TMTB MORNING WRAP

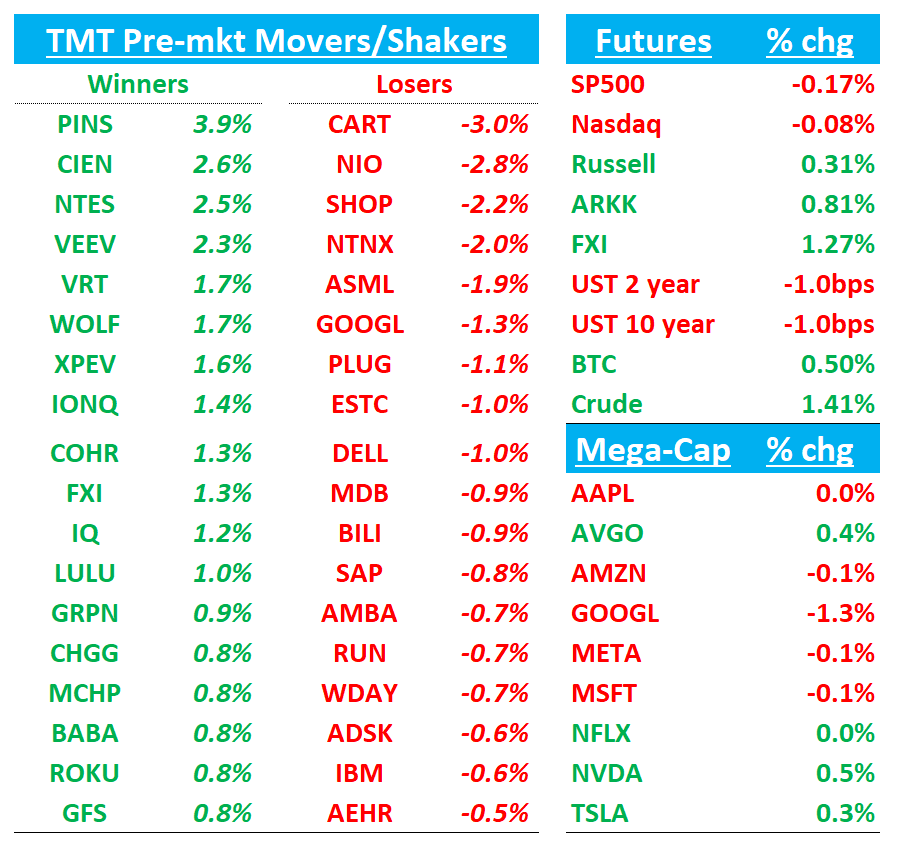

QQQs hovering around flat, BTC +50bps; China +1%; yields dipping slightly.

Lots to get to so let’s get straight to it…

PINS: Pinterest upgraded to Overweight from Neutral at JPMorgan

JPMorgan upgraded Pinterest to Overweight with a $40 price target (from $35), citing improved execution and a favorable setup. While the stock has outperformed year-to-date, it’s still down 18% from February highs. JPM says the company is delivering on 2023 investor day goals—boosting users, engagement, and monetization—while driving profitable growth. Pinterest is effectively using full-funnel ad tools and automation to tap into broader ad budgets. With potential estimate upside and what JPM calls “lukewarm” investor positioning, the firm sees an attractive risk/reward.

XYZ: Block upgraded to Outperform from In Line at Evercore ISI

Evercore ISI upgraded Block to Outperform from In Line and raised its price target to $75 (from $58), reflecting 21% upside. The firm now sees Cash App lending as more measured than initially feared post-Q1, with follow-up checks easing concerns about aggressive expansion into riskier segments. Evercore cites better visibility into Block's balance of growth and risk, along with steady low-end consumer spending and stable unemployment deposits. New Square product launches are also seen as positive signals for innovation and long-term growth. Overall, the firm sees improved risk/reward and stronger execution ahead.

CRDO +15%: Another Beat-and-raise Q

Revenue beat by ~6 % ($170 M vs $160 M); GM beat by 340 bp (67.4 % vs 64 %); EPS beat by $0.08 ($0.35 vs $0.27).

July guidance is ~17 % above Street on revenue ($190 M vs $163 M) and ~10 bp stronger on GM, with implied EPS roughly $0.10 ahead.

The company also set an FY26 revenue bar “above $800 million,” (vs street at $700M) implying ~85 % growth and net margin approaching 40 %.

Key takeaways

April out-performance was driven by Active Electrical Cables (AEC) and by the first meaningful contributions from Microsoft and xAI; Amazon’s share slid to 61 % of revenue from 86 %, easing concentration risk, a main previous gripe for investors.

Three separate hyperscalers were already 10 %+ customers; management expects three-to-four such customers each quarter and says two more hyperscalers will ramp in 2H FY26.

AEC demand tied to AI server scale-out remains the growth engine, but an 800 G optical-DSP win at a U.S. hyperscaler should more than double optical revenue in FY26, adding a second leg to the story.

Gross-margin leverage from volume lifted GM 350 bp sequentially; mix should pull GM back toward the high end of the LT model (63-65 %), yet management now believes scale can keep GM “at or above” that range.

Tariff policy remains a “fluid” risk factor; FY26 guidance assumes no material change in current U.S.–China duties.

Bulls much louder this morning as another great q from CRDO as not much to nitpick in the numbers and lower concentration risk helps alleviate one of key points:

Bulls argue that the quarter validated Credo’s pivot from a one-customer story to a multihyperscaler growth platform: three 10 % customers already, two more ramping, an 85 % top-line growth target, and expanding exposure to optical DSP and PCIe retimers. They also point to 65 %-plus gross margins and operating leverage that could lift net margins toward 40 %, a profile rare among small-cap semis.

Bears counter that Amazon is still the majority of revenue and that any pause in the Trainium-2 build or a slower-than-expected 800 G migration could be an overhang; they also worry that Broadcom and Marvell, with integrated switch/DSP road-maps, may blunt Credo’s pricing power. Valuation—already >13× FY26 sales—and the overhang of potential tariff or export-control surprises remain top of mind.

AAPL, GOOGL, Perplexity: Apple reportedly plans to adopt Perplexity as an alternative to Google Search on the iPhone, as well as a replacement for ChatGPT integration in the Siri voice assistant – Economic Daily

ACN: Announces earnings date on the morning of Friday June 20th

Rocha at Wells this morning saying that’s weird, especially as it’s a day after market holiday Juneteenth — he thinks bad news could be coming.

ASML: Barclays downgrades to Hold

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.