TMTB Morning Wrap

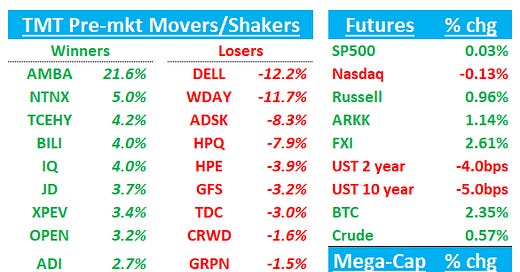

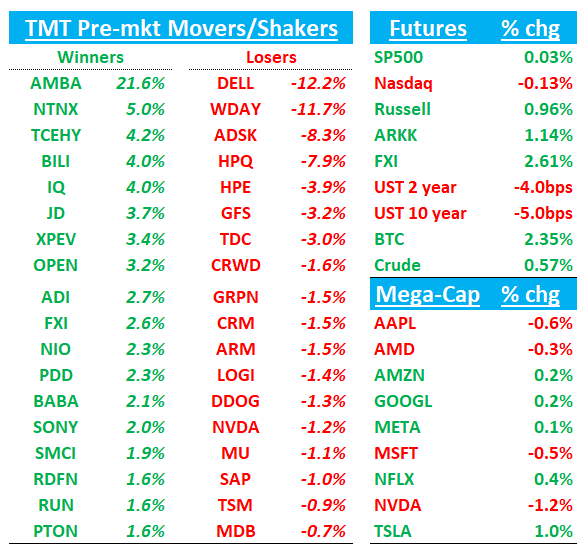

QQQs - 13bps on what will be one of slower volume days of the year. Still have some earnings to go over this morning (DELL, WDAY, CRWD, NTNX, HPQ, ADSK). We’ll go over those first then get to research/news. DELL/HPQ confirmed PC refresh cycle is on hold for now…DELL AI story seems intact but let’s see if we get Michael Dell and Silver selling post-q like we have seen the last few; WDAY lowered #s after just two months since analyst day; CRWD looked mixed but overall bull case intact there; ADSK seeing some selling driven by new CFO appt but #s overall looked ok.

China +2%; BTC +2.3. Treasuries have a bid this morning with yields down 4-5bps across the curve. Fed rate cut expectations have risen to 65%, likely helped by FOMC minutes on Tuesday.

This will be the last post for the week. Happy Thanksgiving! Grateful for all you readers and hope you have a great one!

Let’s get to it…

DELL: Q3 miss driven and Q4 revs guided $1B below street with mgmt citing delayed PC upgrade cycle and push-out in AI server deliveries due to BW. AI Backlog/ISG storage margins better however

Positioning leaned long heading into the print so the miss and guide down not a great look, despite AI orders and storage margins coming in better. Overall, #s disappointing given high expectations heading in, but key KPIs beat and commentary was positive which could keep 2025 AI story alive after a reset (Bulls hope SMCI share gains show up in Apr Q) although bull case on 2025 PC refresh takes a hit. Let’s also remember we’ve seen Michael Dell/Silverlake be in the market selling stock for a few weeks post-earnings the last several quarters which has pressured the stock:

More details:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.