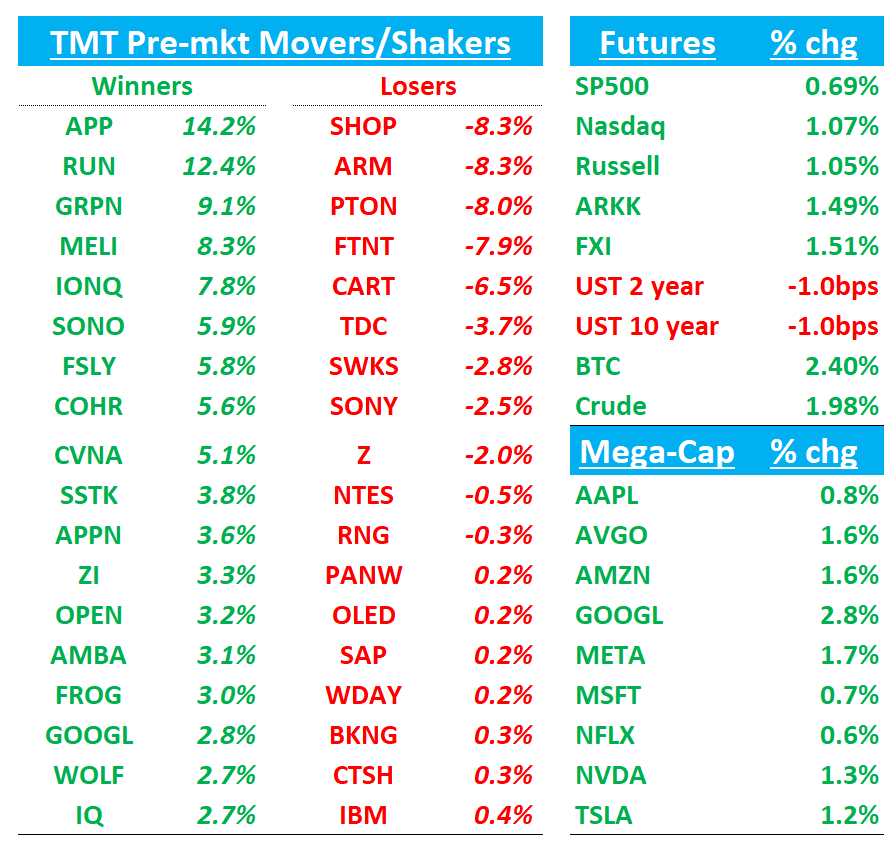

Good morning…QQQs +1% ahead of UK trade deal announcement. BTC +2.6%. Yields flattish. China +1.5%.

Britain set to strike first deal to cut Trump tariffs

Reuters::

The United States and Britain will announce a deal to lower tariffs on some goods on Thursday, the first such agreement since U.S. President Donald Trump sparked a global trade war with universal levies..

Prime Minister Keir Starmer, who describes the U.S. as an indispensable ally, is due to provide an update later on Thursday. The deal is likely to be narrow, with Britain securing lower tariffs on cars and steel, the two sectors hardest hit

A British official had said that the scope of any agreement was likely to be narrow, with Britain expected to secure lower tariffs on a tranche of steel and autos exports.

In return, Britain is likely to agree to lower its own tariffs on U.S. cars and cut a digital sales tax that affects U.S. tech giants.

Britain's digital service tax, levied at 2% of UK revenue for online marketplaces, search engines and social media platforms, was introduced in 2020 in response to an outcry about tax avoidance by big tech.

We’ll hit up earnings first, then move onto Tech/Research:

EARNINGS

SHOP -8%: Softer Q1 Rev Beat, Q2 Guide…Revs above but margins below

3p Checks here had been more positive in late March/April and sentiment had increased going into the print so this is a very surprising miss and should ding the stock a bit today. Weaker gross profit and implied ebit margin guide also worrying investors given Revs were guided above…

Call ongoing…

GMV missed at $74.75B vs street at $74.84 driving the smaller Q1 rev beat. GMs down 190bps y/y in Q1 to 49.5% and guided down q/q in Q2, implies big GP decel.

