TMTB Morning Wrap

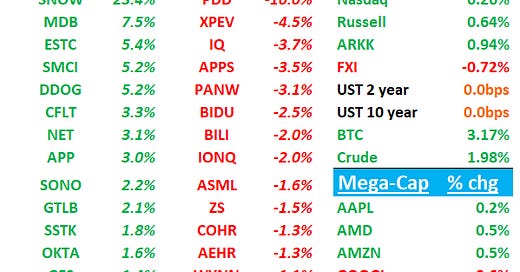

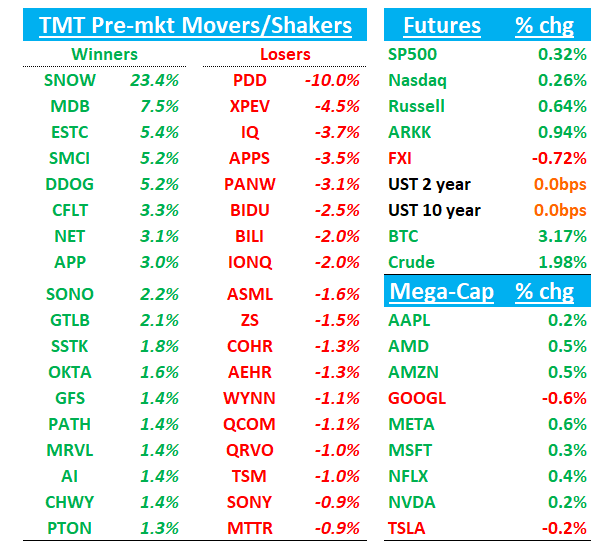

QQQs +30bps as NVDA crosses into the green. BTC +3% past $97k as it gets closer to $100k. We wrote up NVDA thoughts earlier - in your inbox. We’ll get to SNOW and PANW below. Cloud consumption names rallying in sympathy with SNOW. GOOGL remedies out. PDD whiffs. SMCI up as Jensen mentioned their name on the call. Let’s get to it.

SNOW +24%: Big product beat. Better margins. Accelerating product margins. Not much to dislike

Stellar q by SNOW in what had become a sneaky long among sw investors, but still well underowned by Long-onlys.

Product revenue growth of 29% Y/Y was significantly above the Street's 23% and bogeys of 27%, and RPO/cRPO bookings growth accelerated. RPO growth delivering the strongest sequential dollar addition in recent years, as a result of execution against the renewal cycle which included Snowflake closing three $50 Million-plus TCV deals. Product rev guide for next q implies 23% growth after just beating their guide this q by 5.5%. Assuming another similar beat we’ll get to a Q4 exit rate of 29%, which should leave bulls happy that product growth no longer decelerating and has potential to accelerate in 2025 as comps get slightly easier.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.