TMTB Morning Wrap

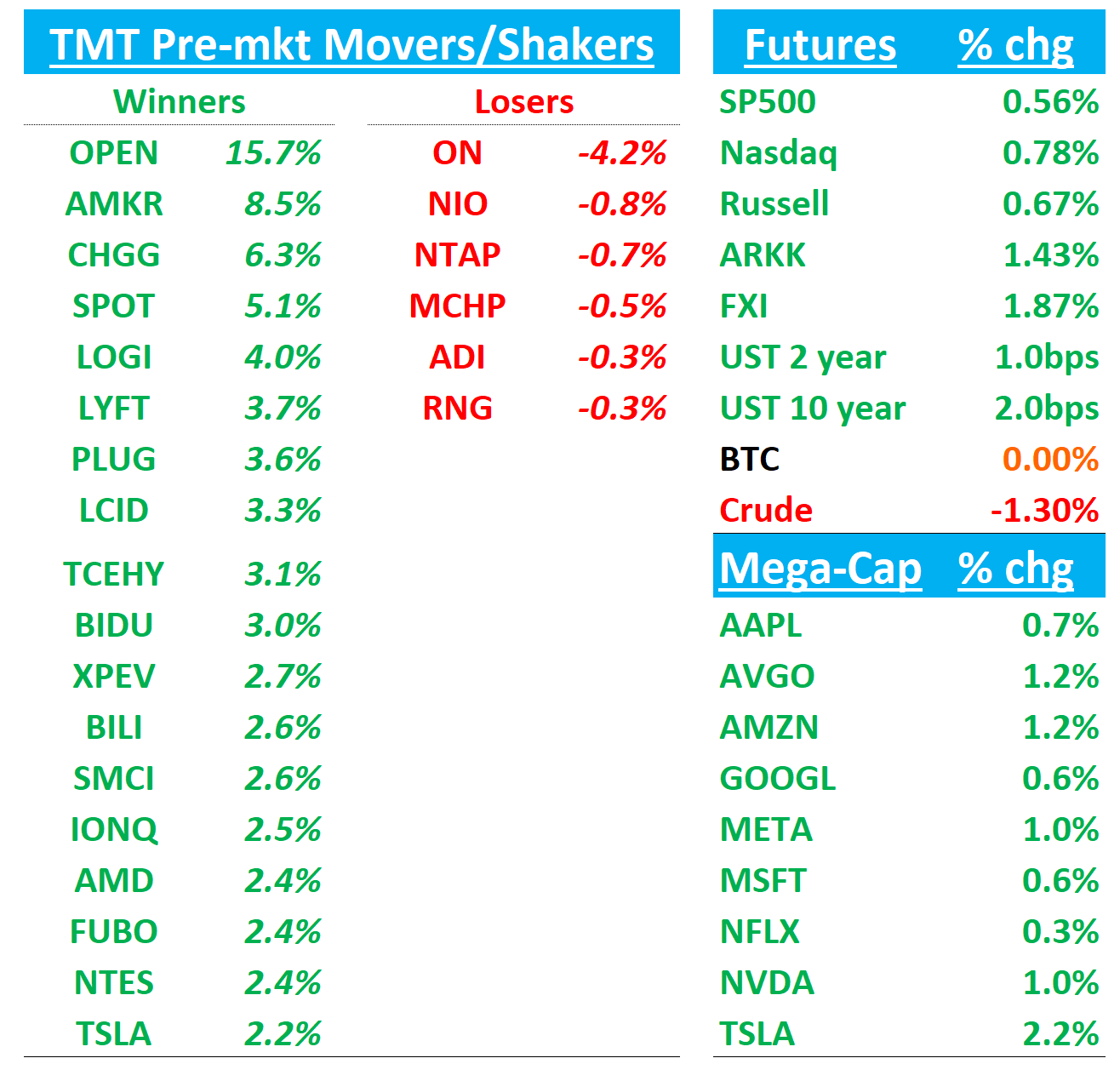

Good morning. Tech Futures +80bps this morning rebounding after Friday’s flush. Will be a pretty quiet macro week after last week with only US ISM services Tuesday Morning, but might get Section 232 Tariffs or a GOOGL verdict.

On top of that, a pretty full week of earnings in Tech, mainly in SMID space (only 10% of companies reporting in TMT vs 40% last week): we’ll see if and SNAP and PINS can follow the stellar ad results we saw from GOOGL, META, and RDDT; some reads in the app sw space (HUBS, TEAM), where px action has been anemic; an AMD print where expectations have risen significantly for 2026 GPU revs (hearing bulls at $15-$16 now); a read on cloud consumption (DDOG) after v weak CFLT results last week; more travel datapoints with ABNB UBER and EXPE. And lots more…

Full lineup: ABNB, ALAB, AMD, ANET, APP, CART, DASH, DDOG, DIS, DT, EXPE, FTNT, HUBS, LYFT, MCHP, MGNI, PINS, SNAP, TEAM, TOST, TTD, TWLO, U, UBER, ZG

We’ll have full bogeys out later today or tomorrow morning.