Headline Results:

Revenue: $2.36B (vs. $2.33B est), +27% YoY

Operating Income: $203M (vs. $208M est), +136% YoY

Gross Merchandise Volume (GMV): $74.75B (vs. $74.8B est), +23% YoY

Monthly Recurring Revenue (MRR): $182M, +20.5% YoY

Q2 2025 Guidance:

Revenue growth expected in the mid-20% range YoY, vs street at 23%

Gross profit dollars expected to grow at a high-teens percentage rate YoY

Operating expenses targeted at 39–40% of revenue

Free cash flow margin projected in the mid-teens, similar to Q1

APP +15%: Big beat driven by advertising. Ad revenue better $1.15B (vs ~$1.1B bogey), while Advertising EBITDA surged to $980M (vs. $813M consensus)

Q2 guide was also strong: Advertising rev guided to 68-70% vs street at 55% and buyside looking for closer to 60% and 81% EBITDA margin, implying ~$980M EBITDA — 13% above the $870M street #

All around v. solid results and should help alleviate some fears the short reports brought up earlier in the year

Key takeaways from the call:

Self-Service Platform – phased roll-out begins in 2Q with a handful of customers; broad access “within quarters, not years.” Mgmt sees it as the next “step-function” growth driver and major TAM unlock (APP currently serves <0.1 % of potential web advertisers).

E-Commerce Ads – on track to exceed 10 % of software revenue in 2025 (> $500 M) despite minimal exposure today; churn <3 % for $250 K+ advertisers.

Tariffs / Macro – little direct China exposure; de-minimis rule changes seen as immaterial. No sign that short-seller reports dented advertiser budgets.

Portfolio Simplification – sale of legacy Apps studio to Tripledot for ~$900 M cash (+20 % stake) set to close 2Q; Apps results will move to discontinued ops.

Capital Return – $1 B buyback executed in 1Q (largest ever); board remains active.

WWDC Watch – privacy changes from Apple are a risk to monitor, but management expects limited impact vs. peers given first-party data strength.

Bulls - of which there are still plenty - will say APP is firing on all cylinders: ~70 % ad-revenue growth, 80 %-plus EBITDA margins, and 80 % free-cash conversion—all before the self-serve platform even launches. AXON model upgrades continue to siphon wallet share from other ad-tech vendors, while early e-commerce wins show the engine can work outside mobile gaming. Management thinks e-commerce alone can exceed 10 % of software sales this year and sees self-serve as a “step-function” unlock once it rolls out over the next few quarters. The sale of the legacy Apps studio cleans up the story, adds ~$900 m of cash, and tightens the focus on the high-margin ad business—fuel for more buybacks after the $1 bn already completed in 1Q. If the company can sustain even mid-teens sequential growth once self-serve ramps, bulls argue that a 25× ’26 EBITDA multiple is justified, implying 50%+ upside to buyside numbers

Bears will point to all the “low quality” revenue argument you’ve read in short reports and say Mgmt’s +3-5 % sequential guide for 2Q is a sharp decel from the +16 % just delivered; absent the self-serve tail-wind, growth could continue to decel. The self-serve launch itself is only starting with a handful of clients and depends on APP hiring enough account-management and attribution talent—something management admits is a constraint. Bears will point out that Apple’s WWDC could bring fresh privacy changes that erode targeting advantages and APP is exposed to cyclical ad industry.

ARM -8%: Q1 inline/better but worse Q2 and lack of FY guide weighs on the stock.

F4Q25 revenue printed $1.24 B (Street $1.23 B), gross margin 52.8 % (Street 50.5 %), and adjusted EPS $0.55 (Street $0.53).

