TMTB Morning Wrap

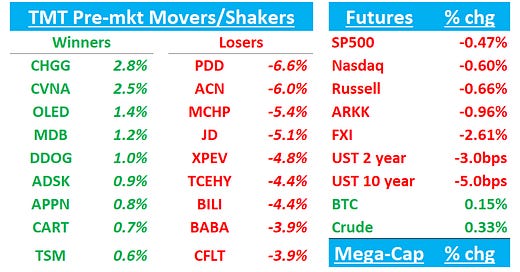

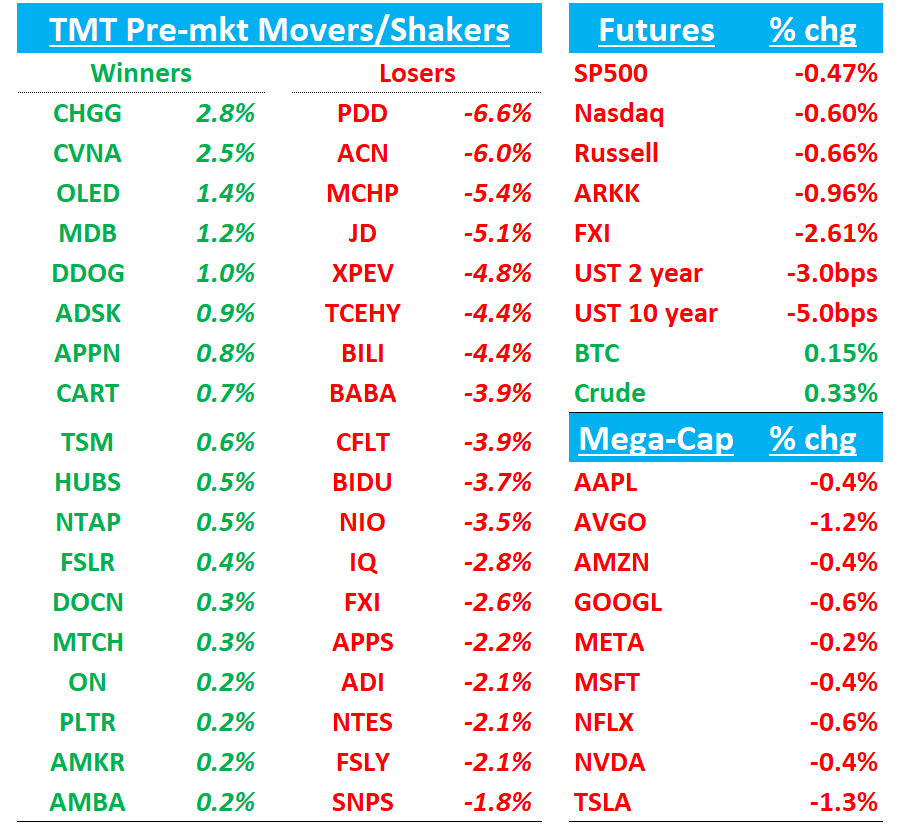

QQQs -50bps as the see-saw continues and no big news for the cause of futures downtick that began at 5:30am est. Yields down 3-5bps across the curve. China -2.5% weak this morning. BTC flat.

ACN and PDD earnings recaps first, then NEWS/RESEARCH.

Let’s dive in…

ACN-5%: Numbers look ok with Revs beating, Q3 guide inline and slight uptick to FY guide. However, big bookings miss ($20.9B vs street at $22.9B) a big red flag, gross margins weak, and OPMs coming down at HE.

Call ongoing…

Expectations were fairly low coming into the print as investors have shifted pretty negative on IT services over the last months given macro/DOGE/consume fears (ACN Federal services is 8% of revs / DOE a $1B contract). Despite rev beat (likely helped by M&A contribution), bookings miss will overshadow here and nothing in the print so far to help bulls take the ball from the bears.

Q2 Revs of $16.66B vs street at $16.6B

Q3 rev guide to 3-7% vs street at 5.5% and inline with buyside bar

FY25 rev guide adjusted to 5-7% vs prior guide of 4-7%.

OMs: F’25 range lowered to +10-20bpts vs. prior +10-30bpts

FQ2/Feb Gen AI bookings: Up q/q to +$1.4b (vs. +$1.2b in FQ1)

The bookings miss came from both consulting and managed services. The other nitpick hearing from investors is rev growth guide likely helped by M&A.

No commentary in the PR about macro/DOGE slowing demand or any project being delayed, but will be very important in terms of how they sound on the call \

PDD -6%: Weak results as total revs came in 5% below street with miss driven by transaction services (33% vs street at 52% y/y gross). GP (56.8% vs 59%) and OP well below street.

Call ongoing but transaction services miss likely due to larger portion of GMV is now semi managed model and Temu losing growth momentum and consumer mindshare in int’l countries.

Third-Party Data Roundup:

CVNA: Yipi said units held steady a 49% y/y in the latest week, not showing any signs of decel

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.