TMTB MORNING WRAP

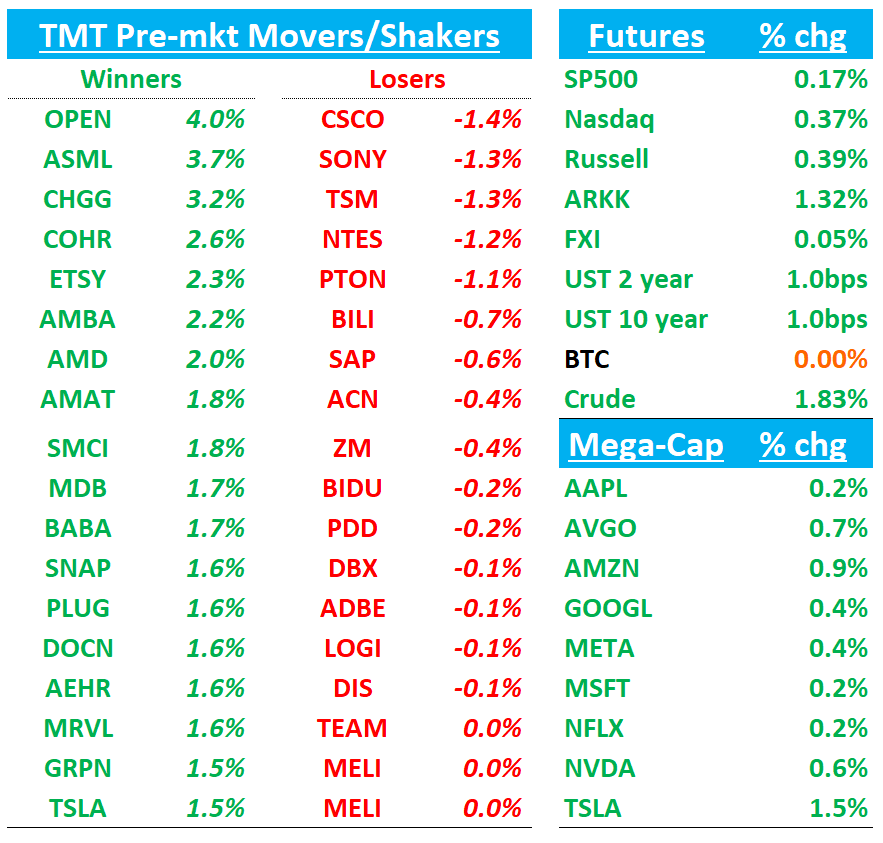

QQQs+37bps although well off their highs as US/EU agreement over the weekend and China/US tariff 90 day pushout helping push up stocks this morning. As part the EU deal, EU will face 15% tariffs on most of its exports to the US, including autos, and has agreed to purchase $750bn in American energy products/invest $600bn in the US. Bessent and China meeting in Stockholm this morning.

The macro calendar this week is full: FOMC decision (Wed afternoon),US PCE for June (Thurs morning), and US jobs report for Jul (Fri morning). Expectations for FOMC are for a similar sounding PR as before (resilient growth + uptick in inflation keeping them on the sidelines) but we likely get a dovish dissent in Waller and any mention of improved clarity on tariffs will be interpreted as a dovish pivot (h/t VitalKnowledge)

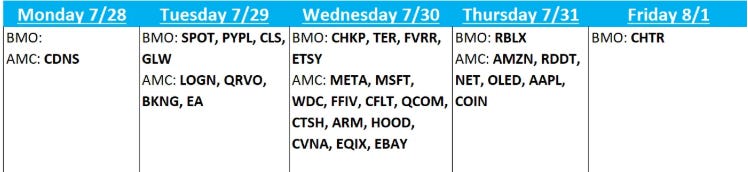

Big week Earnings ahead of us in Tech…

The coming week is packed with reports that should help fill in some blanks in tech as Q3 gets under way. Expect meaningful updates across a wide spectrum: a clearer picture of hyperscaler capex trajectories (META, MSFT, AMZN), critical reads on the pace and breadth of cloud growth (watch reaction in off-cycle names like SNOW, MDB, DDOG in reaction to CFLT, AMZN, MSFT), fresh signals from the digital ad ecosystem as we head into 2H after troughing in April (META, RDDT, AMZN, RBLX), signals on AI native demand (NET), and more clarity on potential demand pull-forwards for mobile (AAPL).

We’ll also find out if retail meme mania continues: According to Citadel’s desk, retail activity has been a buyer of cash equities for the past 19 straight trading sessions. This is the longest daily buying streak in the past 4 years (since March 2021) and 5th longest streak.

Should be lots of fun…

But first, lots to get to today, so let’s dive straight in:

Samsung/TSLA: Samsung to Make Tesla AI Chips in Multiyear Texas Deal

Samsung +6% on the news overnight as its a big win and a big deal for Samsung with assumptions they were done in logic.

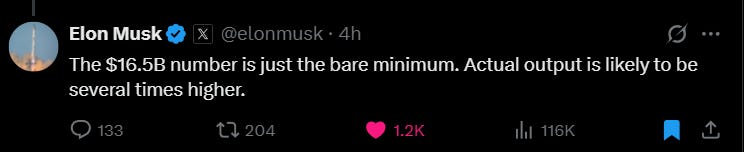

Samsung Electronics Co. will produce AI semiconductors for Tesla Inc. in a new $16.5 billion pact that marks a win for its underperforming foundry division.