For the Jun-Q (F1Q26), Revenue $1.05 B (mid-pt, 12 % Y/Y / -5 % vs Street) and EPS $0.34 (-19 % vs Street) on lower licensing + higher spend. Royalties still expected +25-30 % Y/Y.

No FY26 outlook for the first time; management cites limited visibility on the indirect impact of US-China tariff moves. They did, however, imply segment growth of ~20 % topline / >22 % royalties, but at the cost of >20 % opex growth.

Bulls see an enduring royalty flywheel: v9 already generates more than 30 % of royalty dollars and management targets 60–70 % within three years, while CSS designs and Arm-based AI accelerators in the data centre expand the addressable market. They argue that a 90 %-plus-margin licensing model, rising royalty rates and stepped-up R&D spending can drive 25–30 % compound EPS growth, supporting a premium multiple.

Bears point to the revenue and EPS miss in guidance, shrinking backlog and a steep opex step-up as evidence that growth is moderating just as valuation sits around 60 × CY26 EPS. They worry that custom cores at hyperscalers cap royalty rates, that China exposure, Qualcomm litigation and RISC-V adoption add risk, and that without a full-year outlook investors lack visibility while margins compress.

Key takeaways:

Royalty mix inflection: ARM v9 now >30 % of royalty dollars (25 % in Dec-Q). Management still targets 60-70 % mix within ~3 years, with Compute Sub-System (CSS) shipments only just starting to ramp.

Opex step-up: FY1Q26 non-GAAP opex guided to $625 M (+34 % Y/Y), postponing any margin expansion and driving most of the EPS guide-down.

Custom-core trend: Nvidia’s new Vera CPU, Apple, Qualcomm’s Oryon and others are moving to custom ARM cores. That can improve partner performance but also caps ARM’s royalty rate relative to off-the-shelf CSS. Investors are watching whether hyperscalers’ coming PC/server projects adopt ARM’s turnkey cores or stay custom.

Backlog easing: Bookings fell 27 % Y/Y and the total backlog shrank 10 %. Licensing wins are lumpy; management flagged a normalisation after a heavy renewal year (e.g., Apple).

CVNA +6%: Solid March Q in line with bogeys although June guide leaves something to be desired. Better Long-term guide for first time.

Management guided to sequential step up in units and adjusted EBITDA for Q2 — street is at 495M so implied >$488M a bit light of that. Mgmt also committed to GPU trends remaining consistent w historical seasonality through rest of the year. Mgmt tends to be conservative on their guide so given the big Q1 beat, should get a bit of a pass on the beat despite high expectations going in.

More importantly, CVNA also set out a new LT target for 3M retail units at 13.5% EBITDA margin in the next 5-10 years. For reference street is at 1.5/3.0 retail units in 2030/2035 so that is much better than estimates. Street is at 13.4%/14.3% EBITDA margin in 2030/2035, so just inline-ish on the margin side as CVNA said they would prioritize growth over margins.

Reminder, Q2 3p data continues to track ~10ppts above street on units.

Better metrics all around in the quarter vs street and inline with bogeys:

Revenue came in at $4.23 bn, roughly +7 % above the Street’s $3.95 bn, driven by 46 % YoY growth in retail units sold.

Retail units reached 133,898 versus ~126 k expected (+6–7 % beat).

Adjusted EBITDA printed $488 m, about +$50 m (~12 %) better than the street at ~$437M consensus (11.5 % margin vs. the Street’s 11.3 %)

Gross-profit-per-unit $6.94B, above street at $6.8k

FTNT -9%: Q1 ok. Q2 billings guide worse. Reiiteated FY guide.

Q1 Billings $1.6B vs street at $1.58B…Revs inline with street. Product revs beat by 2%

Expectations/sentiment was mixed heading in and worse billings/rev guide weighing on the stock this morning:

2Q 25 billings: $1.685-1.765 B (+12 % y/y midpoint) – midpoint ~3 % below St.

2Q 25 revenue: $1.59-1.65 B (+12.9 % y/y) – -$5 M vs. St. at midpoint.

