TMTB Morning Wrap

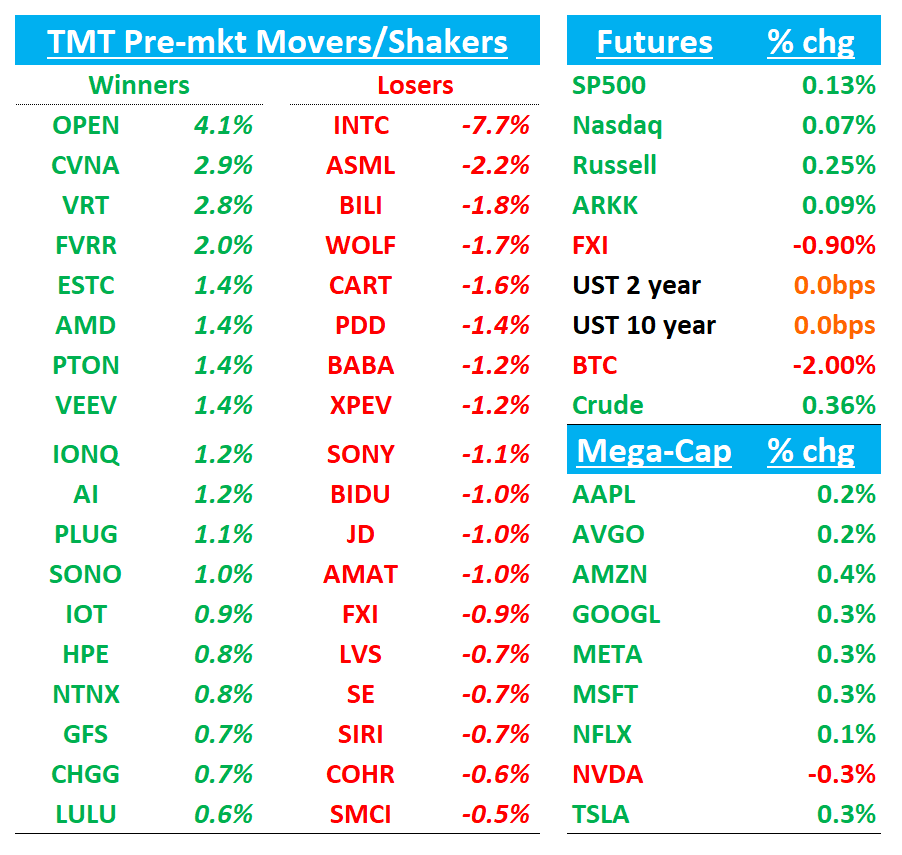

QQQs hovering near flat on what’s a nice slow summer Friday ahead of next week, which will see most big companies in Tech report EPS.

Yields flattish. BTC -2%. China -1%.

Slow news day, but let’s get to it…Have a good Friday!

INTC -7%: Questions around 14A outweigh top line beat/guide up

I continue to hear very little on INTC, and the very little I hear come from the short side. We continue to find the stock unexciting either. Details below….

The co beat led by Client and DC and Q3 was guided above street driven by moderate sequential growth in CCG and slight growth in DC. Co expects GM of 46% for Q3 due to continued elevated mix of outsourced wafers, a headwind that likely continues through ‘26 before 18A ramps more meaningfully

While headline results met expectations, Intel now appears to be positioning 18A as a “long” node spanning three product generations, with less clarity and conviction behind 14A. Previously pitched as a game-changing internal and foundry platform, 14A now hinges on securing a major external customer, which management is not yet committing capacity toward without firm demand, so its unclear if they will develop leading edge mfg capability or not and all likely hinges on landing a big customer in the next 12-18 months. CEO Lip-Bu Tan was clear that he won’t greenlight new capacity investment without firm volume commitments and a clear ROI—neither of which currently exists.

Intel reaffirmed its 2025 gross CapEx guidance of $18B but significantly lowered its outlook for 2026, and noted ‘26 capex will still remain well above basic “maintenance” levels (estimated around $9B)..street coming out at around $13-$14B. Not great for semi-cap.

CVNA: Oppenheimer Upgrades to Outperform, Sees $450 PT (30x EBITDA) on Improved Profit Model and Long-Term Leverage

Oppenheimer raised Carvana to Outperform with a $450 price target, citing a significantly improved business model now “humming” following operational and financial restructuring. The firm’s Q2 adj. EBITDA estimate of $561M beats Street at $532M and reflects momentum in cost efficiency and unit sales. Oppenheimer’s adjusted EBITDA forecasts for 2026 and 2027 ($2.9B and $3.6B) are also well ahead of consensus, driven by improved unit volumes and sustained margin gains. Oppenheimer notes that CVNA still holds a small share of the massive U.S. used car market and sees substantial longer-term upside as the company targets 3M annual units and $14.5B in EBITDA over 5–10 years.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.