TMTB Morning Wrap

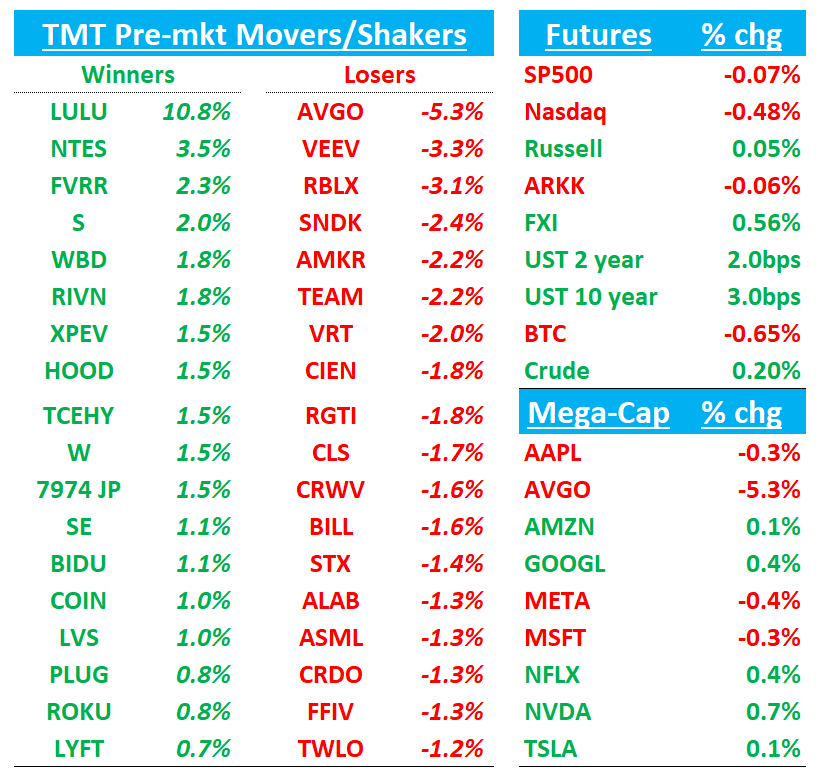

Good morning. Futures -45bps. Stocks up in Asia: TPX +1.98%, NKY +1.37%, Hang Seng +1.75%, HSCEI +1.62%, SHCOMP +0.41%, Shenzhen +0.66%, Taiwan TAIEX +0.62%, Korea KOSPI +1.38%. BTC -60bps.

NVDA spiked up a bit early on this (although haven’t seen any other sources for it):

We’ll hit AVGO first, then get to the usual. Let’s get to it…

AVGO -6% printed a clean top‑line and EPS beat with a big AI guide and enlarged backlog, but margin debate and confusion around the AI backlog/OpenAI timing drove sell-off during the call

This a very HF/LO crowded stock heading into the print. Not a lot of nits around the #s (most liked the F1Q AI Semis guide which was $8.2B vs the bogey of ~$7B)., but stock sold of during the call with most pointing to the lack of upside implied by this comment: “We expect this $73 billion in AI backlog to be delivered over the next 18 months.” Other questions around margins and how repeatable Anthropic orders are given size and mix of revs. Lots of talk about who the fifty customer is. The debate around gross margins centers around Anthropic doubling its rack orders: These shipments are margin-dilutive because they consist largely of low-margin pass-through revenue (e.g., HBM and Google components) rather than high-margin AVGO networking.

On the call back, Hock confirmed #5 is NOT OpenAI . Keybanc thinks AWS; JPM thinks Softbank/Izanagi. Others say AAPL or xAI. It’s up for guesses today. Overall, the print won’t change narrative much long-term, but with multiple priced where its at and many looking to protect PNL given rapid shift of narratives/preferences in AI not a surprise its down. Still get the sense most buyside didn’t change much, with most sitting around ~$16-17 for CY27, with those at most bullish end of spectrum around $20+.

Key Takeaways & Numbers

FQ4’25 (Oct‑25Q) revenue $18.015B, +28% y/y (last q +22% y/y) vs Street $17.466B, +~24% y/y, driven by strength across AI semis + software; non‑GAAP EPS $1.95 vs Street $1.87, and profitability was better than feared (non‑GAAP GM 77.9% vs 77.2%, OpM 66.2% vs 65.4%).

Management guided Jan‑26Q revenue to $19.1B, +28% y/y vs Street $18.47B, +~24%, led by AI: AI revenue guided to $8.2B (+100% y/y), well above Street ~$6.8B and bogeys of $7B

Total company backlog was cited at $162B (record), with AI backlog $73B to be delivered over the next 18 months / six quarters—and management explicitly framed $73B as “today” and expected it to grow as orders come in.

Confirmation of the 4th customer (Anthropic) with an additional $11B on top of the prior ~$10B, and 2) a 5th XPU customer with ~$1B initial order for late‑2026.

OpenAI: On the call, management characterized the 10‑gigawatt OpenAI announcement as an agreement aligned to develop capacity over ’27–’29, and said they do not see significant impact in 2026

Margins: Management reiterated that AI (especially system / rack‑scale deals with pass‑through components) is dilutive to gross margin, and explicitly pointed to 2H26 as the period where “more systems” drive lower GM.

Bull vs. Bear Debate:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.