TMTB Morning Wrap

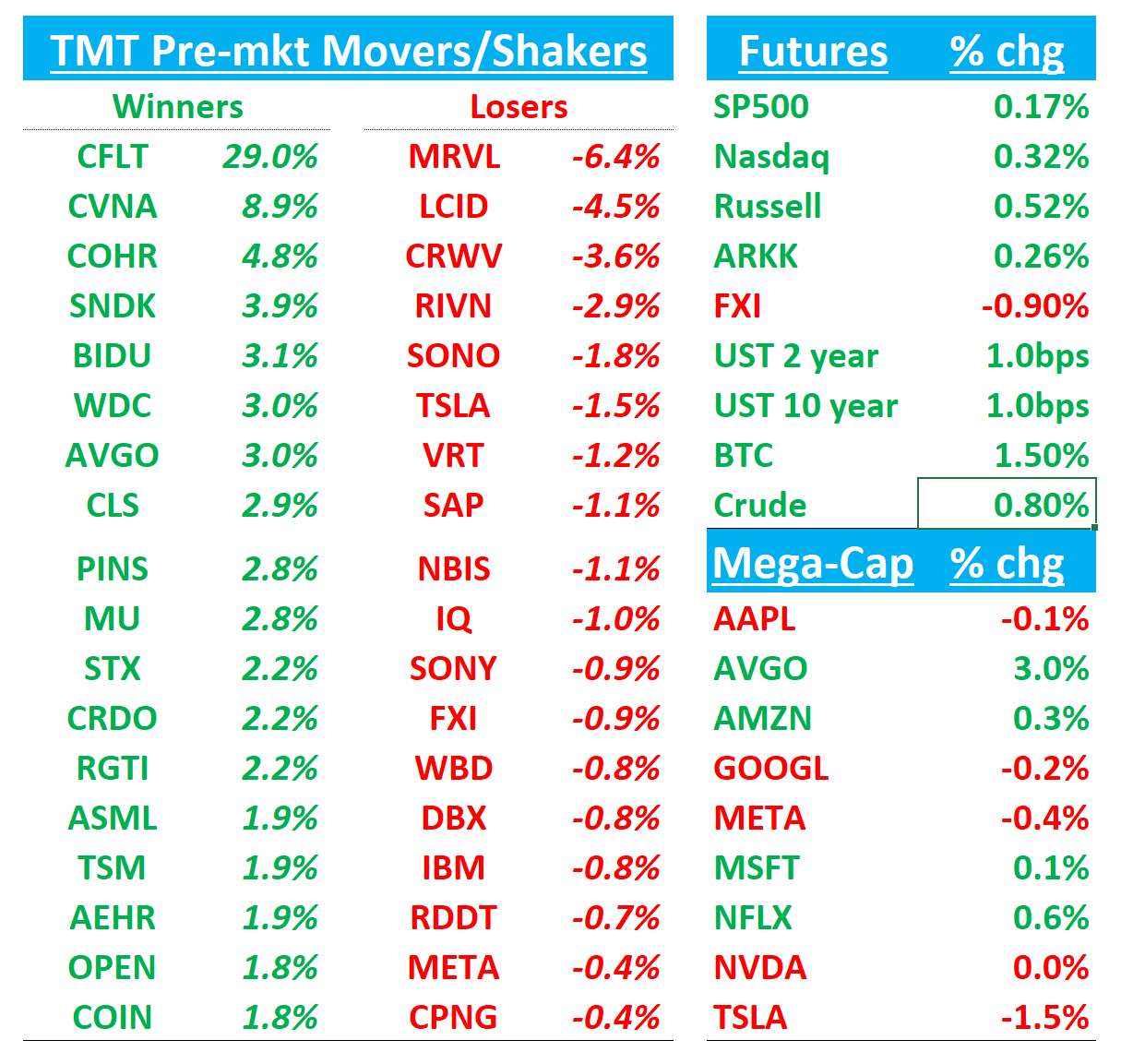

Good morning. QQQs +35 bps starting the week higher as we get closer to new highs. Asian markets mixed overnight: NKY +0.2%, Hang Seng -1.2%, SHCOMP +0.5%, TAIEX +1.1%, KOSPI +1.3%, India -0.8%. Memory names higher Kioxia+7.7%, Phison/Nanya+7%, Hynix+5.7% on some positive Asian press (below). BTC +1.5%. AI names leading the way higher with optical (COHR/LITE +4-5%) particularly strong as investor interest in the sector continues to rise.

IBM acquiring CFLT for $31/share.

