TMTB Morning Wrap

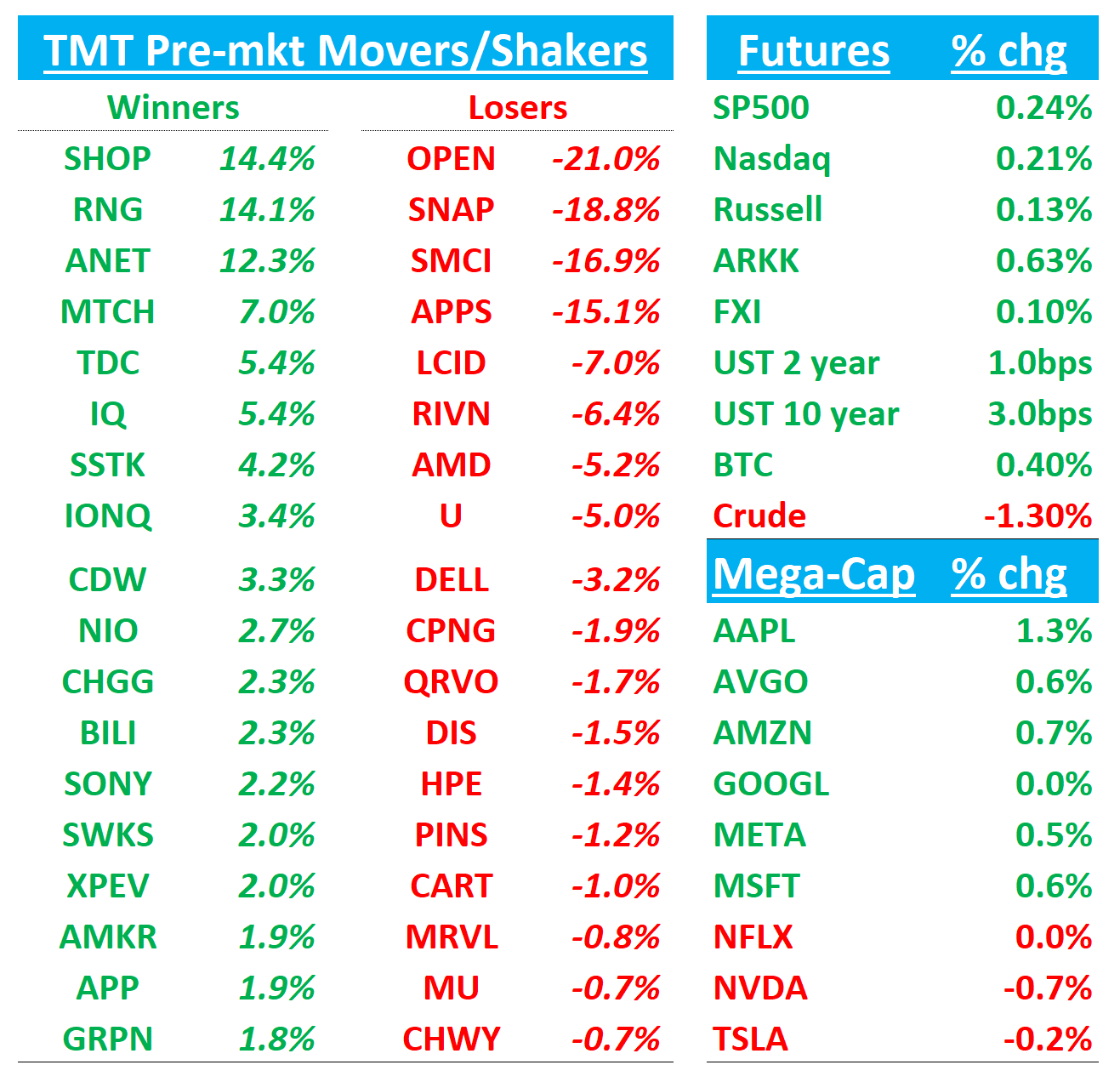

QQQs +20bps early as yields down 1-3bps across the curve.

Lots of earnings this morning and not much news/research/3p, so let’s get to it…

We’ll hit SHOP (wow!), UBER, U, DIS first this morning, then recap AMD, ANET, ALAB, SNAP, SMCI and more from last night below….

