TMTB Morning Wrap

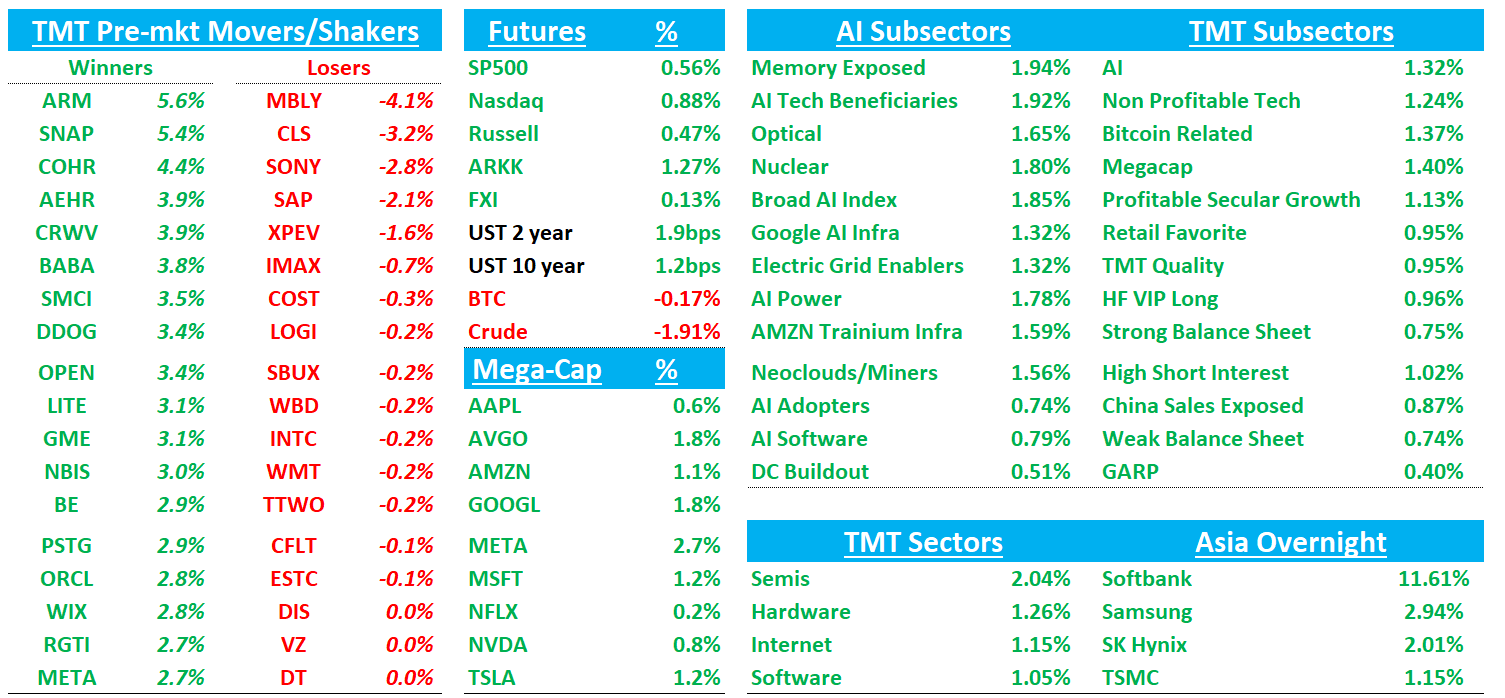

Good morning. Futures +80bps as rally continues after yesterday’s Taco. Asia up across the board: TPX +0.74%, NKY +1.73%, Hang Seng +0.17%, HSCEI -0.09%, SHCOMP +0.14%, Shenzhen +0.69%, Taiwan TAIEX +1.6%, Korea KOSPI +0.87%. Softbank +12%. UBIsoft-30% in Europe. Yields flattish. BTC hovering around $90k. Mag 5 outperforming early - do we finally get some flows back into large cap internet/TSLA today?