South Korea’s largest company announced on Monday that it secured the 22.8 trillion won chipmaking agreement, which will run through the end of 2033. The plan is for an upcoming plant in Taylor, Texas, to produce Tesla’s next-generation AI6 chip

While the contract may represent a small share of foundry revenue annually, it holds greater value as a catalyst for technological refinement and innovation over the long run, according to Ryu Young-ho, an analyst at NH Investment & Securities Co. It also helps burnish Samsung’s reputation as the strongest TSMC alternative at a time when Intel Corp. is struggling to win over investors skeptical about its long-term strategy and road map.

CLSA notes the deal, tied to Tesla’s AI and robotics efforts, represents ~7.6% of Samsung’s 2024 revenue and ~86% of Foundry/LSI sales, contributing ~2.7T KRW annually. CLSA says the win signals regained confidence in Samsung’s advanced node capabilities and could spark follow-on deals. After years of share loss to TSMC and steep foundry losses (5.6T KRW in 2024, 6.6T KRW expected in 2025), this marks a turning point. CLSA believes the contract justifies further investment and could support a multiple re-rating as concerns about profitability fade.

The L Samsung / S Hynix (-1.5% overnight)/MU pair trade — which has become popular among HFs give hopes for Samsung HBM3E 12hi qualification - continues to work. The Samsung chart continues to breakout:

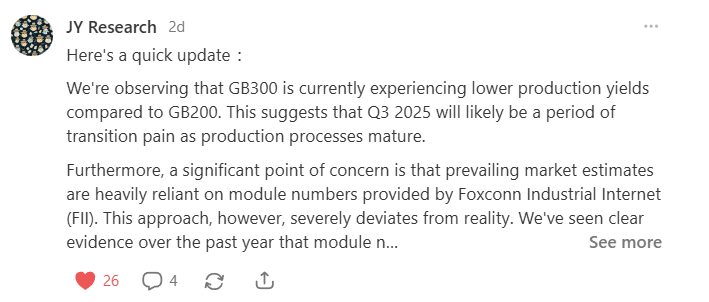

NVDA: JY Research calls out lower production yields in GB300

AMD: Asia press (and some X accounts passing around) that AMD increases price of chip by $10 to $25k, although doesn’t seem new and just taken from HSBC upgrade couple weeks ago.

Stock continues to breakout as investors get more excited about 2H/’26 set up and AI demand datapoints continue to be on fire

MDB: BMO Initiates at Outperform, Sees AI Tailwinds Driving Upside to $280

BMO Capital launched coverage on MongoDB with an Outperform rating and $280 price target, citing its leadership in the fast-growing non-relational database space. BMO sees MongoDB well-positioned to benefit from rising generative AI adoption and expects 20%+ Atlas growth to continue over the next several years. The firm views the current valuation as appealing and says consistent execution could drive upside vs. consensus. BMO adds that multiple catalysts are in play, making risk/reward attractive at current levels.

RBLX: PT Raised to $131 on 2Q/3Q Bookings Revisions and Positive User Trends

Analysts lifted their Roblox price target to $131 following updates to 2Q/3Q Bookings estimates and strong July user activity. They now expect 2Q Bookings of $1.355B (+42% y/y) and 3Q at $1.479B (+31% y/y), reflecting stronger-than-expected performance from "Grow a Garden" and favorable FX impacts. July showed mid-to-high-teens growth in daily active users versus June, driven by title engagement, ongoing DevEx investment, and seasonal patterns. Analysts say 2Q tracking data may overstate active user growth, but underlying platform health remains robust. At ~$45–60 valuation ranges for DAU and 30x on '28 EBITDA, they see upside to shares even after the recent rally.

CEO Interview by Sherwood here over the weekend….

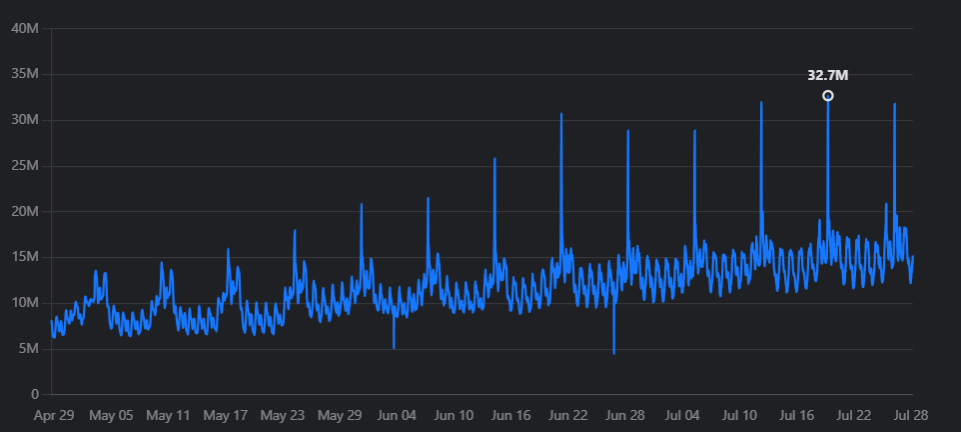

Expectations are high for the print this week, but trends remain strong in Q3 so far:

TXN: Wolfe Upgrades to Outperform, Sees FCF Upside as Capex Winds Down

Wolfe Research upgraded Texas Instruments to Outperform with a $230 price target, citing the nearing end of its multi-year capex cycle. Analyst Chris Caso expects this shift to unlock free cash flow and margin expansion starting in 2027. In the near term, Wolfe sees TXN benefiting from a cyclical rebound in analog demand, improving the setup for both fundamentals and valuation.

TTWO: Wells Fargo Initiates at Overweight, $265 PT on GTA 6 Tailwinds and RCS Upside

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.