SHOP: GMV accelerates to 30% as top line beats by 5%, biggest beat in 10 quarters

What a print!…Massive GMV beat much better than heightened buyside expects. GP growth crushed at 24.6% vs street at 19% while top line guide is also a lot better

GMV accelerated to 30% from 23% last quarter, topping 30% for the first time since Q4 2021 - a big deal as will help drive multiple re-rating higher. The call will be fun to listen to - bulls will love the beat as they’re even more excited about AI agentic/chatbot medium/long term tailwinds.

2Q GMV: $87,837M vs. Street $81,653M

2Q Revenue: $2,680M vs. Street $2,547M; guidance was to grow mid-20s y/y

Revenue growth: 31.1% vs. Street 24.5%

2Q Gross Profit: $1,302M vs. Street $1,247M; guidance was to grow high-teens y/y

Gross Profit growth: 24.6% vs. Street 19.3%

2Q GAAP opex %: 37.7% vs. Street 39.3%; guidance was GAAP opex 39–40% of revenue

2Q FCF margin: 16.0% vs. Street 15.4%; guidance was mid-teens

3Q GMV guide: Street $83,301M

3Q Revenue guide: Street $2,641M. Guided growth: mid to high 20s vs. Street 22.2%

3Q GAAP opex guide %: 38–39% vs. Street 37.4%

3Q FCF margin guide: mid to high teens vs. Street 17.9%

UBER +1%: Looks solid with beat and raise but unlikely to change AV debate as delivery beat and mobility small bookings miss. Additional $20B buyback

Called out 20 total AV partnerships with 5 new expected in 2H

2Q Summary:

Gross Bookings reached $46.8B, up 18% y/y ex-FX—essentially in line with expectations and consistent with 1Q trends. Trip growth ticked up slightly to +18% y/y. Adjusted EBITDA came in at $2.12B, ~1% ahead of consensus, with an incremental margin of 8.1% (down from 9.4% in 1Q).

Mobility Bookings landed at $23.8B, matching consensus but light of buyside bogeys, with 18% y/y ex-FX growth (vs. 20% in 1Q). Segment EBITDA of $1.91B was also in line, yielding 10.5% incremental margin (vs. 10.9% prior). Delivery Bookings beat slightly at $21.7B, growing 20% y/y ex-FX (up from 18% in 1Q), while segment EBITDA of $873M about in line with street

3Q Outlook:

Guidance for Gross Bookings of $48.25–$49.75B implies 17–21% y/y ex-FX growth and is about 3% above consensus at the midpoint. This outlook includes a neutral to slightly favorable FX impact and a ~1% lift from the Trendyol Go acquisition. EBITDA guidance of $2.19–$2.29B is modestly above street, with implied incremental margins easing to 6.9% (vs. 8.1% in 2Q).

DIS -2%: A little light of bullish expectations

Overall, results were solid but likely underwhelming for increasingly bullish investos

Revenue of $23.65B and EPS of $1.61 came in slightly mixed vs. Street at $23.69B and $1.46, with Entertainment ($10.70B vs. $10.81B) and Sports ($4.31B vs. $4.43B) missing, while Experiences beat ($9.09B vs. $8.88B). Core Disney+ subs reached 127.8M vs. Street at 127.5M, and F4Q guide calls for >10M sub adds across Disney+ and Hulu, above Street expectations. FY25 EPS was raised to $5.85 from $5.75 (a smaller lift than the Q beat).

U -5%: Better Q2 revs and EBITDA but Q3 and EBITDA slightly below street at the mid point

Investors will be focused on Vector commentary on the call

2Q25 revenue of $441M, ahead of consensus at $428M. Core Create revenue was $154M vs. Street at $139M, while Grow revenue hit $287M, also ahead of expectations.

Adjusted EBITDA came in at $90M, beating consensus at $77M and guidance of $70–75M.

3Q25 Outlook:

Revenue guidance of $440–$450M is slightly below the Street midpoint of $448M. Adj. EBITDA guide of $90–95M is also modestly below Street at $94M.

