TMTB Morning Wrap

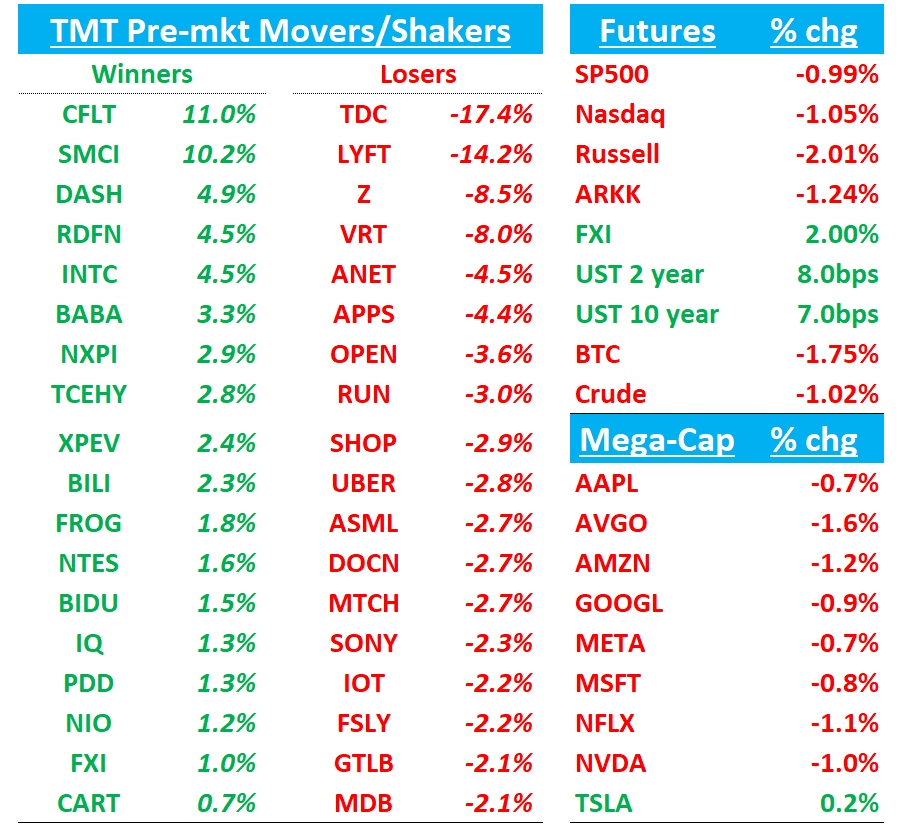

QQQs -1% selling off after a hotter CPI reading (0.5% m/m vs street at 0.3%). Yields popping 8-10bps across the curve. BTC -2% ; China +1%

We’ll go over Earnings first - VRT SMCI DASH LYFT UPST CFLT FRSH - then move onto News/Research. Let’s get to it…

VRT -9%: Q4 beat but stock weighed by flat orders growth / lack of margin flow through

Organic rev growth 27% vs street at 16% and guide of 11-15%, but Q4 orders flat y/y at $2.3B with a drag from EMEA order timing (investors wanted something closer to +10%). ‘25 EPS guided inline at $3.50-$3.60. Call at 11am est.

DASH +6%: Solid Q and great GOV guide; Q1 EBITDA slightly weaker

Very solid print. Overall: story stays intact here as top line trends continue to outperform and EBITDA good enough to keep hopes of $3B in 2025 alive. Similar to other best-in-class internet names like META/AMZN with best in class leadership, this is a name investors want to own and bulls will now look forward to a potential SP500 add in the coming months.

Q1 EBITDA guide only thing to nitpick coming in at $575M at the midpoint vs street/bogeys at $585M+. That’s well outweighed by a top line story that continues to chug along with Q1 GOV guide coming in 2ppts above street/bogeys. Bulls will continue to point to DashPass ramp, say they are only 10% penetrated in restaurants, increased adjacencies/ads/grocery, and newer cohorts more engaged vs pre-COVID cohorts. 25% of MAUs are now shopping across its new verticals vs 20% a year ago as order frequency and basket size grows. Mgmt also indicated q/q margin take rate increases likely in Q2/Q3 similar to 2024, implying 2H GB growth could be above 20%.

Bears will continue to harp on valuation (20x EBITDA), a weaker EBTIDA guide, and a GOV guide that is a 1ppt decel after adjusting for fx and leap year (although given mgmt’s conservatism, that decel is likely an accel, especially with 3p data tracking 4ppts above street Q1TD).

Key quotes:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.