TMTB Morning Wrap

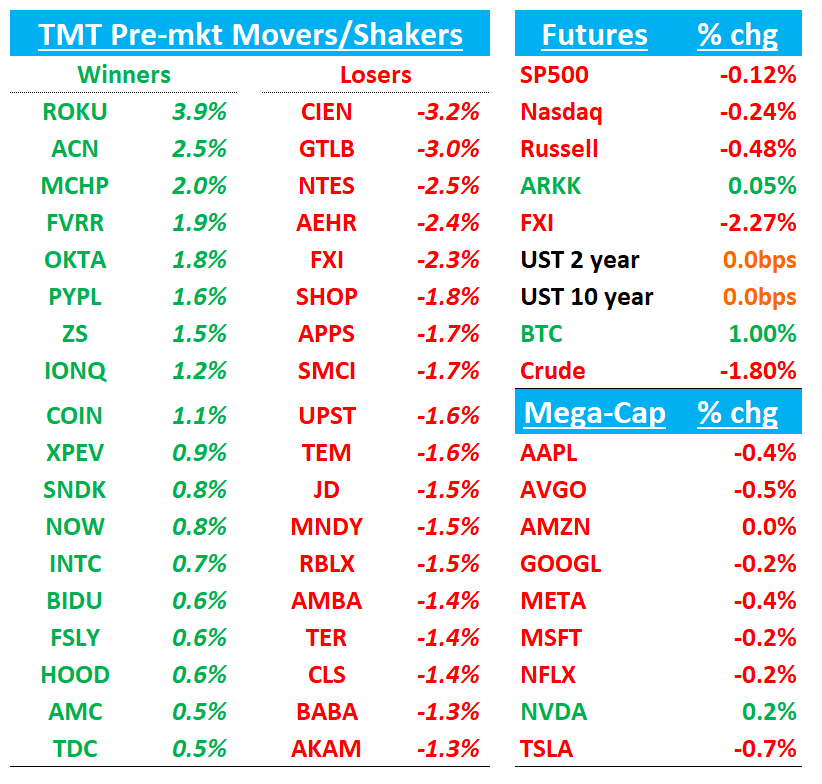

Good morning. Futures -20bps ahead of the jobs report in a few minutes. BTC +1% hovering around $87k. Yields flattish. Stocks down across the board in Asia: TPX -1.78%, NKY -1.56%, Hang Seng -1.54%, HSCEI -1.79%, SHCOMP -1.11%, Shenzhen -1.5%, Taiwan TAIEX -1.19%, Korea KOSPI -2.24%. Warsh remains ahead of Hassett on Polymarket (45% vs. 41%) for the next Fed chair appointment.

Fairly quiet morning although getting a flurry of the typical end of year upgrades/downgrades from the sell-side in their 2026 pieces.

Let’s get to it…

NOW: Guggenheim Upgrades to Neutral, Removes PT Amid Persistent Challenges

Guggenheim upgrades ServiceNow to Neutral from Sell after the stock moved below its prior price target, saying much of the downside is now reflected following prolonged underperformance. The firm notes AI monetization remains underwhelming and that acquisition-driven growth is obscuring softer organic trends. Guggenheim flags rising M&A risk, including recent deals and potential larger transactions, as adding uncertainty to the outlook. While acknowledging ServiceNow’s premium franchise, the analyst removes the $766 price target and stresses this is not a call to buy, with further downside still possible.

CEO Bill McDermitt was on CNBC talking close of Moveworks and saying “the results of our organic growth machine speak for themselves.”

ROKU: Morgan Stanley Upgrades to Overweight, Raises PT to $135 on CTV Ad Acceleration

Morgan Stanley upgrades Roku to Overweight from Underweight and raises its price target to $135, citing a stronger 2026 U.S. advertising outlook led by connected TV. MS says accelerating migration of sports and political ad dollars to streaming should narrow the monetization gap, driving Platform revenue growth to ~19% in 2026 versus ~15% prior and Street. The firm highlights Roku’s scale, deeper partnerships, and expanding monetization tools as supporting more durable double-digit growth through 2027–28. Valuation is based on ~6.5x FY27 gross profit, with sustained Platform growth seen as the key upside driver.

Stock trying to breakout of 3-year base:

ACN: Morgan Stanley Upgrades to Overweight, Sets $320 PT on Valuation and AI Clarity

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.