TMTB Morning Wrap

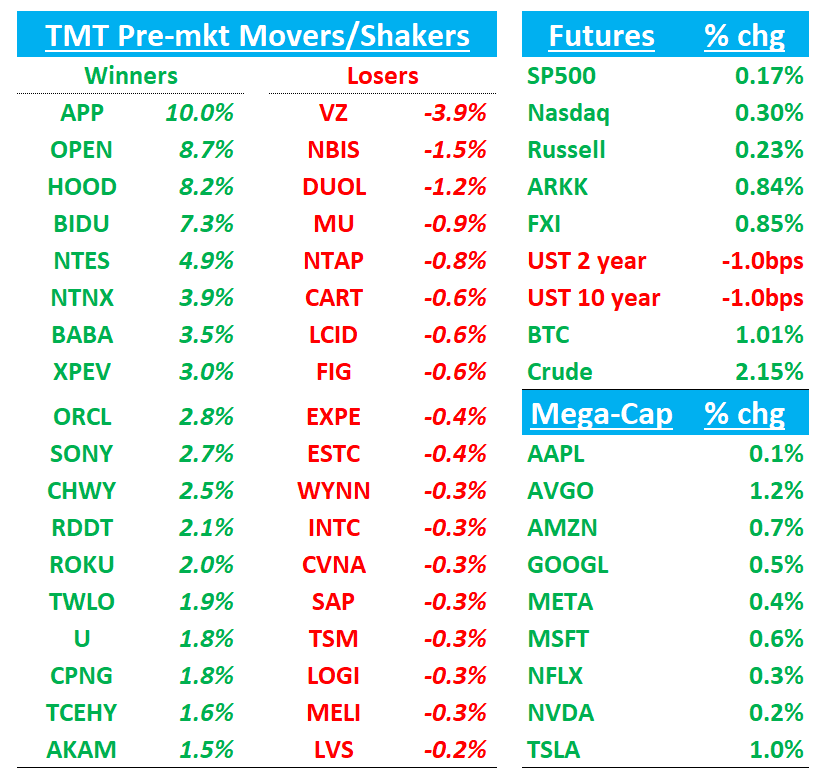

Good morning. Futures +30bps to start the week.

GS TMT Conference starts today and it’s a good one. Schedule can be found here

Today we get (among others): NVDA (CFO), NFLX, U, TWLO, UBER, UPST, MCHP, CHKP, CFLT, EBAY, HPQ, TER, IOT, IBM, ADSK, MTCH, SNOW

AAPL iPhone event tomorrow. ORCL EPS on Tuesday and ADBE on Thursday. ANET Investor day. Should be another busy week in Tech land and we’re here to cover it all…

Let’s get straight to it…

APP/HOOD to join SP500

NVDA: Citi Trims PT to $200 on Rising TPU Competition

Citi lowered its price target on Nvidia to $200, reflecting roughly 4% downside to 2026 GPU sales as AI XPU adoption accelerates, particularly from Google. The firm points to Broadcom’s commentary around faster XPU growth and sees Nvidia facing mounting competition in compute capacity from Meta, OpenAI, and Oracle. Citi now models ~$12B less GPU revenue for Nvidia in 2026, with CY25/26 estimates still 2–5% above consensus on sovereign and cloud AI strength. The team emphasizes its forecast excludes China, which could provide incremental upside if GPU shipments resume. Despite trimming estimates, Citi maintains a Buy rating, citing Nvidia’s dominant 85%+ share of AI compute and long-term demand tailwinds.

CHWY: Mizuho Upgrades to Outperform, PT Raised to $50 on Strong Momentum

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.