TMTB Morning Wrap

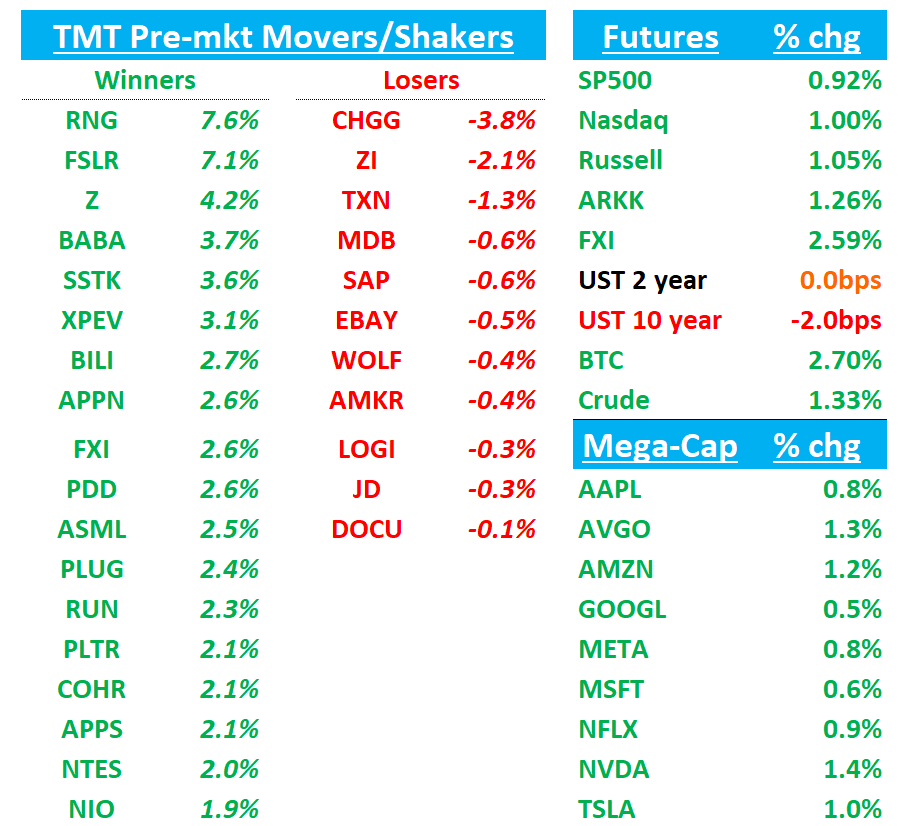

Good morning, QQQs +1%. Yields ticking down slightly with the 10yr down 2bps. BTC +1.6%. China +2.2%. On trade news, US said it made “significant progress” towards a deal with India after VP Vance visited the country. Other than that, relatively quiet

Let’s get straight to it…

NVDA: Morgan Stanley and Keybanc comment on the switch to Bianca board as mentioned yesterday by Alethia, and both come away with a more positive read vs. Alethia.

Recall, Alethia’s takeaway from the switch to Biance yesterday was it “could result in the potential delay of commercialization of the GB300 rack solution.”

According to MS, the primary enhancement for Cordelia boards involved socket design, but signal quality issues apparently require additional development time. MS analyst Howard Kao suggests this reversion could represent positive news, potentially indicating "material" yield improvements with GB200/Bianca boards, with Nvidia likely believing this approach ensures smoother GB300 ramp-up.

KeyBanc indicates this change likely stems from "signal loss performance issues" with Cordelia's SXM socket interface, which was intended to enable broader supply chain support and improved serviceability compared to Bianca's more fixed structure. According to KeyBanc, NVDA made this decision to maintain its Q4 2025 launch timeline for GB300 and ensure a smoother transition from Blackwell to Blackwell Ultra. KeyBanc views this development positively for NVDA, potentially alleviating concerns about the "back-end loaded nature" of the 30K GB NVL rack shipment target this year (expected 30/70 split between 1H/2H), as returning to Bianca "should minimize changes" in the transition to GB300, effectively creating a "drop-in replacement" for NVL72 rack structures.

