TMTB Morning Wrap

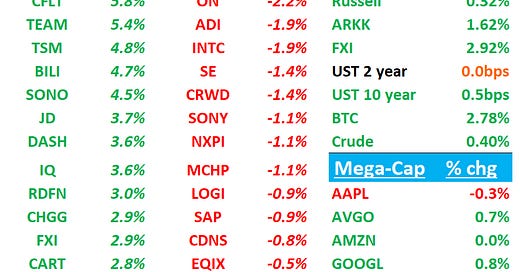

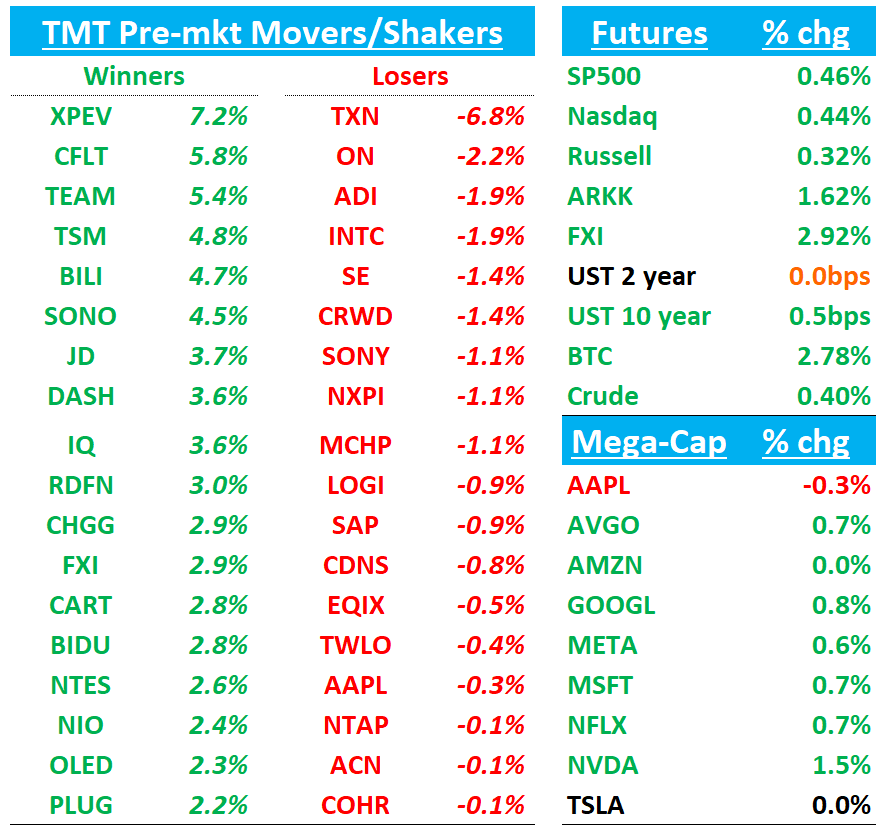

Good morning. QQQs +30bps after a -2 / +2% overnight futures session. China raised tariffs to 125% and said will ignore any further attempts for U.S. to go higher. Dollar breaking below $100. Yields flattish. China +3%. BTC +3%.

Let’s get right to the good stuff…

Tariffs/Semis: The China SIA stating that that the place of origin of imports to China will be determined by where front-end production takes place - link

What this basically means is than any chips that are fabbed in the US but packaged in South East Asia and shipped into China will be subject to the China retaliatory tariffs. TXN-5% hurt the most given large US fab exposure. NVDA/AMD likely ok as they are fabbed with TSM (+4%). Neg for INTC. ON also likely hurt. MCHP operates fabs in the US and has assembly and test facilities in SE Asia.

Earnings: LOGI one of first Tech companies to pull their guide / TCS misses Q4 and called out deteriorating business trends as the quarter progressed .

Third Party Data Roundup (NVDA, AMD, CART, AMZN, NOW, TEAM, CHWY):

NVDA: Clev raising ‘26/’27 unit expectations on NT strength driven by hypercale, OEM, and China customers / M-sci saying strong new BW and Hopper drove DC outperformance

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.