Let’s get straight to it…

DDOG: Stifel Upgrades to Buy on Checks Pointing to Q4 Beat

Stifel upgrades Datadog to Buy from Hold with a $160 price target (from $205), citing channel checks that suggest an “another larger-than-typical” Q4 beat driven by accelerating core growth and continued share gains. The firm believes DDOG will guide 2026 revenue to ~$4.1B, implying a conservative ~19% core growth rate, with OpenAI integration running at a ~$90M per-quarter revenue pace. The analyst adds that valuation looks attractive relative to peers as one of the few names showing accelerating core growth.

GOOG: Raymond James Upgrades to Strong Buy on AI Stack-Driven Estimate Upside

The firm cites bottom-up work across GCP and Search pointing to a material uplift to 2026–27 estimates and upside to Street numbers by 2027, prompting the rating change. The analyst now models GCP growth of 44%/36% in 2026/27 vs. Street at 34%/31%, driven by ~2M TPUs at ~$25B ARR, ~$20B of GPU ARR, ~$10B from Gemini API PaaS, and ~$2.5B from Vertex PaaS exiting 2027, with each incremental 1M TPUs at $20k potentially adding ~$20B of revenue (hardware not embedded). For Search, RJ models 13%/13% growth vs. Street at 11%/9%, assuming core declines of 5–10% are offset by AIO/AIM/Gemini scaling to 4B/2B/1B DAU by 2027 and higher CPCs from AI-driven queries, with a bull-case U.S. AI Assistant ARPU of ~$750. The analyst adds a $400 PT based on 29x 2027 P/E, reflecting a premium for broad-based AI-led revenue acceleration.

GOOG: TD Cowen Raises Waymo Estimates on Accelerating Market Launches

The firm updates its Waymo model to reflect faster ’26 market expansion, now estimating ~6K vehicles offering paid rides across 17 cities by year-end, driving ~28MM paid rides and ~$463MM of gross bookings (~0.7% U.S. rideshare). The analyst notes paid rides average ~540K per week in ’26 (vs. ~450K previously disclosed), with launches spanning existing markets plus new cities including Miami, D.C., Detroit, Dallas, Nashville, San Diego, Las Vegas, Houston, Orlando, and Denver, while testing continues in additional markets. Long-term, the firm lifts ’26/’30 paid ride estimates to 28MM/204MM and U.S. rideshare gross bookings to ~$458MM in ’26 and ~$3.7B by ’30, with Waymo’s attributable share rising to 0.7% in ’26 and 3.5% by ’30.

AMZN / MSFT / GOOG: UBS Cloud Checks Flag Stronger 4Q25 Demand, Upside to Street

UBS says recent checks across ~30 customers and partners point to enterprise cloud demand that is stronger than in 3Q25, supporting upside risk to Street growth estimates for AWS, Azure, and Google Cloud. The analyst notes spending intentions improved sequentially, with no major customers trimming cloud infra budgets, while AI projects and data-readiness initiatives continue to pull through hosted CPU/GPU demand. UBS estimates Dec-quarter growth bogeys of ~39% for Azure, 22–23% for AWS, and ~36% for Google Cloud, seeing upside for Azure and GCP and flagging a higher bar for AWS if growth sustains at 22–23%.

Anthropic/GOOGL/AMZN: Anthropic Lowers Gross Margin Projection as Revenue Skyrockets - TheInformation

Mainly talking about Q4 before the Claude Code ramp, so imagine this has gotten even more out of hand in Q1

The Information reports that Anthropic projects a 40% gross profit margin for 2025, a figure dampened by higher-than-expected inference costs on Google and Amazon servers but still a major recovery from negative margins in 2024. The publication notes that while this trails OpenAI’s projected 46% margin, both companies are struggling with the high costs of renting servers, prompting them to raise massive capital and seek hardware independence. The report adds that despite these headwinds, both firms eventually aim for software-like margins exceeding 70% later in the decade.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.