TMTB Morning Wrap

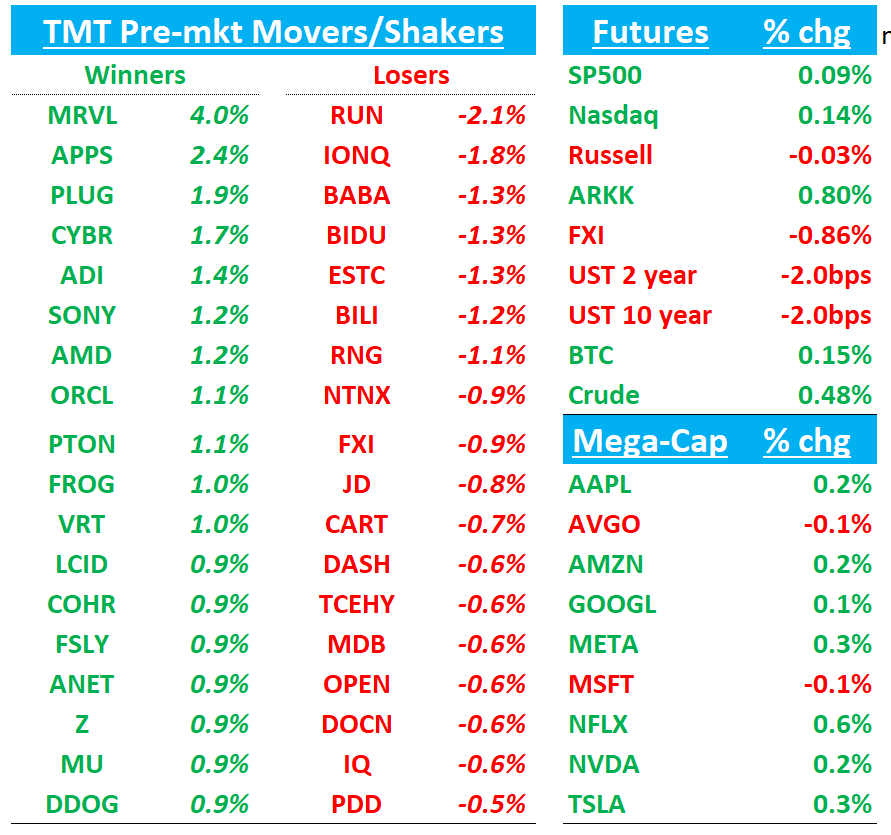

Good morning. QQQs +20bps, BTC flat, China -1%. Yields ticking down slightly. Market remains on its toes regarding any Trump potential intervention in the Israel/Iran conflict.

Lots to get to, so let’s get straight to it…

MRVL: Most of street generally positive on AI Custom Day…here’s a few recaps…

MRVL: BofA Raises PT to $90, Sees $8 EPS Power in CY28 on Broadening AI Pipeline

BofA reiterated a Buy on MRVL and raised its price target to $90 from $80, citing growing AI capex as a major tailwind and a more diverse pipeline supporting long-term EPS growth. MRVL now expects $8 in EPS power by CY28—60% above current consensus—driven by 50+ new opportunities and expanded customer engagement, including 18 unique XPU attach sockets across 10+ customers. Marvell is also benefiting from a stronger position in data center compute, growing its share to 20%, and sees total AI TAM reaching $94B by CY28 (up 26% y/y, excluding HBM), notes the BofA analyst. BofA believes these updates could re-rate the stock, currently trading at 23x NTM EPS, below its historical average.

MRVL: UBS Maintains Buy, $100 PT as New XPU Wins Support $3B+ Annual Rev Upside by C2028

UBS maintained a Buy rating and $100 price target on MRVL following updates to its custom compute outlook. MRVL raised its CY28 DC TAM forecast to $94B (+25% vs. prior $75B), with $55B tied to accelerated compute. Management reiterated its 20% DC share target, implying up to $19B in total DC revenue and $11B+ in compute-specific upside. MRVL also disclosed 6 new XPU socket wins across 18 total sockets and over 50 pipeline opportunities, many tied to emerging hyperscalers—likely including xAI and TSLA. UBS also highlighted “XPU attach” (PMICs, NICs, and other chips) as a faster-growing $14.6B segment with a 90% 4-year CAGR, suggesting $4B–$6B of revenue potential from current engagements.