We get EPS reports ADBE/CHWY on Wednesday and ORCL/AVGO on Thursday (we’ll have bogeys out tomorrow). The Barclays TMT Conference begins on Wednesday as well (Agenda here). Chat GPT 5.2 release expected this week as well.

On the Macro side, all eyes on the Fed where expects are close to 90% for a cut on Wednesday.

Should be a fun one. Lot to get to today, so let’s get to it…

OpenAI’s GPT-5.2 ‘code red’ response to Google is coming this week

OpenAI CEO Sam Altman declared a “code red” situation earlier this week, pushing staff to respond quickly to increased competition from Google and Anthropic. Sources familiar with OpenAI’s plans tell me that the company is planning its first response to Gemini 3 with its upcoming GPT-5.2 update.

I understand GPT-5.2 is ready to be released, and could appear as soon as early [this] week . Sources tell me the 5.2 update should close the gap that Google created with the release of Gemini 3 last month — a model that topped leaderboards and wowed Sam Altman and xAI CEO Elon Musk.

IBM Nears Roughly $11 Billion Deal for Confluent

An $11B deal implies about $32 per share, implying 8x EV/Sales on CY26 #s. CFLT provides real-time data backbone that helps operationalize enterprise AI.

WSJ:

A deal could be announced as soon as Monday, the people said, cautioning that the talks could still fall apart.

Confluent had a market value of around $8 billion as of Friday, while IBM’s was around $290 billion.

CVNA: Set to join SP500

NFLX

Let’s start with NFLX. Lots of push and bull between bulls and bears here over the WBD acquisition as stock getting downgraded by Rosenblatt and Pivotal (used to be a big bull) this morning. Here’s the quick bull vs. bear tug of war. Bulls see the NFLX/WBD deal as a long-term, offensive scale play: it locks up HBO/WB IP, removes the threat of a WBD + PSKY/NBCU combo, massively deepens NFLX’s library with high-quality content, broadens global distribution for WBD assets on NFLX’s rails, boosts pricing power, and creates a larger sub base over which to spread fixed/content costs with potential for better than expected synergies ($3B+). If the deal fails, you still disrupted your largest competitor for 6-9 months. Bears argue it’s a bad/overly risky deal: they doubt the DOJ will approve it (Trump and co prefer Ellison/PSKY outcome), see the transaction as a sign NFLX’s organic growth is plateauing amid fears of long-form engagement preferences shifting, worry about $80–90B of pro forma debt and a deal overhang, and debate whether NFLX overbid given the large break fees.

Trump: WBD/NFLX “Could be a problem.”

A couple downgrades this morning…

NFLX: Pivotal Cuts to HOLD, Calling Warner Deal an $83B Signal of Long-Form Pressure

Pivotal — who used to be a big bull - says Netflix’s planned $83B acquisition of WBD’s studios and streaming assets (including a steep $5.8B breakup fee) looks like an attempt to reinforce its dominance in premium long-form content, but it also layers on regulatory risk and an 18–24 month closing window, plus potential bidding competition from PSKY. The firm argues the “very expensive” deal underscores management’s deeper worry that short-form platforms (TikTok, Instagram, X, YouTube Shorts, Snap) are eroding long-form engagement as younger users spend more time on free, bite-sized content. Pivotal notes it is taking a more conservative posture on long-term subs and ARPU and is not yet baking the Warner deal into estimates, which would likely push forecasts higher but “at meaningful cost.” Running the revised assumptions through its DCF model drove a $55 reduction in the YE26 price target to $105. With limited upside, Pivotal says it is downgrading NFLX to HOLD.

NFLX: Rosenblatt Downgrades to Neutral, Cuts PT to $105 on High Deal Risk and Low Financial Clarity

Rosenblatt downgrades Netflix to Neutral from Buy and slashes its PT to $105 from $152 after the company’s surprise plan to acquire Warner Bros. studios and HBO for an $83B EV. The analyst sees limited financial ROIC, saying the deal leans heavily on vague expectations of leveraging Warner’s content library without clear proof of value creation. Rosenblatt assumes a lower 25x EV/2026E EBITDA multiple and flags heightened uncertainty around execution, integration, and long-term economics. With strategic ambiguity and unclear upside dominating the outlook, the firm resets its valuation framework and moves to a more cautious stance.

Paramount could go hostile after losing to Netflix - Axios

A source close to Paramount said the company, which didn’t have visibility into Netflix’s offer until Friday morning, legitimately thinks it made the best bid and is currently exploring next steps.

An operative word is “patience.”

