TMTB Morning Wrap

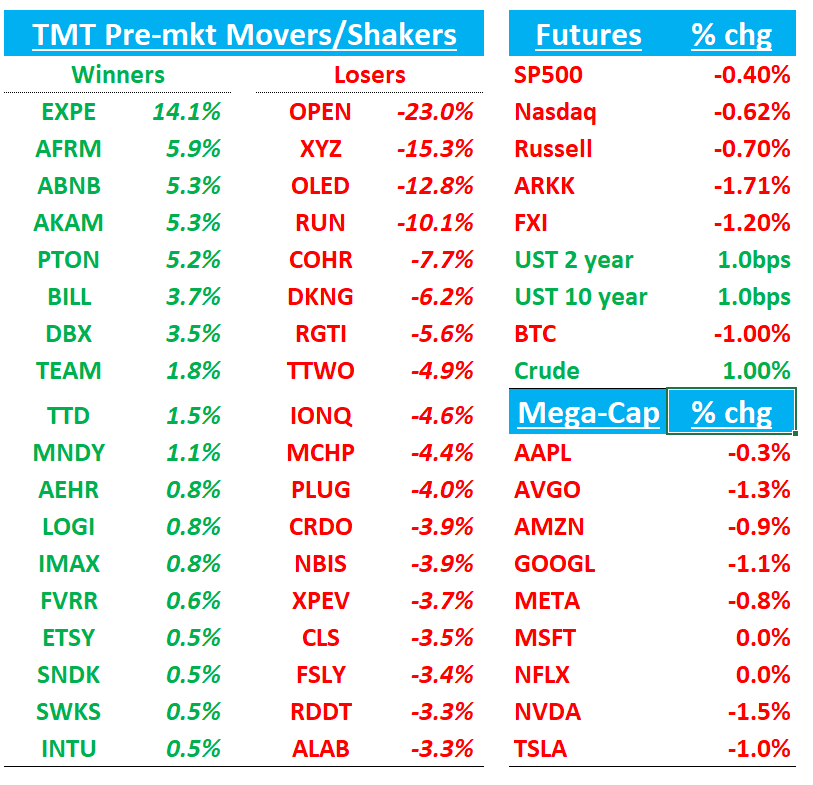

Good morning. More risk off early this Friday with Futures -60bps. Asia weaker: TPX -0.44%, NKY -1.19%, Hang Seng -0.92%, HSCEI -0.94%, SHCOMP -0.25%, Shenzhen -0.3%, Taiwan TAIEX -0.89%, Korea KOSPI -1.81%. Odds of a rate cute on 12/10 down to 65%. On the gov’t shutdown front, hopes cooled overnight for an agreement as Dems said they will block legislation today that would pave the way for reopening (Politico). BTC -1% hanging around 100k

We’ll hit earnings first, then onto the usual…

EXPE +14%: Clean beat & raise, beating bogeys/street — nights +11% y/y (fastest growth in >3 years), revenue +9% y/y, EBITDA margin +~200 bps y/y; FY guide raised with Q4 outlook calling for 6–8% growth and continued margin expansion.

The #s / Key Takeaways

3Q Revenue $4.412B, +9% y/y (last q +6% y/y) vs Street $4.283B, +6%; Adj. EBITDA $1.449B (32.8% margin) vs Street $1.350B (~31.5%); Non‑GAAP EPS $7.81 vs Street $6.97. Beat driven by U.S. nights acceleration and B2B +26% growth.

3Q Gross bookings $30.73B, +12% y/y vs Street ~$29.18B; Room nights 108.2M, +11.1% y/y vs Street ~103.8M (+~7%). Take rate 14.36% vs Street 14.69% (mix/timing)

Q4 guide: bookings & revenue +6–8% y/y (FX +1–1.5 pts) vs street at 4% and ~+200 bps margin expansion (EBITDA 22.5% vs street at 21% — guide 6% above street on EBITDA); FY25 raised to GBV +~7%, revenue +~6–7%, margin +~200 bps. 2026: further margin gains but at a moderated pace.

Macro/Demand: Mgmt cited stronger U.S. with longer stays/booking windows, resilient premium and low‑end demand; monitoring gov’t shutdown/air traffic risk, but air exposure manageable. U.S. nights up HSD (fastest in >3 years); EMEA LDD and APAC >20% nights growth; longer lengths of stay and booking windows indicate a healthier consumer.

Ad revenue +16%; product work (new lodging search flows, rec systems) delivered record attach; Hotels.com relaunch and Vrbo promos lifted brand trajectories.

AI in filters/Q&A/review summaries and service; virtual agents resolve >50% of traveler queries; early but good‑quality traffic from OpenAI/Google/Perplexity integrations; aim to appear in answer engines and route back to direct.

