TMTB Morning Wrap

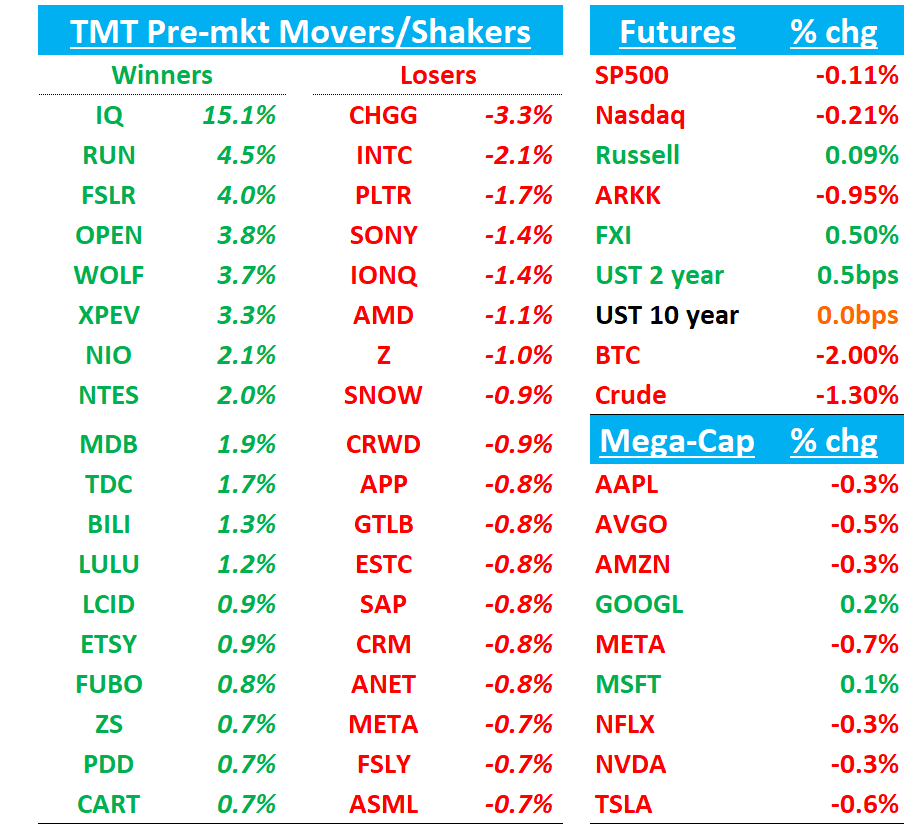

Good morning. Futures -20bps to start the week. BTC -2% following through to the downside after last week’s false breakout. China +50bps. All eyes on Powell at Jackson Hole this Friday. We likely get GOOGL DOJ remedies this week as well.

Lots to get to this morning, so let’s dive right in…

MDB: Citi Reiterates Bullish View, Sees AI Tailwinds and Multiple Catalysts; PT to $405; Adds to 90 day catalyst watch list

Stock was +7% as Valueact took a 2.5% stake in the co…

Good note here from Citi…

Citi says its deep dive supports a more positive long-term outlook for MongoDB than consensus, calling the company a likely AI winner despite ongoing debates over relevance versus Postgres. Their analysis of ~75 AI startups shows MongoDB usage in nearly half, underscoring its traction in emerging tech stacks. With AI-related revenue contribution still small but ramping, Citi estimates MDB’s growth could stay in the mid-20s% through FY26–27, slightly ahead of Street.

Citi outlines the catalyst path: CEO and CFO will be at their TMT conf on Sept 3 post -earnings and inaugural analyst day in Sept and thinks the new CFO will guide FY28 profitability target of ~20% in non-gaap operating margins.

TMTB: We continue to like the set up here heading into the q and expect a 2nd strong q of execution and Atlas acceleration will help put structural fears around Post-gres in the rear-view of investors minds.

DUOL: KeyBanc Upgrades to Overweight with $460 PT, Citing Multiple Growth Drivers

KeyBanc lifts Duolingo from Sector Weight to Overweight with a $460 price target, which reflects 38.3x 2027E EV/EBITDA. The firm argues that concerns about slowing engagement and AI headwinds are overstated. KeyBanc says a combination of product updates (like Energy and Duocon rollouts), price optimizations, and viral marketing should drive upside to bookings and EBITDA forecasts, now projected at $1.45B/$1.79B and $416M/$570M in 2026E–2027E, respectively. The team highlights that AI innovations are more likely to support monetization than hurt it, while sentiment around Duolingo has stabilized.

DUOL: Citi Initiates with Buy and $400 PT, Highlighting Durable Growth and GenAI Upside

Citi began coverage on Duolingo with a Buy rating and $400 price target, calling the company an early-stage education technology leader with strong engagement and ~40% growth in DAUs, bookings, and revenue. Citi argues that expansion into verticals like music, math, and chess provides long-term optionality beyond language learning, while AI risks are overstated. The firm actually sees GenAI as a net positive, noting Duolingo is already leveraging it to enhance the product and accelerate content creation. Citi also highlights Duolingo’s strong gamification, brand, and scale advantages, which they believe support >40% incremental EBITDA margins as TAM expands.

PANW: Buyside Bogeys for tonight

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.