Paramount also thinks its offer could look even better when the Comcast cable networks spinoff begins trading later this month.

It would serve as a market comparison to the WBD stub that Netflix will leave behind.

Netflix’s Sarandos Wooed Trump in Person Ahead of Warner Bid

Netflix Inc. co-Chief Executive Officer Ted Sarandos ventured to the White House in mid-November for a meeting with President Donald Trump. Over more than an hour, the two discussed a range of topics, including the auction of Warner Bros. Discovery Inc., according to people familiar with the interaction.

Warner Bros. should sell to the highest bidder, Trump said, according to the people, who asked not to be identified divulging the details of a private conversation. Sarandos agreed, making the case for his company’s offer. The streaming TV leader wasn’t any kind of all-powerful monopoly, Sarandos argued, and had suffered its own subscriber losses a couple years earlier.

Moving on….

MEMORY: Samsung shifts focus from HBM to DDR5 modules for higher profits - Digitimes

Additionally, Samsung has reportedly decided to shift 30–40% of its DRAM capacity from the 1a process to next-generation 1b or 1c nodes, with 1c set to become the primary focus. Through this process transition, Samsung is expected to free up roughly 80,000 wafers per month and redirect them into general-purpose DRAM, including DDR5, LPDDR5X, LPDDR6, and GDDR7.

Samsung has been struggling to catch up to SK Hynix and Micron in HBM3E. Although its HBM3E finally passed Nvidia and US CSP certifications in the second half of 2025, market sources say Samsung has been slashing prices to expand HBM share. Its HBM3E ASP is roughly 30% lower than SK Hynix’s, and further price cuts of up to 30% are expected starting in 2026.

Memory/Hynix: SK hynix will operate HBM4 ‘ramp-up’ flexibly next year

Delayed by at least 1~2 months according to the customer’s schedule... HBM3E will be an oligopoly by the first half of next year

SK hynix has started to adjust the timing of full-scale mass production of HBM4 (6th generation high-bandwidth memory) next year. Initially, HBM4 production was planned to increase significantly from the end of the second quarter of next year, but it has recently been understood that some timings are being adjusted. It is interpreted as a resilient response in line with Nvidia’s AI chip demand and next-generation product launch strategy.

Another source commented, “I understand that SK Hynix increased the volume of HBM3E significantly more than expected during discussions with NVIDIA regarding next year’s HBM supply,” adding, “The increasing likelihood of a delay in the launch schedule for NVIDIA’s Rubin chip and the sustained strong demand for the existing Rubin chip, which is equipped with HBM3E, likely contributed to this decision.”

MRVL:

MRVL/MSFT/AVGO: Microsoft Discusses Custom Chips With Broadcom

Microsoft is in talks to design future custom chips with Broadcom, which would involve Microsoft switching its business from Marvell, another maker of custom chips, according to one person involved in the discussions.

Those discussions come amid intense demand for such chips as companies like Microsoft race to acquire more semiconductors and increase their AI products. Nvidia lords over the semiconductor market—while And Broadcom is seen as perhaps Nvidia’s most credible rival.

MRVL: JPM Reiterates Overweight, Says Fears of MSFT/AWS ASIC Share Loss Are Unfounded

JPM says its latest checks, along with Marvell’s earnings call and June Custom AI Analyst Day, confirm no ASIC share loss at Microsoft or AWS on current or next-gen AI XPU programs. The firm highlights that Microsoft’s Maia 3nm remains on track for a 2H26 ramp with a 2x y/y step-up in CY27, and that next-gen Maia design work is already underway. For Amazon, JPM notes Marvell has completed qual for Tranium 3, has purchase orders in hand for CY26, and has already begun early design activity for Tranium 4. JPM adds that media chatter about “talks” misses the reality of long, entrenched hyperscaler partnerships that are difficult to displace.

MRVL: Benchmark Downgrades to Hold After Losing Conviction on Amazon Tranium 3/4 Wins

Benchmark cut Marvell to Hold and withdrew its price target after “extensive industry meetings” left the firm highly confident that Amazon’s Tranium 3 and 4 designs have shifted to Alchip, a Taiwanese competitor. The analyst says this design loss is the key reason Marvell’s XPU growth is now expected to slow to roughly 20% in CY26, well below prior expectations. Benchmark adds that while Marvell appears “forthright” in guiding to rising annual Amazon revenue, the firm believes this is mostly tied to ongoing Tranium 2 demand and Kuiper LEO work, rather than any meaningful success transitioning to Tranium 3 as some on the Street have assumed.

TSM

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.