Bull vs. Bear Debate

Bulls argue this quarter confirms “OTA convergence”: EXPE’s room‑night growth (+11%) matched or beat key peers while U.S. nights re‑accelerated for the first time in years. They see a structural earnings story (HSD revenue + consistent margin expansion) powered by B2B (+26% bookings), ad monetization (+16%), and B2C marketing efficiency (B2C EBITDA margin ~41%). With ~2/3 of B2C direct and loyalty scaling, bulls think the mix shift is durable and AI will improve personalization, attach, and service costs (already >50% of queries resolved by virtual agents). While the nights comp gets tougher in Q4, if EXPE can hold HSD growth, that means we likely see DD growth through Q2’26 as copms get much easier in Q1/Q2. On valuation, bulls highlight EXPE trading at ~13x P/E vs BKNG ~18x/ABNB ~25x, despite higher and accelerating room night growth, and say with recent mgmt execution, premium should diminish.

Bears contend Q3’s strength owed partly to a favorable OTA backdrop (hotels leaning into OTAs during a soft macro) that may fade; B2B comps stiffen into 2026, and BKNG/ABNB could spend more in U.S. hotels and alternative accommodations. They flag answer‑engine/AI search risk (re‑intermediation, content control, and paid traffic quality), Google dependence, and take‑rate pressure (Q3 take rate below Street). On valuation, some bears note that on a fully adjusted merchant‑EV/EBIT basis EXPE screens at a premium vs BKNG (~2.5x) despite slower topline and weaker FCF conversion; that premium could ould normalize if growth moderates, marketing leverage ebbs, or Vrbo loses share to a better‑funded ABNB.

What changed this quarter? The U.S. re‑acceleration, B2B +26%, ad +16%, and B2C margin leverage strengthened the bull narrative around platform benefits and mix. Conversely, take‑rate undershoot vs Street, management’s own “moderated” 2026 margin expansion comment, and the acknowledgment that AI traffic is still small/experimental gave the bears some fuel on sustainability and longer‑term disintermediation risk.

SNDK +1% delivered a beat‑and‑raise against high expectations driven by stronger‑than‑expected bit shipments and firming pricing, and guided December revenue and margins well above Street/bogeys on ongoing supply tightness and allocation into AI/data‑center demand

Expectations were high, but numbers were good enough to keep the memory bull party alive and well — #s evidence how much pricing leverage flows through to the bottom line.

Q2 EPS Guide $3-3.4 vs bogeys of $2.75 (although I heard north of $3 from some bulls). Still looks much better

Q2 Rev Guide $2.6B vs street at $2.35B a

Q2 GM Guide 42% vs 34%

Q2 Pricing +DD%, bits +LSD%.

Q1 Revs$2.31 vs street 2.15B

Q1 EPS of 1.22 vs street at 88c

DC +26% q/q with two hyperscalers in qualification and a third hyperscaler and top storage planned for CY26 and engagement with five major hyperscale customers

Bits +mid‑teens q/q (Street ~+7%) and ASP +MSD% q/q (Street ~+8%).

Key quotes:

It’s almost like every week or two, our estimates for calendar year 2026 demand in the data center market move around, and they’re all moving up. When we were sitting here three months ago, we thought our forecast was data center exabytes would increase mid-20% level in 2026. We’ve now upped that to mid-40% in 2026.”

“Customers are proactively seeking long‑term commitments… striking multi‑quarter volume/price deals for supply certainty… some players providing visibility through CY27.” … “Our goal is to grow along with the market… build our business in data center where we are under‑represented.”

Key Takeaways:

Products on allocation across all end markets; 100% fab utilization; no plans to add wafer capacity; BiCS8 at 15% of bits now, majority exiting FY26.

Company at full utilization with no intention to increase capacity absent sustained demand beyond current levels (18+ month horizon to add capacity).

Data‑center exabyte market seen mid‑40s% growth in CY26 to “high‑300s EB”, with SNDK guiding sequential DC revenue growth through FY26; Stargate (128TB QLC) in qualification at two hyperscalers, a third and a major storage OEM planned in CY26; five hyperscalers engaged.

GM rose to 29.9% (33.1% ex start‑up/under‑util.) and guided to 41–43% in Dec as cost headwinds flip to tailwinds with BiCS8 ramp and utilization at 100%.

Opex: extra week added ~$11M in Sep; model similar absolute opex going forward given investments in DC and HBF. Potential share repurchases flagged now that SNDK is net‑cash.

End‑market demand backdrop. Edge/PC: units flat‑to‑slightly up with mid‑single‑digit content growth; smartphones: units slightly up with double‑digit content growth; consumer seasonal strength into holidays.

Bull vs. Bear Debate

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.