TMTB Morning Wrap

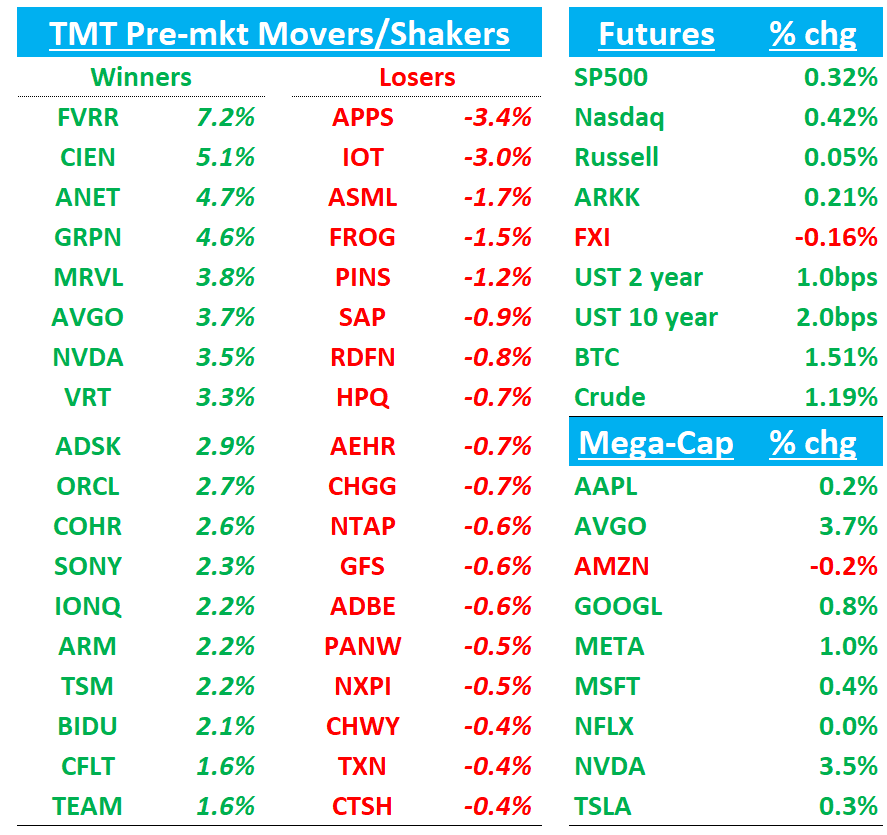

QQQ +40bps trying to gain some traction this morning follow yesterday’s massacre as some AI levered capex names bouncing early as sell-side out generally defending: NVDA +3%; ORCL +2%; MRVL +4%; CIEN +5%; ANET +5%; AVGO +3.7%.

Trump out talking Tariffs again: President Donald Trump said he wants to impose across-the-board tariffs that are “much bigger” than 2.5%, the latest in a string of signals that he’s preparing widespread levies to reshape US supply chains.

Altman says more compute (no surprise):

Yields up 1-2bps across the curve. BTC +1.5%; China flat.

Let’s get to it…

MSFT/Tiktok: Trump says Microsoft is in talks to acquire TikTok - Reuters

Software: Bernstein and Wells Fargo, among others comment on Deepseek’s positive impact on sw

TMTB: We turned positive on AI-agentic sw back in the November, but the Deepseek development is a welcome surprise. While this is unlikely to move #s near-term, we think this is a boon to both investors sentiment (likely to see flows from AI levered capex into the space) and also ability for sw providers to drive costs down, increase adoption of AI products faster, as well increasing amounts of data being driven through pipes is beneficial for cloud consumption players. As we wrote this weekend, our sense is that macro backdrop is still favorable for owning stocks so investors shifting $’s into sw from semis makes sense to us. Our favorites include NOW, CRM, SAP, TEAM, and HUBS. TWLO and MSFT also stands to benefit.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.