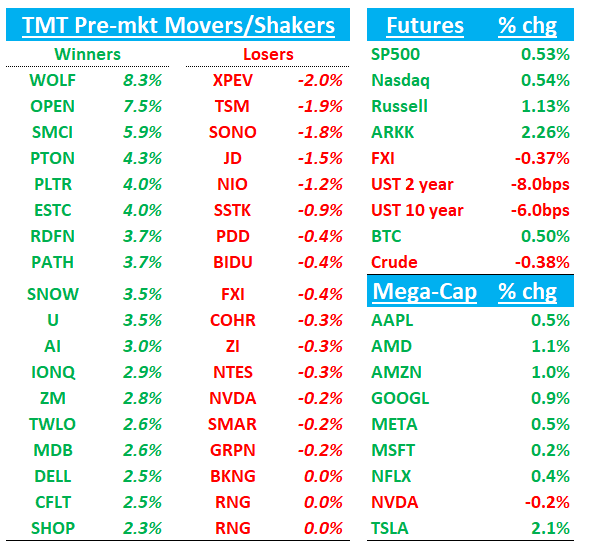

Good morning QQQs +50bps as market liked the Bessent pick for Treasury, who is seen as more market friendly and less punitive on tariffs (see Bloomberg article here…does that help semis today?). Odds of a fed cut continue to hover in the 50-55% range. DXY is sliding 50bps. BTC +40bps hovering around $97k. China -40bps. Treasuries bid with yields down 6-8bps across the curve. We’ll see if trend of mega-caps underperforming continues today. Lots to get to so let’s get straight to it:

AMZN/NVDA: Amazon’s Moonshot Plan to Rival NVDA in AI Chips

Not sure if this is why NVDA underperforming this morning (not a ton new in the article) but don’t see much else out there on it after stock was down 3% on Friday. The article talks about AMZN’s effort to build out a rival chip despite NVDA still maintaining a strong moat bc of their sw.

Demand for Amazon’s AI chips was slow at first, meaning customers could get access to them immediately rather than waiting weeks for big batches of Nvidia hardware. Japanese firms looking to quickly join the generative AI revolution took advantage of the situation. Electronics maker Ricoh Co., for example, got help converting large language models trained on English-language data to Japanese.

Demand has since picked up, according to Gadi Hutt, an early Annapurna employee who works with companies using Amazon chips. “I don’t have any excess capacity of Trainium sitting around waiting for customers,” he says. “It’s all being used.”

Software/ESTC/SNOW: Wedbush gets bullish software sector ad upgrades ESTC and SNOW to buy. Also raises PT on PLTR and CRM

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.