TMTB Morning Wrap

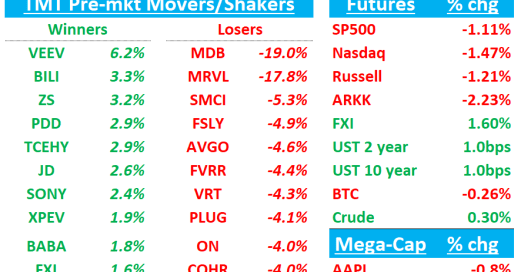

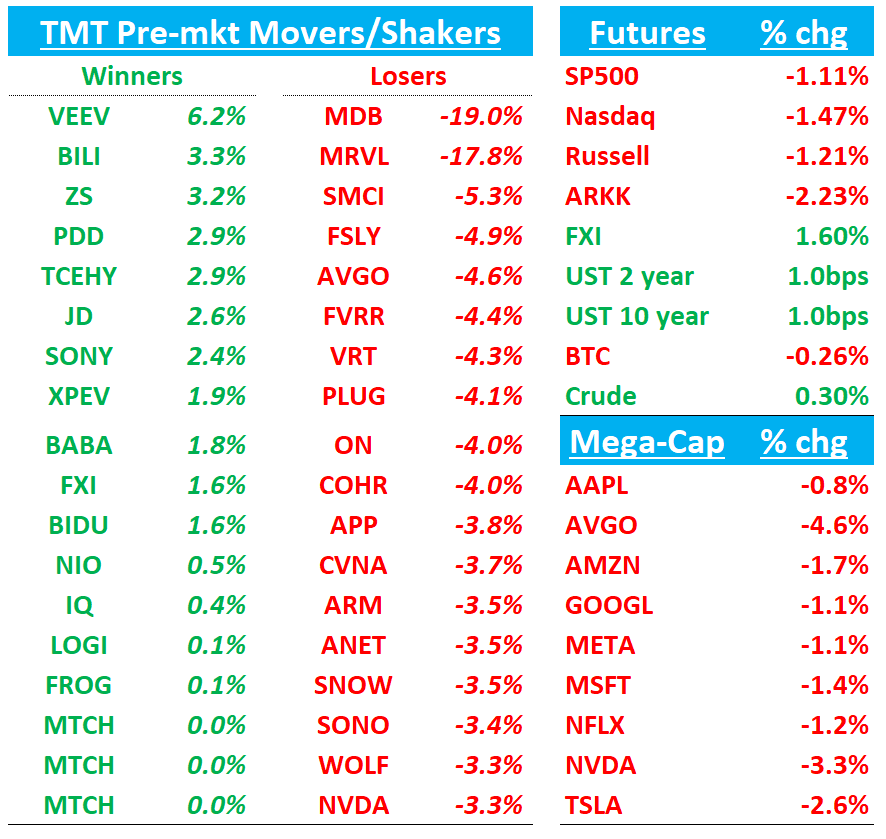

QQQs -1.4%. Not a great night for Tech as MRVL -18% and MDB -18% both missed. Layer on the news that China investing more in AI Tech and FT out saying MSFT pulling back some Coreweave commitments (coreweave has denied), and not the greatest morning for the (US) AI trade. China +1.6%. Yields ticking slightly higher. BTC flat.

Let’s get straight to it.

MDB -18%: Strong Q4 but Q1/FY weaker guide weighs on stock as investors tired of mgmt excuses

Q4 Beat with Atlas 24% y/y vs bogeys of 22% and street at 19%

Q1 Rev guide $524M - $529M vs street at 529M

FY26 FY guide 2.240B - 2.28B vs street at $2.33B

Bulls were expecting more from Q1/FY as FY guide only implying 12-13% growth, well below 19% seen in FY25. Mgmt explained the guide by blaming non-Atlas workloads and noting new customer ramp and Atlas consumption were actually better than expected: ““…we expect our non-Atlas business will represent a meaningful headwind to our growth in Fiscal 26 because we expect fewer multi-year deals and because we see that historically, non-Atlas customers are deploying more of their incremental workloads on Atlas.” $50M impact to EA, which is expected to decline in HSD%.. OPM guidance was down 300bps on “1) 50m of mulit year license rev doesn’t repeat which is roughly half of 500bps margin decline; 2) Ramping R&D spend + voyage acquisition; 3) marketing investment” (Citi)

Bulls will say that MDB has a history of guiding conservative with F24 initial guide at 16.4% —> actual = 31%….F25 initial guide at 13.8% —> actual = 19%. They’ll say mgmt had extra incentive to guide conservative given the ongoing CFO transition. So bulls say with initial guide at 12-13%, we still get high teens growth. Bulls will also say limited visibility into multi-year deals and ASC 606 accounting for EA has covered up otherwise strong growth in Atlas that is now 70% of sales and now a $1.5B ARR segment. Bulls will say the pace of new workload acquisition remains strong and mgmt still sees core Atlas growth in the low 20s for FY26 and with “ 1)Ramping usage on solid new workloads 2) Waning impact from weaker Q1FY25 consumption headwinds 3) Renewed focus on deep-pocketed strategic account expansion deals both improving in the q” (Barclays) there is a pathway for Atlas accelerating in Fy26.

Bears are tired of mgmt’s games on FY guidance, with this being the third straight year tepid rev guidance on ASC 606 noise and EA renewals has caused headaches for investors. You are getting increased pace of investments for lower growth. Mis-execution and low teens guide is not a great look for a co trading a 9x sales.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.