TMTB Morning Wrap

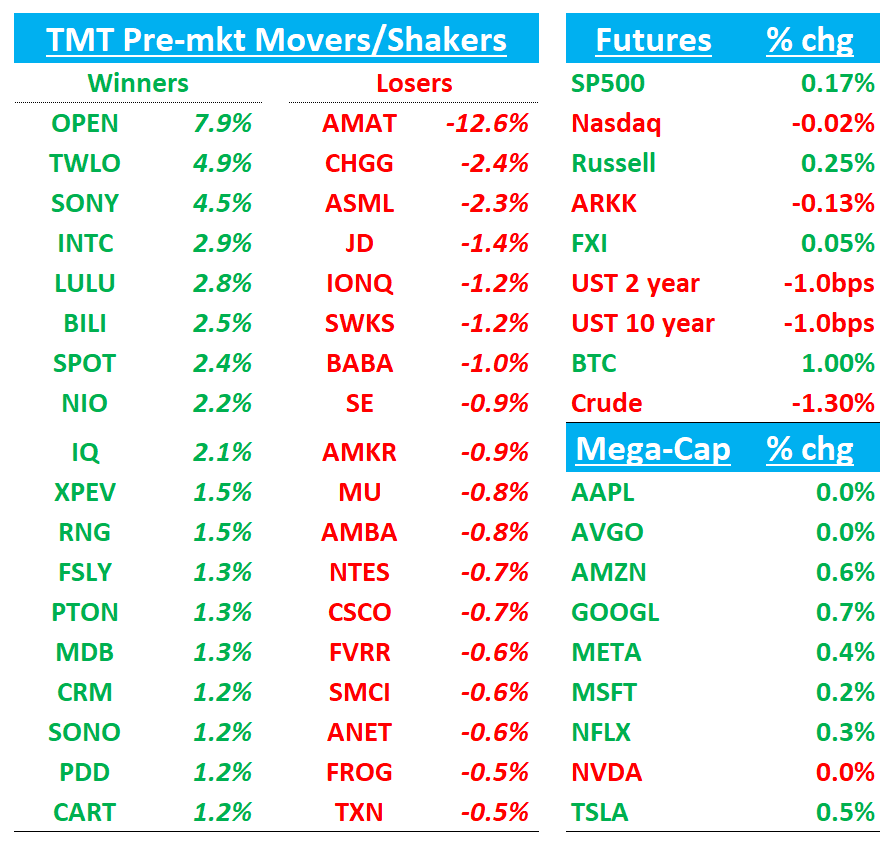

Good morning. Sleepy futures as QQQs hover around flat. BTC +1%.

We cover AMAT SNDK JD Earnings first, then get into research, where there are some interesting things out for a Friday in August…

AMAT -13%: JulQ beat overshadowed by weak OctQ guide on China digestion and lumpy leading‑edge demand

AMAT reported revenue/EPS beat modestly, but guidance miss which was the largest miss in years and reflects China digestion, a large backlog of export licenses assumed not approved, and non‑linear leading‑edge demand tied to concentrated customers/fab timing. Buyside was expecting a lot better and optimism had started to re-build on the stock recently so these results won’t go over well (can you say rug pull?) The call didn’t go great as mgmt said China “digestion” would continue for “several more quarters” and “its hard to give a specific guide".”

Q3 Guide:

Revenue $6.7B ± $0.5B vs. Street $7.32B;

non‑GAAP GM ~48.1% vs. Street 48.3%;

non‑GAAP EPS $2.11 ± $0.20 vs. Street $2.38

Other semi cap names getting hit early as well: KLAC -5.5%; LRCX -4.5%

Key Takeaways

China mix resetting lower near‑term. Management expects Q4 China ≈29% of revenue (incl. Display) and indicated China down ~15%–20% y/y and likely at that level “for the next few quarters.” Multinationals in China were noticeable in Jul‑Q but “very small” in Q4.

AMAT framed FY25 GAA revenue at ~$4.5B (from prior $5B view), estimates ~100k wpm of GAA capacity in the field, with ramps biased to 2H26–2027.

Management expects leading‑edge DRAM revenue up ~50% in FY25, with HBM growth ~30%–40% and ~15% of DRAM capacity allocated to HBM; they emphasized it’s not a blip.

Advanced Packaging on track to more than double to >$3B “over the next few years”; AMAT claims high share above overall WFE share.

AGS revenue $1.6B; core services +~10% y/y; >two‑thirds of service revenue is subscription and has grown 24 consecutive quarters.

Gross margin benefited from mix and pricing to offset tariff‑related headwinds; management flags policy/trade/tariffs as raising uncertainty and lowering visibility.

Largest guidance miss in years driven by China –$500M and leading‑edge –$500M, partly offset by non‑China ICAPS strength; some peers were firmer on China/LE visibility, sharpening the near‑term debate.