FY 25 (unchanged): billings $7.2-7.4 B (+11.8 %), revenue $6.65-6.85 B (+13 %).

FY 25 op-margin midpoint raised 50 bp despite a -90 bp FX headwind.

Bulls point to the double-digit product beat, widening margins, and an impending 2026 firewall end-of-support cycle that could add $400–450 million in billings over the next two years, all with minimal direct tariff risk and at a valuation that has compressed toward the peer group.

Bears will push back on the inline guide saying no flow through from the billings beat and given big refresh cycle, co. should have raised. Bears will also focus on the sequential dip in services, six straight quarters of declining new ARR, a softer Q2 outlook that suggests emerging demand hesitation, and rising competitive pressure in SASE and SecOps—contending that without a clear return to sustained mid-teens growth the multiple — 30x FCF — still looks full. Bears will also point out that 35% SMB exposure which likely to face headwinds in a slower macro and potentially mute firewall refresh uplift.

COHR +6%: Solid Beat and Raise driven by comms business, which offset weakness elsewhere. Mix shift causing some GM pressure.

FQ3-25 (Mar-Q) actuals

Revenue $1.50 B (+24 % Y/Y, +4 % Q/Q) — beat Street by ~$60 M

Non-GAAP gross margin 38.5 % — +50 bp vs. consensus

Non-GAAP operating margin 18.6 % — +80 bp vs. Street

Non-GAAP EPS $0.91 — +6 % vs. Street’s $0.86

Communications segment $897 M (+46 % Y/Y, +9 % Q/Q); Datacom +54 % Y/Y on AI-driven 800 G demand, Telecom +21 % Y/Y

Industrial segment $440 M (+5 % Y/Y, flat Q/Q); semi-cap strength offset by precision-laser softness

In-house InP EML capacity tripled Y/Y; gross-margin roadmap to >40 % reiterated

FQ4-25 (Jun-Q) guidance

Revenue $1.425 – 1.575 B (mid-pt $1.50 B) — ~2 % above Street

Non-GAAP gross margin 37 – 39 % (mid-pt in-line with Street’s 38 %)

Non-GAAP EPS $0.81 – 1.01 (mid-pt $0.91) inline with street

Mix commentary: Communications expected up Q/Q again; Industrial expected down; GM pressure contained within 37-39 % range

Bulls believe COHR is the clearest pure-play on the AI optical-interconnect upgrade cycle. They see hyperscalers shifting spend to non-Chinese vendors, COHR’s internal EML capacity providing a structural cost edge, and new 1.6 T / optical-switch products adding incremental growth. With gross-margin initiatives already lifting GM 200 bp Y/Y and a stated path to 40 %+, bulls argue earnings power is understated and management guidance intentionally conservative ahead of the May Analyst Day (May 28th).

Bears argue the communications boom is cyclical and prone to pauses once 800 G deployments normalize, while one-third of revenue tied to Industrial/Instrumentation is already soft and could unwind the recent margin gains. They question whether COHR can hold price as competitors add supply, worry about hyperscaler order lumpiness and mix-driven GM drag, and note that capital-intensive capacity adds may outpace demand if AI build-outs slow.

Other key Takeaways:

Datacom transceiver growth +54 % Y/Y vs. hyperscaler optics TAM ~+20 %.

Comm GM still mid-30s despite mix – evidence cost/pricing actions are sticking

Internal EML share >50 % of Comm revs vs. <30 % a year ago.

Cap-ex ramp to 6-inch InP wafers supports 1.6 T and co-packaged optics.

1.6 T roadmap – first 1.6 T products sampling now; initial revenue targeted C2H-25, positioning COHR for the next wave of AI optics.

Supply-chain resilience – 60 global sites (30 U.S.); Malaysia transceiver output shields most U.S. customers from China tariffs (buyers pay freight/tariffs).

