TMTB Morning Wrap

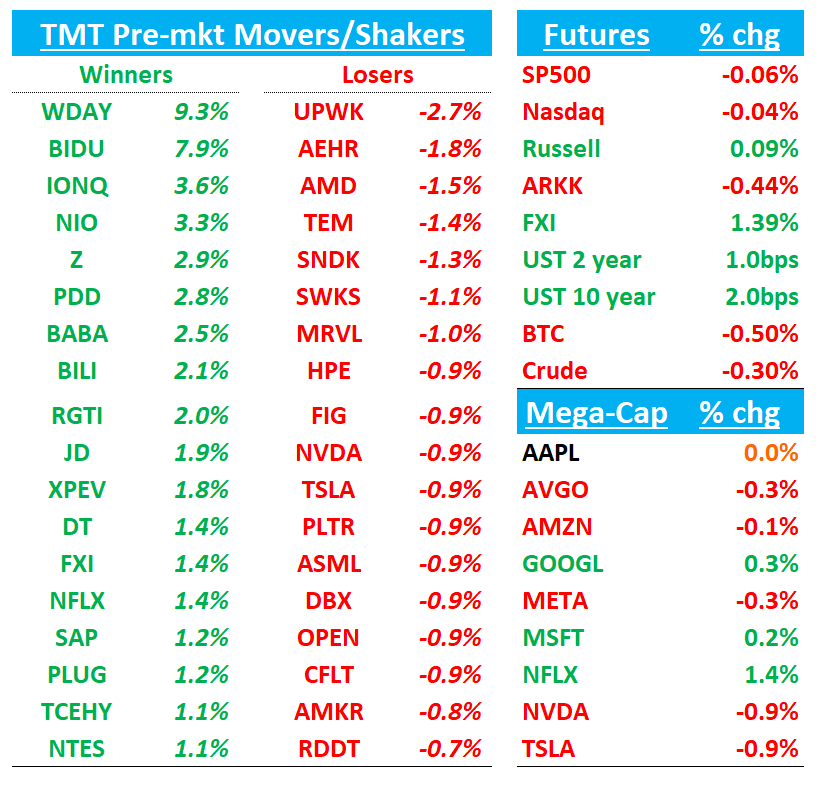

Happy Fed Day. Futures are flattish and yields are slightly down ahead of Powell this afternoon. Asian markets mixed - NKY -0.2%, Hang Seng +1.8%, SHCOMP +0.3%, TAIEX -0.7%, KOSPI -1%, India +0.3%. HSTECH +4.2% as tech stocks surged in China. Why are China stocks ramping? We liked this take:

GS’s Privo was also out with an interesting take saying the bigger read through from the ORCL/TikTok deal is China tech:

If capital and IP can flow freely from east to west, then they should flow west to east as well. The key factor holding back global investors from buying China tech has been concern over capital security inside China (echoes of Russia sanctions/restrictions still loom large amongst asset managers). With US + China rapprochement ahead of a planned Xi/Trump October summit, the global allocation problem is becoming harder to ignore. Parts of Chinese tech trades at a fraction of US multiples, and the world looks set to evolve into two independent tech verticals...how long can investors stay on the sidelines?

Although that argument doesn’t hit as hard when we get headlines overnight that China is banning NVDA chips (BIDU 8% seen as biggest beneficiary with their stake in Kunlun)

Let’s get to it…

NVDA: China bans tech companies from buying Nvidia’s AI chips

China’s internet regulator has banned the country’s biggest technology companies from buying Nvidia’s artificial intelligence chips, as Beijing steps up efforts to boost its domestic industry and compete with the US. The Cyberspace Administration of China (CAC) told companies, including ByteDance and Alibaba, this week to end their testing and orders of the RTX Pro 6000D, Nvidia’s tailor-made product for the country, according to three people with knowledge of the matter. Several companies had indicated they would order tens of thousands of the RTX Pro 6000D, and had started testing and verification work with Nvidia’s server suppliers, the people said. After receiving the CAC order, the companies told their suppliers to stop the work, the people added. The ban goes beyond earlier guidance from regulators that focused on the H20, Nvidia’s other China-only chip widely used for AI. It comes after Chinese regulators concluded that domestic chips had attained performance comparable to those of Nvidia’s models used in China.

NVIDIA CEO JENSEN SAYS "WE CAN ONLY BE IN SERVICE OF A MARKET IF A COUNTRY WANTS US TO BE"

WDAY +8%: Piper Raises PT to $235, Upgrades to Neutral

Piper lifted its rating on Workday to Neutral from Underweight and increased its price target to $235 from $220, citing early signs that management is pushing harder to stay relevant in the AI race. The firm points to three acquisitions in the past month, adding over 1,300 employees with AI expertise, plus new products like Flex Credits that shift pricing toward consumption and away from employee headcount. Piper also highlights Workday’s rollout of a new data cloud with zero-copy integrations into Databricks, Snowflake, and Salesforce, alongside fresh AI and low-code tools. While execution risks remain, the firm says the valuation reset—with EV/FCF near a 10-year trough at 18.8x—balances risk and reward.

WDAY: Guggenheim Upgrades to Buy, PT $285

Guggenheim raised Workday to Buy from Neutral with a new price target of $285, arguing the company is better positioned now than in prior years despite a challenging macro backdrop. The firm says Workday has strengthened through deeper partner engagement, global payroll expansion, success moving down-market, and new AI-driven acquisitions. Guggenheim notes that while large transformational HCM projects remain pressured, Workday continues to grow at double digits and should sustain that pace even if IT spending stays muted. The report highlights Workday’s rising share repurchase program, activist support, and recent leadership hires as additional positives. While concerns remain around the cost of running its proprietary infrastructure, Guggenheim believes the risk is outweighed by consistent execution and the company’s ability to scale.

WDAY: Elliott Management takes $2B stake and says Workday made substantial progress in recent years

Elliott Investment Management issued the following statement: "Elliott is one of Workday's largest investors, with an investment of more than $2 billion. We believe CEO Carl Eschenbach, CFO Zane Rowe and the entire Workday team have made substantial progress in recent years, positioning Workday as a unique software franchise with industry-leading growth potential, best-in-class customer retention and a proven management team. We are pleased with our dialogue with the team and believe the plan announced at today's Financial Analyst Day represents a significant enhancement of Workday's operating model and capital allocation framework. We believe this multi-year plan will drive substantial long-term value creation for Workday shareholders, and we look forward to continued collaboration with the company."

In addition to Elliott, bulls also like the additional $4B buyback and better than expected margins (35% in ‘28 vs expects in low 30s) while bears will continue to point to slowing core biz & lower subscription growth while AI structural fears remain as WDAY has a lack of AI product story.

WDAY: Morgan Stanley Highlights Analyst Day Targets, Focus on AI & FCF Growth

Morgan Stanley says Workday used its 2025 Analyst Day to showcase a stronger financial framework and broader AI opportunity. Management committed to sustaining >20% FCF per share CAGR through FY28 along with a Rule of 48%, which the firm views as achievable given revenue growth and margin expansion. MS notes Workday’s AI-based solutions are already generating $450M+ in ARR, up 50% YoY, with emerging AI products adding another $150M+ in ARR at 200% YoY growth. The firm also points to momentum from the new Data Cloud, more partner integrations, and a doubled developer base, which could drive adoption and new monetization avenues like Flex Credits. Morgan Stanley says execution on these growth levers will be key to meeting the long-term financial framework.

ALAB: Citi Boosts PT to $275 on Stronger AI Ramp, Keeps Buy and adds to 30 day catalyst watch

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.