Bull vs Bear Debate:

Bulls say AMAT is structurally levered to AI’s manufacturing inflections—GAA/backside power, advanced DRAM/HBM, and advanced packaging—that expand its SAM and tilt value toward materials engineering where Applied is strong. Management expects multiple points of share gain as GAA ramps in 2H26–2027, DRAM up ~50% in FY25, and packaging to > $3B over the next few years; Services offers subscription durability and rising mix. Bulls argue the Oct‑Q reset reflects timing/linearity and China licensing conservatism, not a change in secular trajectory, and that valuation now embeds a discount to peers.

Bears aren’t buying it and say The largest guide miss in years hinges on two sensitive items: China (down to ~29%, with licenses assumed zero) and leading‑edge F/L (visibility “non‑linear,” customer concentration). Skeptics see risk that GAA spending cadence is slower than hoped (FY25 now $4.5B vs. prior $5B), that AMAT’s LE mix trails peers near‑term, and that policy/tariff frictions keep visibility low. Some bears also worry that WFE growth in CY26 could be tougher if INTC/Samsung stay soft and if China digestion lasts “several quarters.”

What this quarter specifically added: Bulls point to DRAM/HBM resilience despite the guide and to services/packaging strength as proof of durable earnings power; bears highlight the $500M leading‑edge shortfall plus China –$500M in Oct‑Q and management’s admission that customers are taking longer to commit, creating a shorter visibility window.

Key quotes:

we expect revenue and earnings to be sequentially lower in our fourth quarter, primarily due to uncertainties in our China business… The dynamic macroeconomic and policy environment, including trade and tariffs, has wide‑ranging implications for the semiconductor industry, increasing uncertainty and lowering visibility in the near term…

there are three main factors that mute our outlook… First is digestion of capacity in China. Second is our large backlog of pending export license applications… and we have taken a conservative position and assumed none of these licenses will be issued in the next quarter.

Gets a dg at BofA saying AMAT’s higher exposure to oversupplied mature node and certain leading-edge customers such as Intel (INTC) is impacting them more this part of the cycle. However, the firm suspects the slowdown is more company specific and doesn't see the same read-across KLAC or LRCX.

SNDK -9%: June beat; Sep revenue guide above but GM/EPS light on startup costs; pricing up amid tight NAND supply

Key takeaways

Beat on revenue/EPS, but Sep‑Q gross‑margin guide came in light on startup/under‑utilization costs, which management says step down materially by F3Q26.

Pricing actions are underway; several products are on allocation, and management expects mid‑single‑digit undersupply through FY26, supporting further price increases.

Data center traction improving: DC was >12% of bits in the quarter; 256TB UltraQLC NVMe eSSD now sampling; second hyperscaler in qualification (GB300).

BiCS8 node ramp is the 2026 pivot: ~7% of bits in Jun‑Q moving to 40–50% exiting FY26; near‑term cost headwinds turn to tailwinds as mix shifts.

Cloud/AI spend backdrop remains strong; mgmt cites U.S. hyperscale CapEx +47% y/y to ~$368B; demand expected to exceed supply through CY26.

mgmt monitoring potential “232% tariffs”; confident in ability to navigate.

The Numbers:

Q2:

Revenue of $1.90B +12% q/q, +8% y/y vs Street $1.82B;

gross margin 26.4% (incl. $51M underutilization, $42M fab startup) vs Street ~26.3%;

EPS $0.29 vs Street $0.05.

Bit growth +7% q/q vs guide for flat.

By segment: Cloud $213M +8% q/q (+25% y/y), Client $1.103B +19% q/q, Consumer $585M +2% q/q. Ex‑charges, GM would have been 31.3%. (Citi Figure 1 on p.3 shows Actual vs. Street; Barclays pp.2–3 detail segment mix.)

Q3 Guidance:

Sep‑Q (F1Q26) revenue $2.10–$2.20B (+13% q/q) vs Street $2.01B.

GM 28.5–29.5% vs Street 30.2%, including $10–$15M underutilization and ~$60M fab startup (mgmt: startup costs fall significantly by F3Q26).

EPS $0.70–$0.90 vs Street $0.91. Bit growth ~6–7%.

Bull vs Bear Debate:

The bulls argue SanDisk is entering a pricing‑led NAND upcycle with disciplined supply (products on allocation; mid‑single‑digit undersupply through FY26), while BiCS8 ramps toward 40–50% of bits and data‑center/AI demand expands (second hyperscaler, 256TB UltraQLC). Bulls also point to positive FCF, improving working capital, and undemanding valuation vs. peers. This quarter reinforced that setup: better‑than‑expected top‑line and an outlook implying units+ASPs drive Sep‑Q growth, even as gross margins are temporarily capped by startup/under‑utilization that management says fades by F3Q26.

The bears focus on the quality of margins (GM guide miss), rising cost per bit near‑term (startup & under‑utilization headwinds), long DC qualifications delaying revenue leverage, and pricing competition (including aggressive China players) or policy risks (tariffs). In this quarter, bears will focus on the GM miss vs. Street and that underlying cost/bit is still increasing low‑single‑digits q/q for the next couple quarters, plus the headline risk around “232% tariffs.”

