TMTB MORNING WRAP

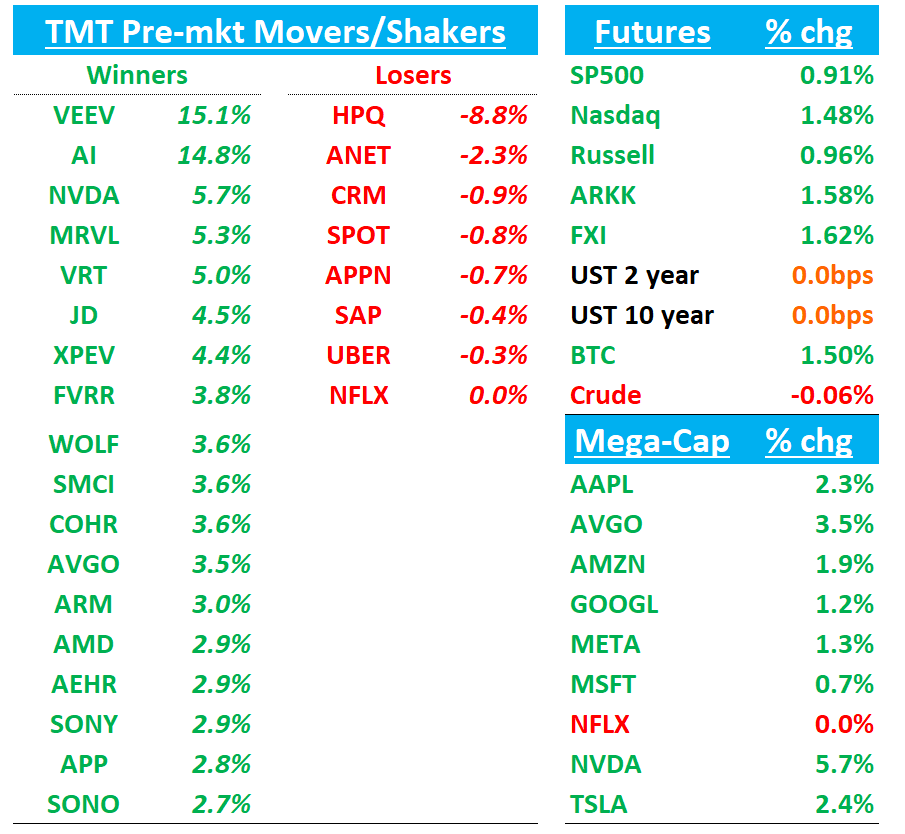

QQQ +1.5% rallying this morning after NVDA’s stellar print and news that Trump’s tariffs were deemed illegal although it seems he has other paths to continue to enforce them (details below).

Yields are flattish. BTC +1.3%. China +1.7%. Ai semis up on NVDA sympathy.

Lots to get to, so let’s get straight to it…

Trump’s Global Tariffs Deemed Illegal, Blocked by Trade Court

Bloomberg:

The vast majority of President Donald Trump’s global tariffs were deemed illegal and blocked by the US trade court, dealing a major blow to a pillar of his economic agenda.

A panel of three judges at the US Court of International Trade in Manhattan issued a unanimous ruling Wednesday which sided with Democratic-led states and small businesses that accused Trump of wrongfully invoking an emergency law to justify the bulk of his levies. The court gave the administration 10 days to “effectuate” its order, but didn’t spell out any steps it must take to unwind the tariffs.

Wapo:

Legal experts have told The Post that the lawsuits are likely to succeed if they make it to the Supreme Court.

The Trump administration is certain to appeal the decision and could seek an emergency stay, which would reinstate the tariffs at least temporarily.

The president’s trade team also could try to impose the same tariffs using more traditional legal avenues, according to Simon Lester, author of the international economic law and policy blog. Relying on other provisions of trade law would take time and require the government to complete various procedural steps.

The trade court noted that Trump retains more limited power to impose tariffs to address trade deficits under another statute, the Trade Act of 1974. But that law restricts tariffs to 15% and only for 150 days with countries with which the United States runs big trade deficits.

Goldman highlights that the current 232 tariffs—covering sectors like steel, autos, chips, and possibly aviation—now impact around 40% of U.S. trade, and more could follow under separate legal authorities.