AMD -5%: Solid print but nothing to get bulls more incrementally positive

Tone on the call was good, but nothing new to get bulls incrementally more excited. Let’s not forget the stock is up 50% since mid June as buyside GPU estimates for 2026 have gone from sub $10B to $14-15B+. Mgmt said GPU would be “tens of billions” but didn’t give any specific timing. Also talked up strong interest in mi400 with expanded set of customers in 2026, mi355 in 1H and mi400 after that, but no specific timing after that.

Bears will continue to be skeptical of AMD — we all remember how the 2025 GPU buyside estimates that were out in early 2024 turned out to be a dud. Bears will point to lack of timeline for ramp and opex hurting leverage, while pointing to upside being mainly gaming driven and say stock trades at 30x 2026 street numbers so why not just buy NVDA instead?

Our view: We remain bullish heading into 2026, but continue to think stock likely needs some digestion following a massive run and ramp in buyside expectations. AMD ran away from us while we only had a small-sized position, so we’ll be looking for the right spot/setup to add on a dip, but aren’t in a rush v. near-term.

The Numbers:

Revenues came in at $7.69B, up 31.7% y/y vs. Street at $7.43B. EPS was $0.48 vs. $0.49, with a one-time $800M inventory charge tied to China export controls weighing on profitability. Gross margin fell to 43.3%, though normalized to ~54% ex-charge vs. Street at 43.1%.

Gaming led the beat while EDC was in line: Gaming beat at $1.12B vs. $0.75B; Client slightly missed at $2.50B vs. $2.56B; Data Center and Embedded were in line at $3.24B and $0.82B, respectively.

For 3Q25, management guided revenue to $8.70B ± $300M vs. Street at $8.37B, with implied EPS of ~$1.14 vs. $1.17. Gross margin is expected to recover to the mid-54% range as MI355 GPU volumes scale.

ANET +11%: Clean beat and raise against high expectations

Buyside expectations were high here, but ANET delivered with a clean beat to top line and margins, raising 2025 and 2026 guide, and moving up FY25 campus targets. Not much to nitpick for bears here.

2Q25: Revenue $2.205B 30% y/y vs. $2.10B 27% y/y; gross margin 65.6% vs. 63.0%; op-margin 48.8% vs. 46%; EPS $0.73 vs. $0.65. Deferred $2.8B up from $2.1B

3Q25 guide: Revenue $2.25B 24% y/y vs. Street $2.12B 17% y/y; GM 64% vs. Street 61.5%; OM 47% vs. 44%.

CY25: Management now sees $8.75B (+25% y/y) vs. Street ~$8.29B, GM 63–64% vs. 62–63% Street, OM 48% vs. 45–46% Street.

FY25 Campus target raised to $750M-$800M helped by VeloCloud SD-WAN deal

FY26: $10B+ vs street at $10.3B

Management disclosed two hyperscale customers already running more than 100 k GPUs and a fourth ramping faster than planned, alongside a growing roster of ~25–30 enterprise and “neo-cloud” buyers.

Bulls see Arista as the pure-play winner from the rapid migration of AI clusters from InfiniBand to open-standard Ethernet while saying rising inference workloads are starting to pull forward front-end network refreshes, not just the back-end fabrics. Management notes that large back-end fabrics are already “rapidly migrating to Ethernet based on the Ultra Ethernet Consortium spec” and that the same shift is brewing in scale-up interconnects once dominated by NVLink. Because Ethernet is cheaper, vendor-agnostic, and backed by a vast silicon roadmap (400 G → 800 G today, 1.6 T next year), hyperscalers and a fast-growing “neo-cloud” cohort are designing clusters around Arista’s “Etherlink” portfolio, which improves GPU utilization and provides a single control plane for both front- and back-end traffic.

Not much to pick at on the quarter for bears, but skeptics will counter that Ethernet’s takeover may take longer than bulls expect: proprietary NVLink (and NVIDIA’s bundled InfiniBand) still commands the scale-up socket today, and ANET itself concedes its share here will depend on industry standards maturing “over the next few years”. Customer concentration remains a worry. Bears also point to chatter that NVIDIA, Celestica and white-box ODMs could undercut Arista on price, rekindling earlier concerns about branded switch premiums.

Investor day comes in Sept.

ALAB +20%: Another big beat and raise on surging Scropio AI switch sales has bears on backfoot

Expectations high here going in (although heard chatter of shorts still involved) but ALAB delivered with another beat and raise across the board.

Key Takeaways:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.