JD -1%: Food delivery results + commentary slightly overshadow strong top line

BABA -1% as JD says JD says they won’t back down in food delivery, a 5/10/20-year initiative: “In the long‑term… this is a five, 10, even 20‑year initiative… We’ll focus on more refined subsidy strategy… and improve fulfillment efficiency to collectively improve the profitability of our Food Delivery business.”

Key takeaways

Beat on revenue; mixed on margin: Top‑line upside was broad‑based (1P E&A +23%, services +29%). Group margin compressed on food‑delivery losses despite core Retail OPM 4.5% expansion. JD guided order volume to grow QoQ in 3Q and is aiming for higher quality orders.

User growth inflecting: QAC >+40% y/y to a record; shopping frequency >+40%; Plus members >+50%—with food‑delivery as a major traffic source.

Marketplace/marketing +22% for the sixth straight quarter of acceleration; logistics & other +34% (food‑delivery) at an eight‑quarter high.

Management linked E&A strength to trade‑in subsidies and domestic demand recovery; no incremental tariff commentary on the call.

International optionality: Early‑stage Joybuy launch planned in Europe this year; proposed Ceconomy deal framed as supply‑chain + brand synergy.

Company emphasized AI adoption in logistics/automation and rapid iteration of dispatching/route algorithms for food delivery

Bull vs Bear Debate:

The bull case argues JD’s core Retail engine is accelerating—double‑digit growth across E&A and general merchandise, Retail OPM at 4.5%, and user metrics inflecting (active customers and frequency both >+40%). Bulls also point to services monetization (marketplace/marketing +22%) and policy‑assisted E&A demand as validation of JD’s supply‑chain moat and execution. They view food delivery as a strategic funnel that is already driving traffic, younger users, and cross‑sell into retail categories—i.e., near‑term losses for longer‑term ecosystem value.

The bear case focuses on profit dilution from the food‑delivery ramp, with Street pegging 2Q losses at RMB10–13bn, compressing group margins despite Retail’s strength. Bears worry that competition intensified in July, that unit economics remain uncertain, and that investment levels may stay elevated near term, delaying the margin recovery pathway. Some also flag FCF softness (LTM FCF down, partly from trade‑in cash outflows) and macro volatility once subsidy comps turn tougher. This quarter, bulls point to the broad‑based top‑line beat and user inflection, while bears point to the size and duration of the food‑delivery losses and the risk of a prolonged subsidy/price war.

RESEARCH/NEWS

MU/Samsung: News flow overnight continue to say Samsung close to NVDA qualification for HBM3E

'South Korean media outlets Alphabiz, Nate, and E-science.co.kr reported that Samsung and Nvidia have already reached a deal for the 12-high HBM3E, with shipments to be made in batches totaling 30,000–50,000 units. All units would reportedly be used in liquid-cooled servers to support high-performance AI workloads.'

'Separately, speculation is mounting in South Korea that Samsung Chairman Lee Jae-yong could meet Nvidia CEO Jensen Huang during his current trip to the US. Market sources suggest Lee may personally promote Samsung's semiconductor capabilities to secure quality certification for its HBM products and finalize a large-scale supply agreement with Nvidia

RBLX -4%: Oppenheimer Flags Near-Term Risk as “Schlep Gate” Controversy Builds

Oppenheimer warns Roblox faces heightened short-term risk as backlash over its ban of “vigilante” users—most notably one known as “Schlep”—spreads across social media. The firm notes Schlep claimed to have conducted sting operations that led to multiple arrests, but Roblox argued such unsanctioned activity had become risky and warranted enforcement. Since August 12, the dispute has been picked up over 140 times in global media, fueling hashtags like #FreeSchlep and #BoycottRoblox, with public responses so far failing to ease unrest. Oppenheimer likens the situation to Unity’s 2023 “Runtime Fee Gate,” where a policy move quickly escalated into a viral PR crisis. While maintaining an Outperform rating and long-term bullish view, the firm advises a defensive stance in the near term, looking for a better entry point once the controversy subsides.

RBLX: TD Cowen Flags Elevated Regulatory Risk After Louisiana AG Lawsuit

TD Cowen notes Louisiana Attorney General Liz Murrill has filed suit against Roblox, alleging the platform enables child predators, lacks adequate safety controls, and prioritizes profits over user safety. The case seeks to block Roblox from certain activities under the Louisiana Unfair Trade Practices Act, secure restitution, and impose civil and other penalties. The complaint cites multiple incidents, including a recent sting where law enforcement found a predator using voice-altering tech on the platform, and follows a series of prior cases alleging exploitation of minors. TD Cowen says having a state AG involved significantly raises the risk profile and could prompt similar suits from other states. The firm adds that, beyond legal damages, such actions may push parents to more closely restrict children’s Roblox usage, creating potential engagement headwinds.

TickerTrends has a full rundown of the controversy

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.