GS believes this likely isn’t the end of tariff escalation and that the administration may pursue alternative legal routes to reinforce the broader tariff regime. Their economists expect a potential shift toward Section 122 for broad-based tariffs, alongside targeted Section 301 actions that could allow duties above 10% on key trade partners. While there may be temporary relief following recent legal setbacks to the IEEPA-based tariffs, GS warns this reprieve may not last as the broader policy framework remains in flux. Overall, GS sees a two-sided risk for markets with tariff uncertainty likely to persist.

EARNINGS

NVDA +5.5%: Solid all around — not much to nitpick

For me the key comes down to this: they printed $44B for the Q, and if you add in the $2.5B in lost H20, you get closer to $46.5B ex ban. Q2 guide ex ban ($8B) would be $53B, which would be a massive raise in a normal q...that implies ~14% sequential growth in July quarter. The GM guide of 72% was also better than bogeys at 71.5%.

Let’s not overcomplicate things: after getting past what was supposed to be a messy quarter, focus now shifts to 2H blackwell acceleration and ramp as build issues improve and GMs can work their way up from the trough. China is de-risked. While bears will still want to focus on “CY26 peak”, the AI vibes are in full force (we think better than at any point over the last year) and investors want exposure here. All systems go….

Bulls now sit close to $6.25 in FY27, at 25-30x that’s $155-$185. We think $150 is first stop on the way to new highs and continue to like NVDA.

Jensen sounded bulled up on the call, but I would say tone was a bit less ebullient than previous ones (not in a bad way, just seems like last couple months haven’t been as fun as usual operating procedure)

He talked about 4 drivers that are “turbo charging” demand: 1) Step function demand increase in reasoning AI; 2) Shift in Trump Admin approach to AI diffusion rules: “wants America to win…and recognizes that we have to get the American stack out to the world and have the world build on top of American stacks”; 3) Enterprise Ai agents ramping and 4) Lots of new AI factories being built around the world

In other words: AI infrastructure spending remains on an upward trajectory: U.S. hyperscalers continue to layer new Blackwell clusters while Taiwan ODMs report accelerating rack shipments; sovereign projects in the Middle East are committing gigawatt-scale data-centre builds; and enterprises are beginning to budget for on-prem inference capacity.

On demand/NVL:

“On average, major Hyperscalers are each deploying nearly 1000 NVL 72 racks for 72,000, Blackwell GPUs per week and are on track to further ramp output this quarter. MSFT for example has already deployed tens of thousands of Blackwell GPUs and is expected to ramp to hundreds of thousands of GBP 200s with OpenAI as one of its key customers.”

ANET -2% getting hit a bit as NVDA networking revs $5B vs expects of closer to 3.5B, fueling some concerns of share loss...

“For scale-out our enhanced Ethernet offerings deliver the highest throughput, lowest latency networking for AI. SpectrumX posted strong sequential and YoY growth and is now annualizing over $8b in revenue. Adoption is widespread across major CSPs and consumer Internet companies, including CRWV, MSFT Azure Oracle cloud and xAI. This quarter, we added GOOGL Cloud and META to the growing list of SpectrumX customers.”

CRM -25bps: Mixed and unexciting despite low expectations

Expectations/sentiment were low heading in, especially after news of the INFA acquisition, but we found the quarter unexciting as better Q1 top line was balanced by worse operating margins and an uninspiring Q2 cRPO guide. FY guide raised but entirely due to cc growth assumptions.

The stock is a do-nothing for us and we came away from the q less excited given weaker cRPO guide and worse op margins…

Details:

Q1 top line was better: cRPO growth of 12.1% (11% CC) came in ~200bps above guidance, and above bogeys of 10.5-11% with strength in Data Cloud and Agentforce.

Q1 subscription growth of 9% vs bogeys of 8.5% and street at 7.7%….Q2 subscription rev guide of 9%cc inline

But Q2 guide of 9% cc was below bogeys closer to 9-10% ad street at 9.2%. The headline optics also don’t look good as this is first dip of cRPO into single digits.

Q1 operating margins 32.3% a bit light of street at 32.65% and lighter than bogeys hoping for 33% (co has usually beat by 100bps so this is a disappointment). CRM is aggressively adding sales capacity (aiming for +22% reps by year-end) and re-investing AI-driven cost efficiencies into go-to-market expansion, particularly for Agentforce, which is hitting margins

Management described the macro environment as “stable,” with no visible deterioration in demand. SMB and mid-market segments showed resilience, offsetting softness in enterprise and marketing-related areas.

