDC). Lots of sw and internet co’s at Citi as well. We’ll have summaries and updates as the week progresses. The Agendas can be found here:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.