TMTB Morning Wrap

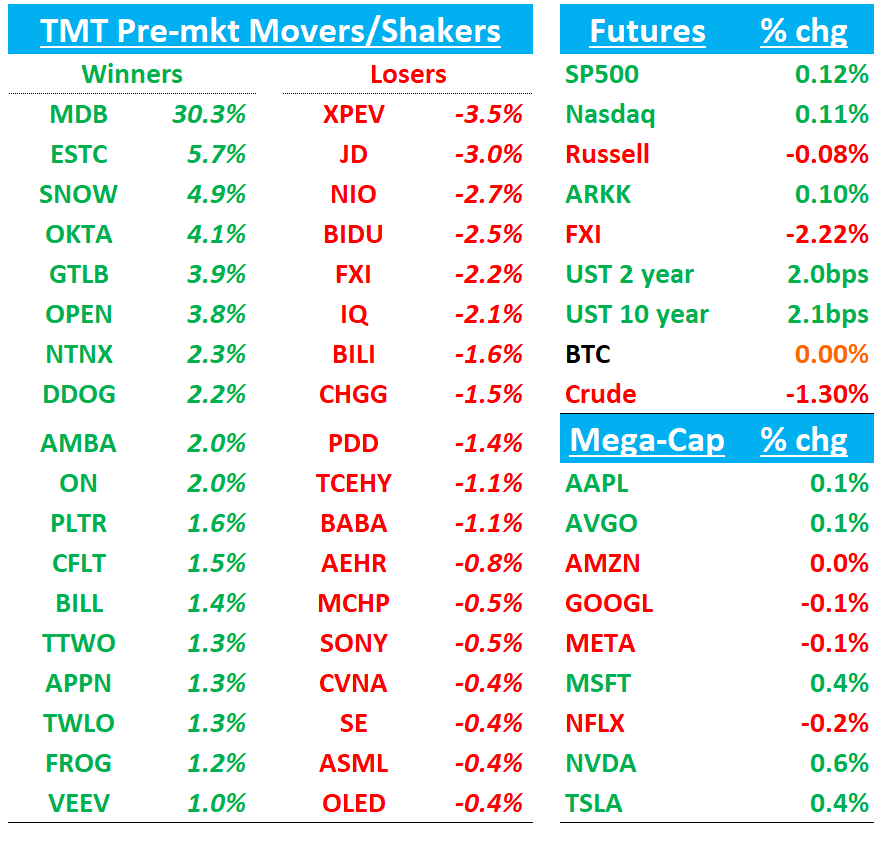

Futures up small as MDB +31% blew out the quarter yesterday. SNOW +4%; DDOG +2% in sympathy. Questions remains whether the rest of sw will get a bid on results - we don’t think MDB all that releavant to app sw. Tonight more fun: NVDA the main event, and BILL, CRWD, SNOW, VEEV also on the docket.

China -2%, BTC flat, yields ticking up slightly.

We’ll hit MDB and OKTA first then hop into news/research…

MDB +31%: Atlas accelerates to 29% and narrative shifts to AI winner

Sentiment was a bit mixed going into the print although HFs were generally long this, but this was much better than expected.

Atlas 29% growth was above bogeys of 26-27, implying New ARR up about +30% for 2 straight quarters, with mgmt saying there was broad-based strength, especially large U.S. customers. Total Revs $591M vs buyside closer to $575M. Q3 Rev guide a bit better at $587-$592M vs street at $582M and a touch below buyside but will likely be viewed as conservative given new CFO. Op margins 14.7% vs street at 10.4%.

FY guide taken up and implies mid 20s growth for Atlas in 2H - given 5%+ Atlas beats over the last two quarters, bulls will pencil in 30%+ growth in back half and ~25% growth in 2026 as comps continue to get easier, just as ELA flips to a tailwind. Decent set up ahead with co at Citi conf in early Sept and analyst day in Mid Sept, where bulls hope CFO will talk up margins and give MT targets for the first time, along with talking up AI roadmap.

As we said yesterday, this 2nd quarter of execution going a long way to 1) put Post-gres fears in rear-view and 2) bucket MDB as an early AI winner. Bulls will argue stock has some catching up to do to SNOW’s multiple (7x revs vs 11.5x revs), with ~10x CY26 implying $350-$375. Tough for bears to point anything from the q but they’ll say Post-gres debate still not fully settled and since no AI contribution yet, will take some time for stock to re-rate to 10x. That’s a fair point — after all, it took 3 quarters of execution for SNOW’s perception among investors to fully flip - and MDB so far is only 2/2. Wouldn’t be surprising for stock to hang around $275-$300 for a bit.

