TMTB Morning Wrap

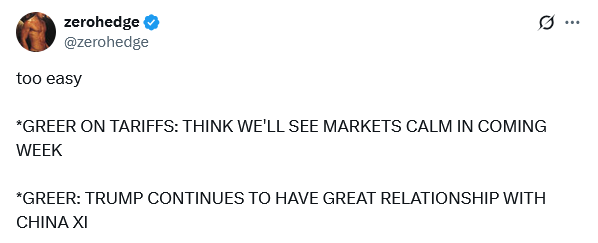

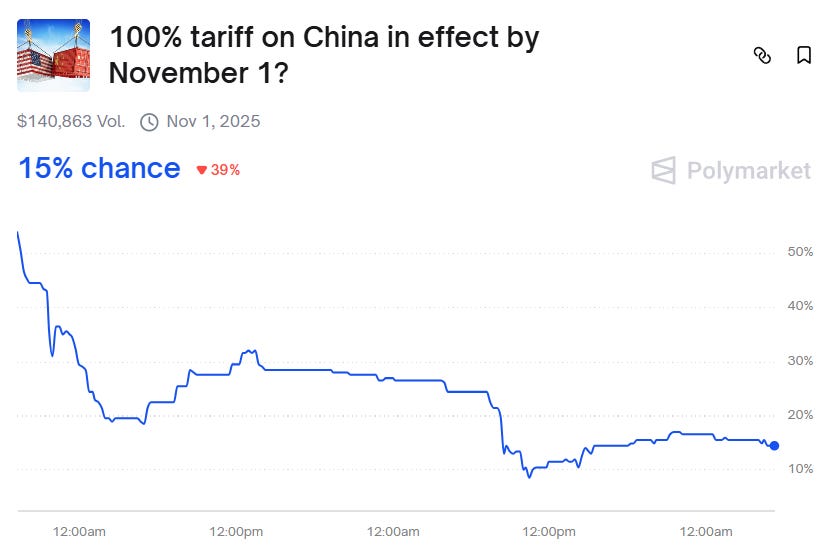

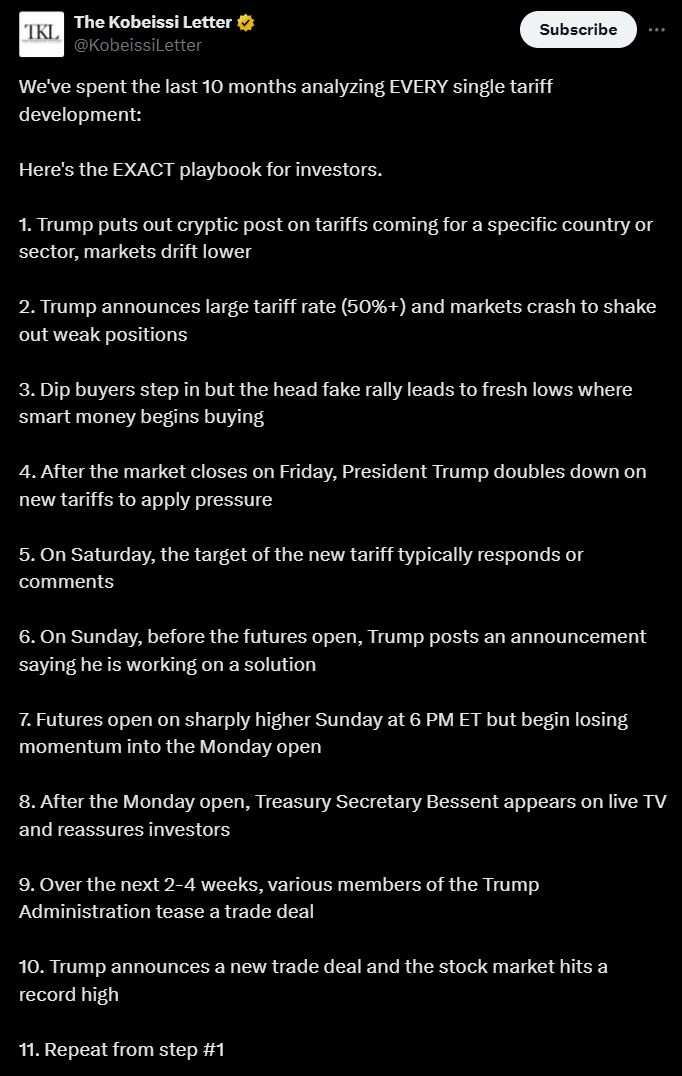

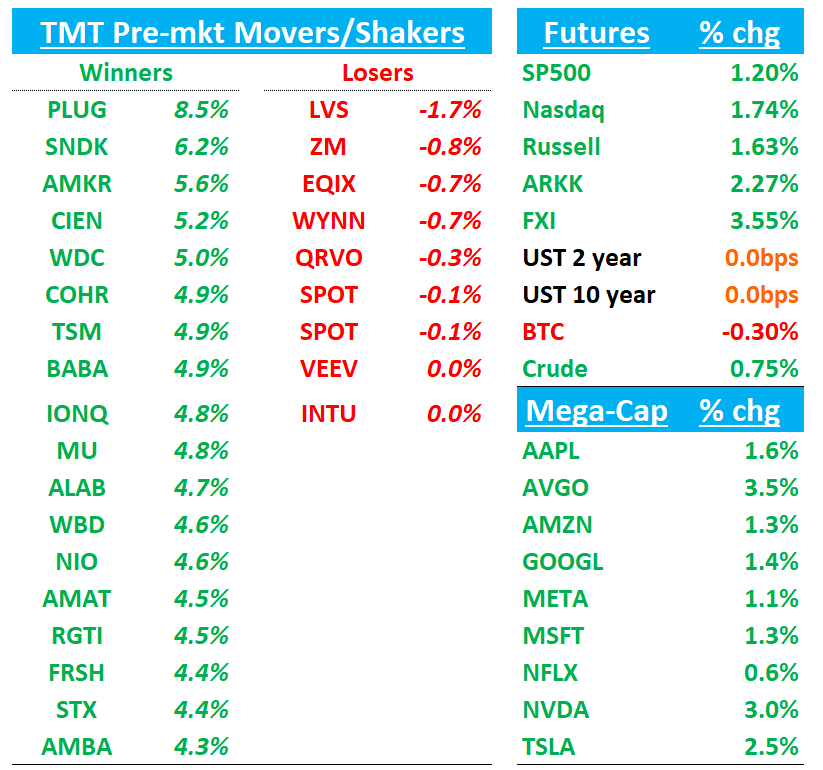

Good morning. QQQs +1.7% as we got some good TACO over the weekend from Trump + Xi. China played down significant of its latest rare earth restrictions over the weekend and Trump and team did their best to assuage investors:

BESSENT (this morning): “There was substantial communication over the weekend.” “There will be lots of staff-level meetings. They are neither going to command nor control us….We don’t want to decouple but China is sending a decoupling message. Everything’s on the table [incl. delisting China ADRs], but confident that this can be de-escalated If not, we have substantial levers we can pull…. We could move more aggressively than how China has….This Is China Vs World” “We Won’t Let China Export Restrictions Go On” “We expect support from India and others. We believe China is open to discussion on this.”

Busy week in Tech before earnings really kick into full gear. NET Connect and ORCL World start today with ORCL Financial Analyst Day on Thursday. CRM’s Dreamforce starts tomorrow with their investor Day on Wednesday. HPE Analyst day on Wednesday. ASML and TSM Earnings Wed/Thurs as well.

ORCL: All AI eyes focused on the Analyst Day on Thursday, especially after the huge RPO/IaaS #s ORCL provided on the last earnings call. Most investor focus will be on what mgmt says about margins, especially after the controversial TheInformation article last week that talked down GMs. Buyside right now seems to be hovering around a ~25% GM number. It’s unclear whether we get detailed guidance specifically around GMs, but investors want to hear a plausible glidepath to ~25%+ and generally expecting some sort of EBIT/EPS target by FY30 (buyside around $20 EPS in FY30) — IR has implied as much in communications to investors over the past few weeks. This is a mgmt/IR team which has done a great job getting people to believe the dream and most are expecting them to sounds great and do their best to get investors comfortable with margins and growth (bulls hoping mgmt says they have "firm “non-cancellable” commitments from OAI and others), so in general have heard investors leaning long into it.

