TMTB Morning Wrap

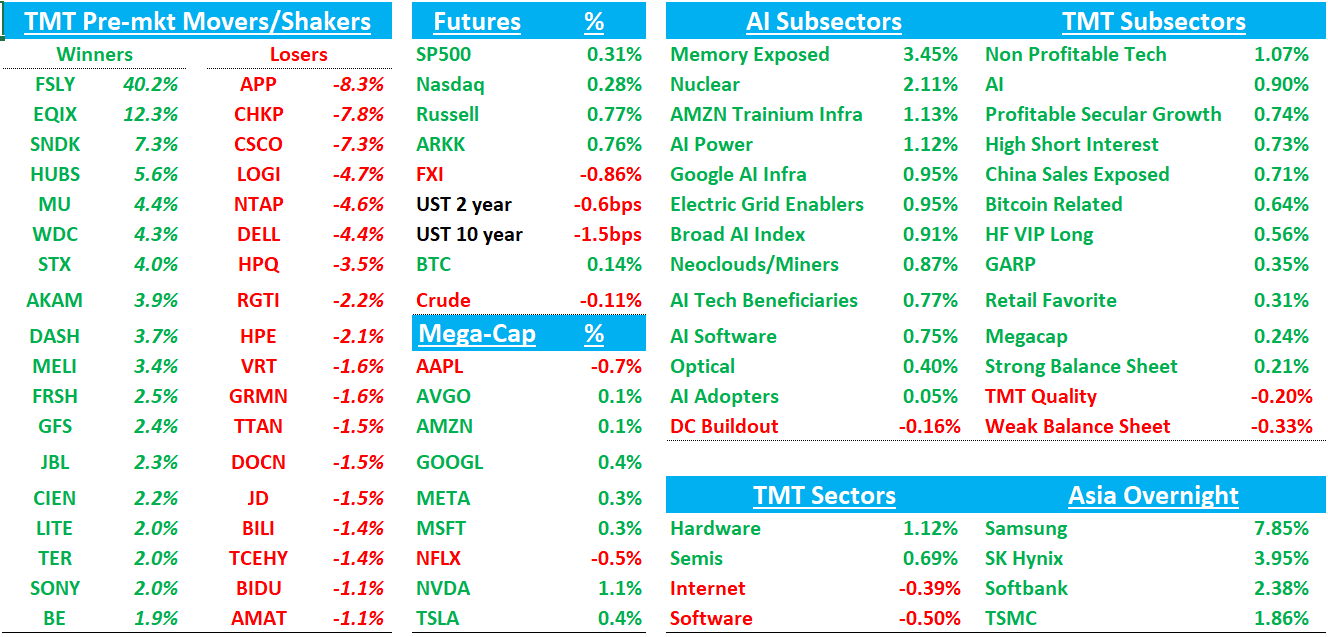

Good morning. QQQs +23bps. Asia mixed although memory names up with Samsung +8%, Kioxia +10%, etc: TPX +0.7%, NKY -0.02%, Hang Seng -0.86%, HSCEI -1%, SHCOMP +0.05%, Shenzhen +0.51%, Korea KOSPI +3.13%. BTC flat. Yields slightly down.

Lenovo -5% in HK after calling out margin pressures. This follows CSCO -8% who also called out GM headwinds. Both of these (along with a neg BofA note) is hitting IT Hw names (NTAP/DELL/HPQ -4%)

Memory names leading the way up early with SNDK +7% MU +4% WDC/STX +4%

We’ll hit APP CSCO HUBS earnings first, then onto the usual…

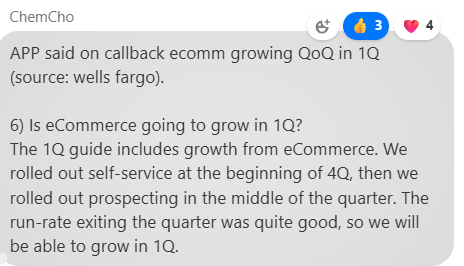

APP -8%: Beat-and-raise with Q1 revs roughly inline with bogeys, but investors were hoping for more on e‑commerce/ web ads scaling. Full Ecom G-A seems a few months away.

The #s:

Q4 Revenue $1.658B, +66% y/y (last q +68% y/y) vs Street $1.62B, +~62% y/y.

Adj. EBITDA $1.399B, +82% y/y vs Street $1.33B, +~73% y/y; margin 84.4% vs Street ~82%

GAAP EPS $3.24 vs Street $2.94–$2.95

1Q26 guide: Revenue $1.745–$1.775B (mid $1.760B, +~52% y/y) vs Street ~$1.70–$1.71B;

Adj. EBITDA $1.465–$1.495B (mid $1.480B) vs Street ~$1.39B (implying ~84% margin).

Key Takeaways:

On ecomm, Mgmt didn’t quantify Ecomm saying Ecom wasn’t large enought impact overall numbers…mgmt said they “won’t break out e-commerce revenue,” and “if gaming model improves 50%, e-commerce model might be affected, so no need to separate”

Management reiterated timelines around opening up self‑serve more broadly (and talked about improving the onboarding/conversion funnel first), but also tempered near‑term expectations by framing early GA months as not immediately needle‑moving given the scale of the business today.

Mgmt cited ~57% of qualified leads converting to active advertisers (expects improvement) and indicated CAC payback is now fully recouped over 30+ days. On GenAI creative, APP has a 100+ customer pilot for the “interactive page” unit and plans a similar pilot for the initial video portion; they view GenAI as important to feed AXON with more creatives (Ecom has only hundreds of assets vs gaming’s thousands) and said they’re still months away from a “v1” of GenAI.

The CloudX commentary leaned heavily on MAX’s IP/identity advantages, implying it’s hard for a competitor to match the RoAS advertisers see on APP. In Q&A, mgmt suggested MAX terms wouldn’t permit “first-look” inventory access in a way MAX couldn’t bid into fairly, hinting at a potential technical/publisher dispute, consistent with prior chatter that some publishers weren’t sold on the CloudX setup.

Mgmt said MAX install rates are notably higher than 1% described 1+ year ago, but still far below 5% which is the goal

On META / iOS, they expect META to start bidding into non-IDFA traffic over coming quarters (the remaining ~1/3 of MAX impressions META doesn’t currently bid on), but don’t expect an outsized impact given APP’s 1P advantages from seeing cross-industry impressions. They reminded that META’s share of industry impressions is likely far below the old ~50% era (they framed it as potentially ~10% max in IDFA/Android). If META bids up, APP could better identify true high-value impressions, route lower-value elsewhere, and still collect the $0.05 “MAX tax” on the back end—though they didn’t really address a scenario where META overbids to “land grab,” and admitted it’s unclear if that’s META’s plan.

Bull vs Bear debate:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.