Importantly the call went well. Mgmt pushed back on Postgres/clone concerns; emphasized OLTP as AI “high ground” and shortcomings of JSONB at scale.. They said AI early but strategic: AI cohort not yet material; differentiation centers on JSON + integrated search/vector + Voyage embeddings; notable AI wins (e.g., EV voice assistant at >1B vectors, DevRev AgentOS).

Key quotes on AI/Post-gres competition:

“Again… the AI cohort was not a material driver of the growth… We’re a JSON database… we integrate search and vector search, so you can do sophisticated hybrid search… we’ve now embedded Voyage models on our platform… if you control the embedding layer, you sit at the gateway of AI… that reduces things like hallucinations.”

“MongoDB has redefined what’s core for the database by natively including search, vector search, embeddings and stream processing… Comparing MongoDB to Postgres is not apples‑to‑apples… Agibank… migrated from Postgres to Atlas… delivering nearly five times better performance and 90% lower costs…

Many startup founders go with what they know. As they scale, they’re running into real scaling challenges with Postgres… JSONB on Postgres… creates enormous performance overheads… Newer versions of technology like Neon has, it's not that mature…Going to prototyping to production is a totally different game…Those tolerance from developers for those types of issues are very low

OKTA +4%: Solid Q2 as cRPO of 13.5% met bogeys but subdued q3 guide

Clean beat-and-raise: revenue, cRPO, margins, EPS all ahead; FY26 raised; 3Q revenue/FCF ahead but op income/EPS a touch light. cRPO +13.5% y/y and NRR stabilized at 106%; public sector (incl. a largest DoD deal) was a clear driver. CFO removed macro/Federal conservatism and said they’re “shooting closer to the pin.”

The Numbers vs. Street

Q2:

Total revenue $728M, +12.7% y/y vs Street $711M (~+10.2% y/y). Subscription revenue $711M, +12.5% y/y vs $697M. cRPO $2.265B, +13.5% y/y vs Street ~$2.20–2.21B (+~10.5%). NRR 106% (flat q/q). Non‑GAAP op margin 27.7% vs 25.9%. EPS $0.91 vs $0.84. FCF margin 22.3% vs ~19% guide.

Q3 guidance vs. Street:

Revenue $728–730M (+9–10% y/y) vs Street ~$721M. cRPO $2.260–2.265B (+~10%) vs ~$2.257B. Non‑GAAP op income $160–162M vs $164M. EPS $0.74–0.75 vs $0.75. FCF margin ~21% (in line).

FY26 (Jan‑26) guidance vs. Street:

Revenue $2.875–2.885B (+10–11% y/y) vs Street ~$2.857B. Non‑GAAP op income $730–740M vs $718M. EPS $3.33–3.38 vs $3.27. FCF margin ~28% (raised from 27%). Diluted shares ~185M

Bull vs Bear debate:

Bulls argue the identity platform story is working: cRPO re‑accelerated to ~14%, NRR stabilized at 106%, and execution improved (record pipeline, partner leverage). Federal traction (largest DoD deal) and specialization point to healthier bookings mix. AI/NHI and Cross App Access expand Okta’s strategic relevance, while PAM (Axiom) and IGA broaden the platform. Profitability is compounding (FY26 ~28% FCF margin, rising op margins), leaving room for multiple expansion from roughly ~5–6x EV/NTM revenue / high‑teens EV/NTM FCF. This quarter, bulls point to the macro/Fed prudence removal, the public‑sector strength, and raised FY26 as evidence the model can grow low‑teens with attractive FCF despite DOGE. Bulls say OKTA can sustain 13–15% revenue growth with ~28–30% FCF margins so a 7–8x CY26 revenue multiple makes sense which is $120+

Bears see growth stuck near ~10%, with NRR at 106% still well below pre‑DOGE levels; new logo adds remain muted per sell‑side trackers. They worry that 3Q cRPO guide implies decel and that “shoot closer to the pin” reduces the positive surprise cadence so OKTA less likely to be a big beat and raise story. Competitive intensity (Microsoft Entra; now PANW/CYBR on PAM) could cap pricing and share gains; Axiom’s impact is immaterial near‑term. This quarter, bears point to the slightly light op income/EPS for 3Q, the possibility of a large AI‑native customer churn (OpenAI) and an upsell‑heavy pipeline. Bears say growth likely skews near 10% and competitive pressure presists so stock should trade higher than 5x revs which is a $90 stock.

No strong view here…

AMZN: Morgan Stanley Sees AWS Capacity Ramp Driving 20%+ Revenue Growth in ’26; PT $300, Bull Case $350

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.