Bull vs Bear Narrative:

Bulls point to growing adoption of Agentforce (now over $100M ARR) and Data Cloud (combined >$1B ARR growing 120% y/y), viewing them as long-term catalysts for reacceleration. Bulls also see margin expansion, strong FCF conversion, and renewed sales capacity investments as early signs of a growth resurgence into FY27. The stock trades at a 17x forward EV/FCF multiple, well below peers, providing valuation support.

Bears, however, argue that core business growth continues to slow (Sales/Service Clouds now mid-single digits), margin upside has stalled, and Agentforce contribution is still nascent relative to CRM’s $60B+ RPO base. They question whether AI hype can sustainably offset broader saturation and macro sensitivity. Further, the FY guide raise being entirely FX-driven reinforces concerns that organic growth isn’t meaningfully accelerating.

To sum: CRM posted a steady but unremarkable quarter. Early signs of Agentforce momentum are encouraging, but with core deceleration and little organic upside to guidance, investors remain unconvinced on whether the AI flywheel can fully reaccelerate growth in the near term.

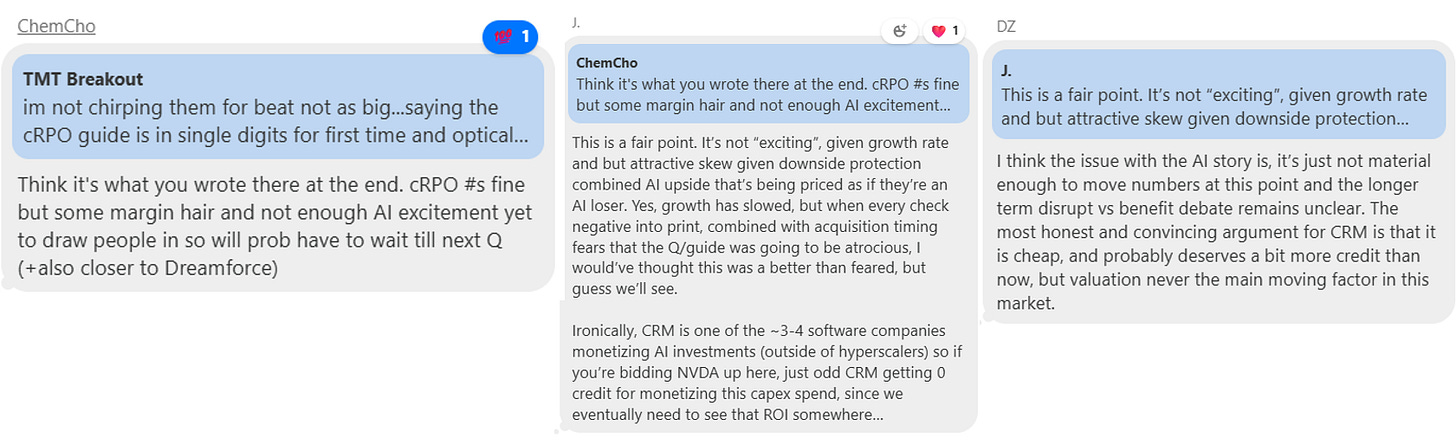

Some good bull vs. bear debate in TMTB Chat:

Gets a downgrade at RBC:

RBC downgraded Salesforce to Sector Perform from Outperform and slashed its price target to $275 from $420, citing increased execution risk following the acquisition of Informatica. The firm argues that the deal signals a potential return to Salesforce’s “empire building” mindset and raises questions about whether Informatica is essential to own outright rather than partner with. RBC also flagged integration concerns, noting that past acquisitions like MuleSoft and Slack haven't been fully absorbed, making this deal potentially distracting to Salesforce’s core business. While progress with the Agentforce AI strategy is acknowledged, RBC suggests market feedback has been mixed and competition in the AI-driven CRM space remains intense. Overall, they believe this deal introduces new risk at a time when execution needs to stay tight, leading to the downgrade and lowered target.

