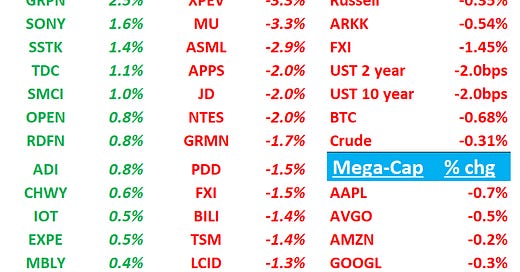

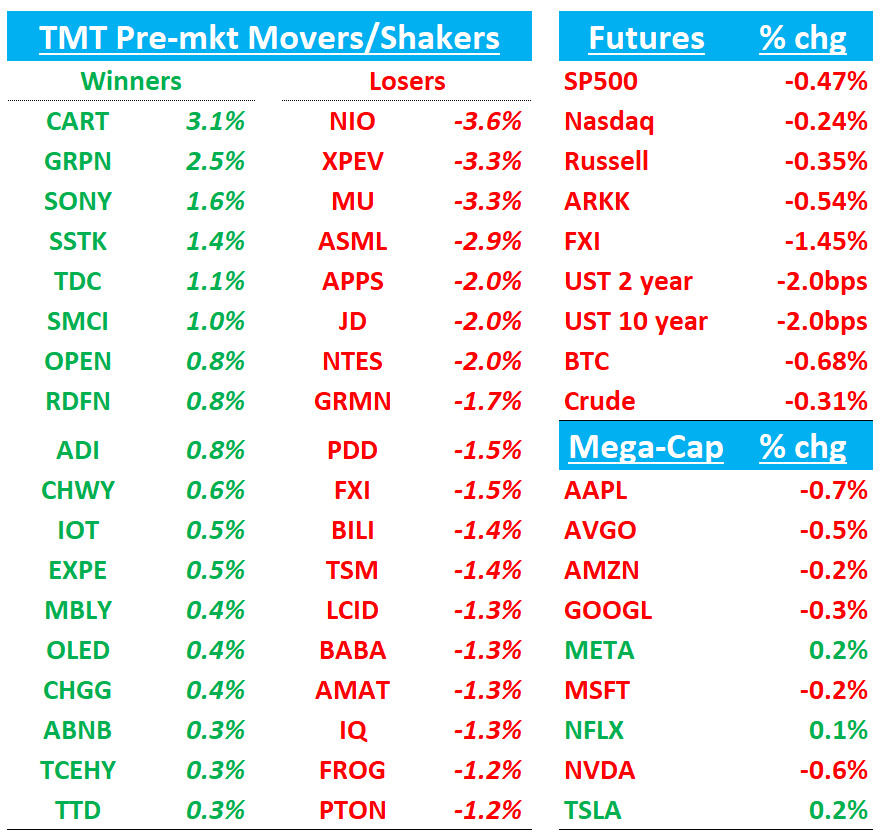

Good morning. QQQs - 25bps. Yields ticking slightly lower. China -1.5%. BTC -60bps. Fairly slow day on the news/research front, but let’s get to it….

MU -3.5%: Q3 Guide much better than feared + HBM better but lack of GM upside in Aug feed fears that GMs will be below previous cycle peaks this cycle

Overall, solid print with Q2 roughly in line but Q3 guide of $8.8B significantly above bogeys of $8-$8.3B as most expected a guide down. That’s up significantly q/q vs Q2 at $8.05B

HBM shipments ahead of plans as they ramp faster - HBM +50% q/q.

HBM shipments were ahead of plans, as they ramp faster (HBM up 50% sequentially). Continue to see HBM and trade % constraining non-HBM supply. Revised up 2025 DRAM demand from “mid teens%” to “mid-to-high teens %.”

(“our HBM shipments were ahead of our plans, demonstrating strong execution of our ongoing ramp…as previously mentioned, Micron is sold out of our HBM output in calendar 2025… we are seeing strong demand for our HBM supply in 2026, and are in discussions with our customers on agreements for their calendar 2026 HBM demand”).

Gross margins the main issue on investor’s minds this morning:

Co said that Q4 Gross margins will be “up somewhat” so getting the commentary we wanted around Q3 being the bottom in GMs; however, they said GMs would only be up 50bps in Aug Q despite 10% higher revenue (street was at 40% vs ~37%+ implied guide). MU said Q2 and Q3 lower GMs is driven by a few factors including a higher mix of consumer DRAM and higher NAND sales as well as NAND underutilization charges. Citi’s Danley writes more on the issue: “MU’s margins reached 60% in 2018 upturn and 50% during 2022 upturn, significantly higher than the 36.8% margins in Q2 at similar revenue levels.”

Plenty of stuff for bulls to like on the print: HBM revs strong, commentary around HBM yields for 12H positive and HBM will continue to be “nicely accretive” to DRAM GMs (Danley at Citi thinks HBM has a 6x pricing premium vs normal DRAM with 70% GMs which we think is a reasonable assumption). MU noted that HBM4E (Rubin Ultra, 2027,1TB HBM, 5x GB200) trade ratio is 4-to-1, which is one-third higher than HBM trade ratio for HBM3e. Mgmt was positive on DRAM/NAND pricing which continues to tick up. Bulls will say yes GMs look low right now, but need to wait for DRAM/NAND pricing to flow through, NAND underutilization to run off, and wait for HBM ramp which is accretive.

Bears will point to the lack of GM bump in Q3 as discussed above as well as point out there could have been some tariff-related pull in that helped NAND shipments. Bears will also say some of the DDR share MU was getting from Samsung likely to reverse in next couple of quarters as well as Sammy getting qualified at some point in June/July. Bears will also say a slowing economy will eventually flow through to end demand and into DRAM/NAND pricing.

Overall, we continue to think r/r under $100 is v good and stock should continue to o/p as long as DRAM/NAND pricing going up into Blackwell launch and Samsung unlikely to be a big factor in HBM until late 2H or early 1H’26 (although we’ll likely get news of Samsung qualification before then). We do think the lower peak GMs argument has some validity and we weren’t completely satisfied with mgmt’s answer on why GMs are not higher in the Aug Q, but we think there is v likely upside to Aug GMs given HBM ramp which has higher GMs, assuming DRAM/NAND pricing continues to tick up, and NAND underutilization charges begin to roll off. We still think $13+ in EPS on the table for ‘26. At the end of the day this is first a cyclical stock with a secular kicker — and both of those are tailwinds right now.

NEWS/RESEARCH

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.