Let’s get to it…

SPOT: Spotify boosts Premium monthly price outside the U.S.

Spotify announced that over the next month, its Premium subscribers in multiple markets across South Asia, the Middle East, Africa, Europe, Latin America, and the Asia-Pacific region will see higher prices. Beginning in September, the monthly price will increase from EUR 10.99 to EUR 11.99. "We're increasing the price target Premium Individual so that we can continue to innovate on our product offerings and features, and bring you the best experience.”

SPOT: Phillip Securities Upgrades to Neutral on Pullback Despite Cost Pressures

Phillip Securities raised its rating on Spotify (SPOT) to Neutral from Reduce, keeping the price target steady at $600. The upgrade is driven by the recent decline in the stock, which the firm believes better reflects current risks. While user and subscriber growth remain strong, Phillip notes that Spotify has guided for softer near-term performance as it ramps up spending and absorbs higher operating costs.

Amphenol Nears Big Broadband Deal in AI Boom

WSJ:

Amphenol is closing in on the business as it sees rampant demand for data centers that require its technologies and a big need for fiber-optic cables to power high-speed internet and data transmission. The deal would be valued at roughly $10.5 billion, including debt.

The transaction could be completed as soon as Monday, assuming no last-minute snags, the people said. A number of big strategics and private-equity firms had been pursuing the unit, known as CCS.

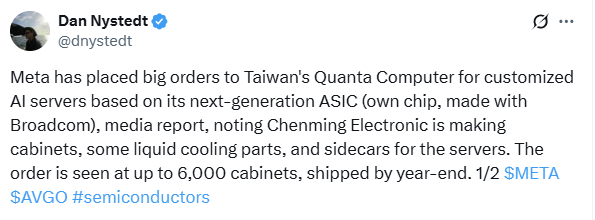

AVGO/META:

COIN: Compass Point Cuts to Sell Amid Retail Slowdown and Competitive Headwinds

Compass Point downgraded COIN to Sell from Neutral, trimming its price target to $248 from $330. While still optimistic about the broader crypto upcycle, the firm flags a "volatile" Q3 shaped by typical late-summer seasonality and declining retail engagement in crypto proxy stocks. Compass warns that intensifying stablecoin competition poses a threat to both Coinbase and Circle (CRCL) in the back half of 2025. The note highlights deteriorating Q2 and Q3 performance trends, suggesting COIN's earnings are softening even as the crypto rally persists. Compass also argues that if crypto prices falter, there’s little valuation cushion left to support the stock.

TSLA: Tesla approves share award worth $29 billion to CEO Elon Musk

CNBC:

Tesla has granted CEO Elon Musk 96 million shares worth about $29 billion, a move aimed at keeping the billionaire entrepreneur at the helm as he fights a court ruling that voided his original pay deal for being unfair to shareholders.

In 2024, a Delaware court voided Musk’s 2018 compensation package, valued at over $50 billion, citing that the Tesla board’s approval process was flawed and unfair to shareholders.

TSLA/UBER/Waymo: TSLA expands Robotaxi service area

TSLA: Piper Sandler Reiterates Overweight, Sees Robotaxi as Catalyst Despite Legal Noise

Piper Sandler maintained its Overweight rating on Tesla (TSLA) and held firm on its $400 price target, implying 32% upside from current levels. The firm believes that the upcoming robotaxi unveiling is sparking fresh optimism around Tesla’s autonomous strategy. While recent headlines tied to Autopilot-related lawsuits have generated media buzz, Piper Sandler suggests these fears are overstated and not material to the company’s long-term outlook. The analyst acknowledges the jury verdict in a Florida crash case that triggered coverage of a "$243M penalty" and a "massive blow," but contends that such coverage distorts the broader picture. “In our view, these headlines paint an unrealistically negative picture,” the note states. Piper reassures investors not to overreact, emphasizing that Tesla’s growth narrative remains intact.

Tesla's July China-made EV sales fall 8.4% -Reuters

AAPL: iPhone 17 is expected to see 5% px hike with Pro model priced >US$1K for 1st time ever - BGR

W +11%% on a beat as strong operating leverage shines

3P data had been positive heading into the print here, but the S&M leverage will leave bulls happy as proving out that the model still has tons of EBITDA torque left. Call at 8am where mgmt guides…

Wayfair reported strong Q2 results, with revenue of $3.27B topping Street at $3.13B. EBITDA came in at $205M, significantly ahead of street $148M, marking a 39% beat — even larger than last quarter’s 35% outperformance. Adjusted EPS was $0.87 vs. the Street at $0.33. Revenue per active customer grew 5.9% y/y to $572, ahead of the $557 consensus, while total active customers of 21M was roughly in line.

Management called the quarter a “resounding success,” citing accelerating sales, share gains, and expanding profitability - >6% EBITDA margin. Marketing and ad spend were particularly efficient, with strong leverage contributing to the upside in margins and EBITDA.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.