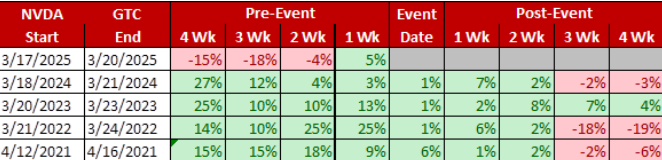

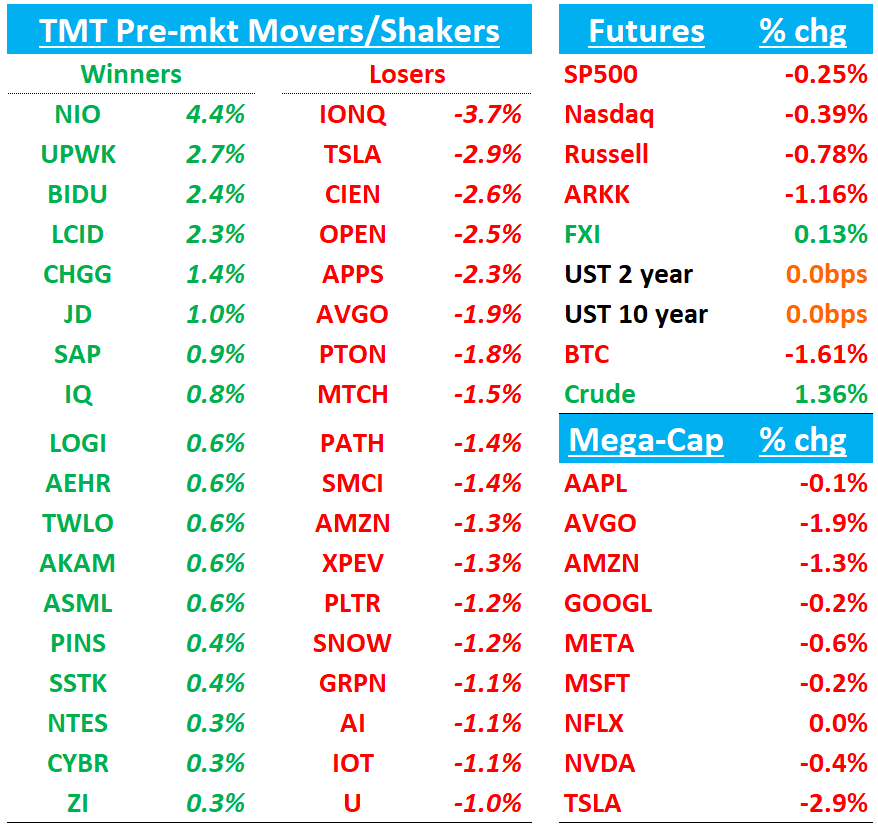

Good morning. QQQs -40bps starting the day off in the red. BTC -1.5%; China flat; yields flattish. All eyes on Jensen at 1pm est. keynote (link) and Powell tomorrow. Rocha from Wells looks at NVDA’s performance leading into and out of GTC:

Let’s get straight to it:

AAPL: ISI deep dives into AAPL, raises PT to $275 from $260

Evercore believes investors fixate on iPhone growth while overlooking AAPL's consistent EPS/FCF expansion via margins, operating leverage, and buybacks. The firm notes AAPL can monetize AI without heavy GPU investments. Evercore examines growth catalysts (Emerging Markets, Apple Intelligence, Healthcare, Ads, Payments), iPhone dynamics, services growth (12%+ achievable), wearables potential, margin levers, and regulatory challenges comign away with the belief that AAPL is positioned to remain a Tech staple that “should sustainable grow revs mid-single digits and EPS/FCF low/mid teens over the next few years. Evercore maintains AAPL can sustain or expand valuation given strong FCF generation and 100% shareholder returns, setting BULL case at $375.

Third Party Data Roundup:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.