HPE: This is the event bulls have been playing for as stock has rallied from low 20s to 26 on hopes that HPE will present a compelling medium term framework here and maybe a slight raise to synergies target of $600M - remember the bull case is that post-JNPR the pro-forma co should re-rate something closer to ~13x+ given larger portion of networking biz which deserves a higher multiple and bulls think $3+ is possible in ‘27.

CRM: Haven’t heard a lot of conversations around this name heading into Dreamforce as investor interest continues to be muted — nothing near-term to get them excited about a potential acceleration back to DD growth although the “bulls” I talk to point to bombed out valuation (15x FCF) and sentiment. Most aren’t expecting and PnL/margin frameworks although they did give some out at their last investor day in 2022. Bulls will focus on commentary/details around Agentforce where Benioff will do his best to get investors excited about the LT opportunity (last KPIs we got was 12.5/6k closed upaid/paid deals in Q2 and $100Mm ARR in Q1).

Lots to get to, so lets get to it:

BE +30%: Bloom Energy Shares Soar on $5 Billion Brookfield AI Partnership

Bloomberg:

Shares of Bloom Energy Corp. soared as much as 36% in premarket trading as Brookfield Corp. agreed to invest up to $5 billion to deploy the company’s fuel cells at new data centers that operate artificial intelligence.

The investment firm and the energy storage company are collaborating on AI data centers globally, including a site in Europe that will be announced before the end of the year, according to a release Monday. Bloom will become the preferred onsite power provider for Brookfield’s global AI data centers.

META: Citi Adds to 90-Day Catalyst Watch; IG Ad Load Expands, Engagement and ROAS Improvin

The firm’s 3Q25 tracking shows IG Sponsored Reels ad load rose 230bps Q/Q to 27.1%, the fastest pace since 4Q22, with IG monthly active users surpassing 3B+ in September. Citi notes Meta’s ad products are driving higher ROAS and conversion rates, aided by investments in AI foundation models and monetization efforts across WhatsApp, Threads, and Business AI. The firm views the online ad backdrop as healthy, expecting Meta to gain incremental share, with 4Q guidance likely implying mid-to-high teens sequential revenue growth and continued expense discipline into FY25.

GOOGL/META/AMZN: Jefferies Ad Checks Show Google Leading on AI Efficiency; Meta Mixed, Amazon Gaining DSP Share

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.