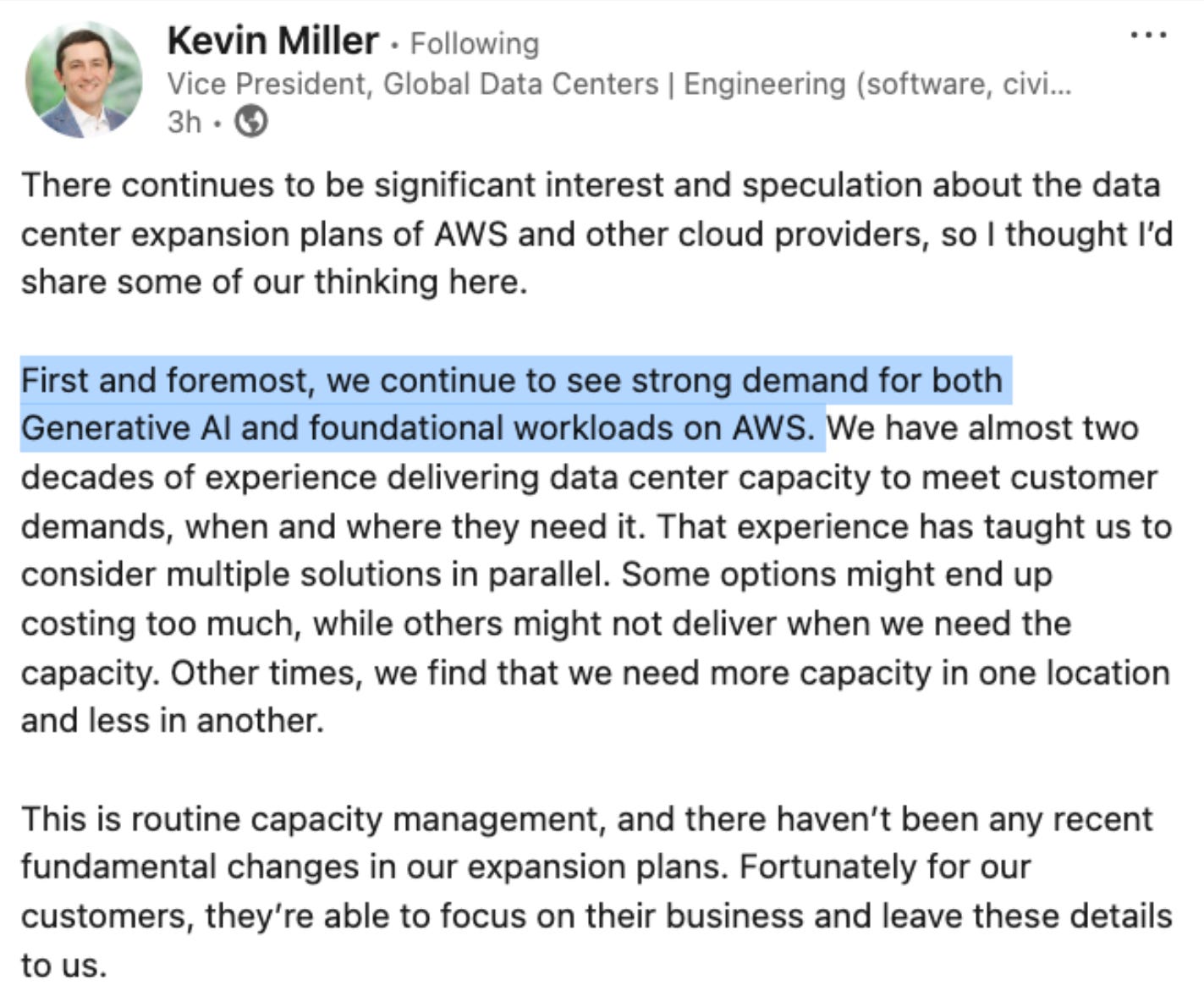

AMZN; VP of Global Data Centers at AMZN with a LinkedIn post talking down Leasing news from yesterday saying “this is routing capacity mgmt, and there haven’t been any recent fundamental changes in our expansion plans.”

Rocha at Wells Fargo (who along with Cowen noted the leasing pauses) notes that investors pushback yesterday mainly that AMZN stands up AI clusters in their own DCs, not colo so its not a great read-through for AI demand in particular (although granted could be a read-through for traditional cloud demand).

NVIDIA Rumored To Collaborate With DeepSeek To Develop Custom AI Chips For China; Massive Turnaround Plan For Domestic Markets

Not sure what to make of this, just passing along..

It is claimed via Ctee that NVIDIA plans to develop custom AI chips in partnership with DeepSeek, and while details around this rumor are uncertain, it is argued that Team Green intends to rely on China's supply chain altogether. This includes HBM, process node, and packaging facilities, and the venture makes a lot of sense, which we'll discuss ahead. NVIDIA needs to come up with alternatives for China's market quickly, and by potentially manufacturing in the nation, the firm could see favours from the state and adoption from domestic markets.

Team Green plans to get closer to the Chinese markets by building a dedicated R&D center in China as well, which means that NVIDIA is serious about this move. The firm cannot rely on releasing "US-compliant" products with each generation, given that it translates into less computing power with each new AI chip, so NVIDIA needs a solid solution now, hence creating chips in China makes a lot of sense here. To top it off, with mounting competition from the likes of Huawei, NVIDIA needs to move quickly here.

Also I missed this Video in China where he said NVDA will make significant effort to optimize products to continue to serve Chinese market

Cloud: UBS says sell-side cloud numbers look to high and need to be de-risked.

UBS analysts found that core cloud infrastructure spending "appears likely to continue decelerating over the coming quarters as a tougher macro takes its toll," though this weakness should be partially offset by "strong continued growth in AI inference and training spend." After speaking with more than 20 customers and partners ahead of upcoming earnings calls for major providers, UBS concludes tha tsell side estimates for cloud providers throughout 2025 "look too high and need to be further de-risked." They’re hosting a call at 8:30est. this morning.

AAPL: MS says their survey points to strong than expected consumer perception for AAPL Intelligence

MS conducted an extensive March 2025 AlphaWise survey of 3,300 US consumers that revealed surprisingly positive iPhone metrics despite challenging market conditions. MS highlights three positive survey findings: strong consumer adoption and willingness to pay for Apple Intelligence, record-high 12-month US iPhone upgrade intentions, and significant interest in upcoming iPhone form factor improvements including thinner designs and foldables. MS notes that consumer willingness to pay for Apple Intelligence has increased to $9.11/month from $8.17 in their September 2024 survey. Additionally, MS reports their supply chain checks indicate iPhone 17 component shipments for CY2H25 are tracking ahead of MS and buyside expectations, with mid-90M units expected.

Third Party Data Roundup:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.