Cost/portfolio actions – exiting SiC modules, selling under-utilised sites; long-term GM goal >40 % reiterated.

SWKS -2.3%: Small beat and raise, hinted AAPL related content losses next year might be smaller than feared

Overall, seems ok here give low expectations, but tough to craft a compelling bull case on SWKS at the moment…

Q1 Results: Revenue of $953M (+in line), gross margin 46.7% (vs. Street 45.8%), and EPS of $1.24 (vs. Street $1.20).Adj. operating income of $222M vs. Street $211.5M

Q2 Guidance: Revenue of $940M and EPS of $1.24, both ahead of Street estimates ($919M / $1.06).

Management flagged no evidence of tariff-related demand pull-ins or push-outs and expects Android units +25 % q/q to partially offset normal Apple seasonality (-9 % q/q).

Mobile (62 % of revs): up 7 % q/q thanks to stronger iPhone 16 build-mix and unusually brisk Android demand in June; company still assumes a 20-25 % content hit at its largest customer (Apple) beginning with the Fall ’25 handset refresh, but management now thinks the decline could be “closer to 20 %” because better-spec’d internal modems enlarge the RF dollar-content “pie.”

Broad Markets (38 %): +3 % y/y and expected to accelerate to +6 % for CY25 on Wi-Fi 7, automotive and Edge-IoT adoption; mix shift keeps gross margin >46 %.

CFO Kris Sennesael is leaving (headed to WDC); former NXP CFO Mark Dentinger named successor.

Bulls argue that a clean beat-and-raise, resilient gross margins >46 %, and accelerating Broad-Markets revenue prove the company can cushion next year’s Apple content headwinds; they see the internally designed iPhone modem as a fresh $2-plus ASP content win that could shrink the feared 25 % share loss to nearer 20 %, while Wi-Fi 7, auto and IoT diversification, $2 bn of buyback fire-power and a 10-12× FY26 P/E multiple leave ample upside once handset visibility improves.

Bears counter that Apple still drives ~66 % of revenue and any 20-25 % content cut in Fall ’25 equates to a mid-teens revenue hit just as QRVO, AVGO and QCOM fight for the same sockets; Android premium units remain lumpy, Broad-Markets growth is only mid-single-digit, and the unexpected CFO change adds execution risk. With limited catalysts until the Apple design-win verdict in early CY26, bears say 12x is fair to rich…

Earnings quick hits:

MELI +9%: Strong beat with revs $5.9B vs street at $5.5B, with the big standout EBIT $763M vs street at $635M, +45% y/y. EBIT margin 12.9%, +70bps vs fears of contraction. Ads revenue grew 50% (vs. 41% last quarter) and reached 2.5% of GMV (vs. 2.1% last quarter). This is very good. Penetration had been flat for a few quarters…

INFA -3%: Strong Q1 revenue and operating income, but Q2 revenue and operating income guided light and no topline or OI flow through to the FY'25 guides.

ZG -2%: Q1 inline, but weaker Q2/EBITA guide below street. Announces $1Bn buyback. Bears don’t like implied hockey stick 2H acceleration.

EPAM: +9% raises FY rev/EPS guide

SNDK+4.4%: Solid beat and raise.

RESEARCH/NEWS:

GOOGL: Company responds to AAPL’s Cue’s comments yesterday about declining Safari search growth…

Google’s response, which seems like its implying mix shift to Chrome/Google app from Safari:

GOOGL: Street takeaways, mainly saying move was an overreaction:

Jefferies views Google's sharp 7% drop amid record trading volume (128M shares/$19B) as excessive following Apple's disclosure of April Safari search declines and potential AI search partnerships. JEF's analyst counters concerns with several key points: AI Overviews' 1.5B MAUs indicates more efficient results rather than lost traction; iOS/Safari represent only 18%/17% of their respective markets; Google's iOS app usage grew 15% year-over-year; and Q1 search revenue increased 10% with Google maintaining ~90% overall market share.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.