MRVL: Rosenblatt Reiterates Buy, Sees 77% Upside on $94B AI TAM and Custom ASIC Leadership

Rosenblatt reiterated a Buy on Marvell (MRVL) with a $124 price target, citing the company's strong positioning in custom AI infrastructure and its expanded $94B TAM (up from $75B). Management now targets 20% market share, up from 13%, driven by its leadership across SerDes, chiplets, networking, packaging, and silicon photonics. The firm believes MRVL is targeting the most profitable AI opportunities and stands out among ASIC providers for its ability to scale and deliver customer success. Rosenblatt sees continued earnings leverage and reaffirms MRVL as a top pick in AI infrastructure.

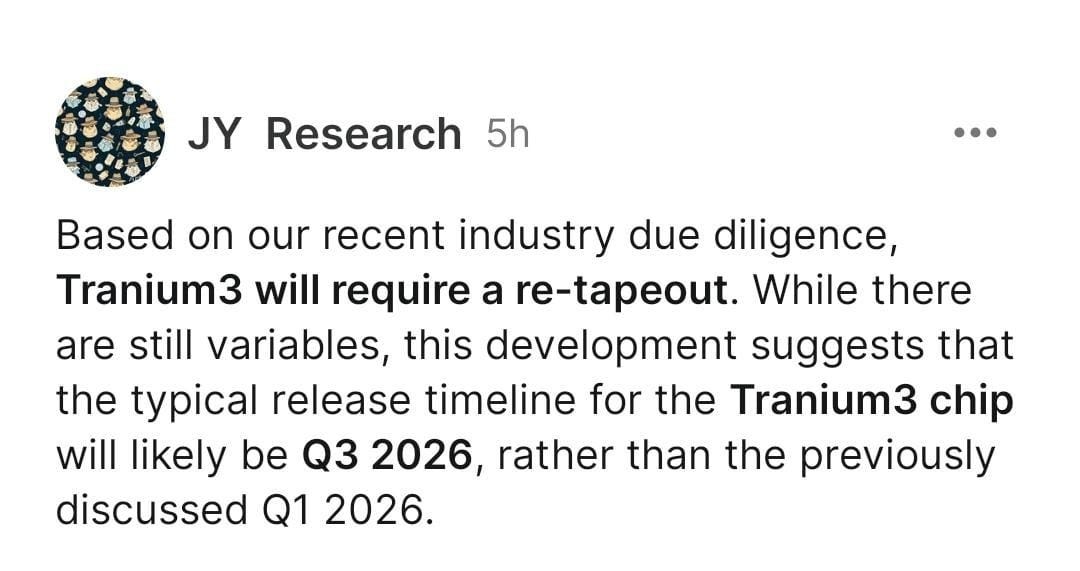

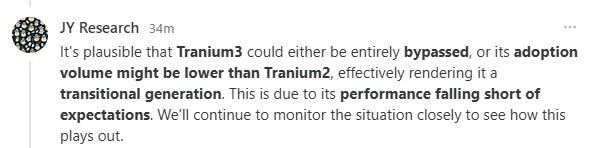

JY Research saying Trn3 pushed back a bit…

Good for MRVL as means early ‘26 likely more de-risked

THIRD PARTY DATA ROUNDUP

AMZN: Clev says Q2 retail sales appear steady while Edgewater says Q2 positoined for upside as NA retail improves. Weirdly, Clev says cloud industry demand better but tone on “AWS-specific sounds slightly worse vs previous update” while edgewater says AWS growth consistent q/q. Edgewater says AMZN 2H outlook remains less certain given tariffs

GOOGL: Edgewater positive on search saying most agencies describe a resilient demand environment

CART: Yipit says GTV tracing ~1ppt above street

UPST: Yipit says loan volume growth significantly accelerated in May

Wukong: AMD MI350 Shipping Early; Amazon and OpenAI Ties Deepening after small group meetign with company

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.