HPQ -10% as Tariffs and Macro his guidance

Q2 Revs inline but GM and EPS missed and guide also weaker citing tariffs

The numbers:

Revenue $13.2 B (+1 % vs Street $13.1 B) and up 3 % YoY; non-GAAP EPS $0.71 (-11 % vs Street $0.80) after a ~$0.12 hit from April-dated U.S.–China tariffs, which shaved ~100 bp off gross margin and Personal Systems margin

Gross margin 20.7 % vs Street ~22 %; operating margin 7.3 % vs 8 % Street

FY-25 EPS guide cut to $3.00–$3.30 (Street ~$3.55) and FCF guide trimmed to $2.6–3.0 B; 3Q EPS outlook $0.68–0.80 vs Street $0.90

PS revenue $9.0 B (+7 % YoY) on commercial Windows 11 refresh/early AI-PC demand, but PS margin fell to 4.5 %—below the 5-7 % target

Printing revenue $4.2 B (-4 % YoY); segment margin a strong 19.5 %, above the 16-19 % long-term band, helped by pricing discipline and a one-time grant

Management is moving almost all U.S. PC production out of China by end-June and pushing selective price increases, expecting tariff drag to be largely neutralized by 4Q

Bull vs. Bear Narrative:

Bulls argue the quarter’s shortfall is tariff-specific and transient. They point to a modest top-line beat, resilient Print profitability and a clear mitigation plan—factory relocation plus pricing—that should restore PS margin back toward 5 %+ in the second half. Coupled with the $2 B “Future Ready” cost-save program (up from $100M) and a 4 % dividend yield, they see FY-25 free cash flow stabilizing and a cheap 8 × P/E providing downside support. Bulls also view commercial Windows 11 upgrades and an on-deck AI-PC cycle as catalysts that could lift unit growth just as tariff headwinds fade

Bears counter that the cut to guidance underscores structural fragility: PCs remain a low-growth business and printing is in secular decline. They question management’s ability to deliver the steep 4Q EPS/FCF ramp implied by guidance, especially with tariffs potentially raising ASPs and crimping volume, memory prices trending higher and macro demand softening. Bears will say the 19.5 % Print margin may prove peak, buybacks are constrained by leverage, and any AI-PC uplift is a 2026 story, leaving near-term estimates still at risk.

VEEV +16%: Broad based beat on revs, subs billings and EPS and mgmt flowed upside into higher FY guide

Very solid print for this underowned stock as it breaks out to new highs in the pre…

The Numbers:

Revenue grew 17 % year-on-year to $759 million, about $31 million ahead of consensus; subscription revenue rose 19 % to $635 million, beating by $19 million. Normalised billings increased 16 % to $714 million, roughly $33 million ahead.

Non-GAAP EPS printed $1.97 against the Street’s $1.74, and operating margin reached 46.1 % versus 42.3 % expected.

Full-year revenue guidance is now $3.09-3.10 billion versus the Street’s $3.05 billion, billings guidance is $3.32 billion versus $3.25 billion, and the EBIT-margin outlook rises to 44 % from 42.7 %.

Key takeaways:

Crossix ― the life-sciences marketing & analytics unit with usage-based pricing ― was the single biggest driver; it is now running at roughly $200 million ARR and growing north of 30 % year-on-year.

Commercial momentum is accelerating as Vault CRM scales: more than 80 customers are already live (up 28 in the quarter) and Veeva expects ~200 by next year, including three top-20 pharmas, even after the well-publicised Takeda defection to Salesforce.

Guidance was raised across revenue, billings and operating margin; roughly half of the lift comes from Crossix strength and half from a weaker dollar, with full-year EBIT margin now guided to 44 % versus 43 % prior.

Management acknowledges “macro” chatter (drug-pricing policy shifts, tighter biotech funding, geopolitical risk) but says it has seen no measurable impact on pipeline or results; the model’s long-dated, mission-critical subscriptions and Crossix’s quick-ROI profile are cited as buffers.

Competitive noise is confined to a handful of customized CRM deals (Pfizer earlier, Takeda now). Veeva argues that most customers favor the lower-code Vault path and that prior “boomerang” wins suggest churn may reverse once custom projects run over budget.

Optionality is building: first AI “agent” features (CRM Bot, MLR Bot) arrive in December, and the company’s first horizontal-market CRM application is slated for limited release by year-end.

Bull vs. Bear narrative:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.