TMTB Morning Wrap

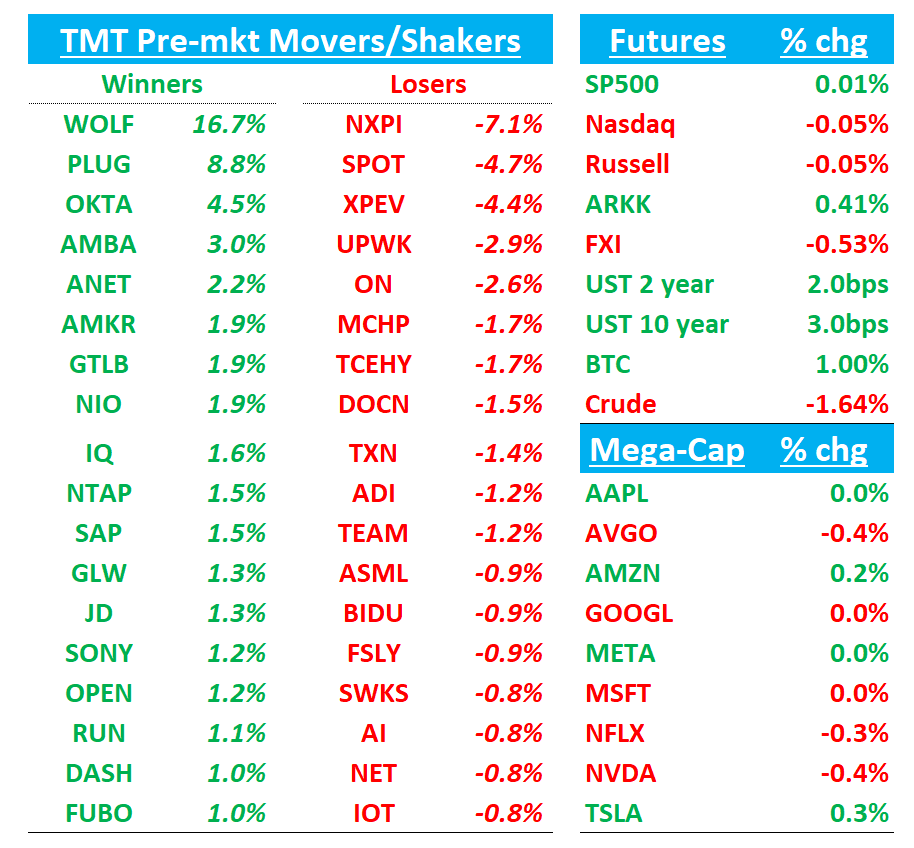

Good morning. QQQs -4bps, BTC +50bps, China -50bps, yields slightly higher.

Earnings first then Research/News/3p. Lots to get to, so let’s get straight to it…(excuse typos pls)

EARNINGS

SPOT -5%: Inline revs but ad supported MAUs and GMs and operating income below street (mainly social charges). MAU and Op Inc guide below street. Q2 total prem subs adds at 2M below whispers closer to 5M+

This has been a darling for internet investors (+35% YTD with 35x multiple), with sentiment buoyed by lack of tariff/China exposure over the recent few weeks so the miss on certain line items and lower magnitude beat on others vs. prev q’s not the best look. Investors have become accustomed to big GM/op inc beats here so will likely take a bit of the wind off sails for a bit, although nothing thesis changing here so far.

Mgmt commentary: “The underlying data at the moment is very healthy: engagement remains high, retention is strong, and thanks to our freemium model, people have the flexibility to stay with us.”

Call ongoing

SPOT GUIDANCE: Q2

- Guides monthly active users 689M, EST 694.38M

- Guides operating income EU539M, EST EU553.2M

- Guides revenue EU4.3B, EST EU4.38B

- Guides total premium subscribers 273M, EST 271.41M

- Guides gross margin 31.5%, EST 31.6%

RESULTS: Q1

- Operating income EU509M

- Revenue EU4.19B, EST EU4.21B

- Premium revenue EU3.77B, EST EU3.79B

- Gross margin 31.6%, EST 31.5%

- Monthly active users 678M, EST 679.04M

- Total premium subscribers 268M, EST 265.22M

- Ad-supported MAUs 423M, EST 426.32M

- Average rev. per user EU4.73, EST EU4.79

- EPS EU1.07

CDNS -40bps: Solid Q1 with Inline guide and FY raise (F25 revs now +12% from +11% and EPS up 8c to $6.78)

Management reported ~$850M in total orders, well above expectations on stronger software deals, and increased their buyback. Customer behavior remains steady despite the trade war (saying no impact to tariffs), similar to 2018–19. The co expects secular drivers to remain intact in the near term, with GenAI among the key opportunities driving future growth as uncertain macro tempers sentiments, but management noted no change in customer behavior.

Mgmt called out strong leading-edge chip design activity , third-gen hardware is early in its ramp, and IP sales are gaining momentum. Despite +19% YoY China revenue growth, management is guiding flattish for China in 2H.

Stock had run up into the print, but this should be good enough and guide looks conservative. Bulls will like the print focused on no tariff impact, point to strong AI orders from ByteDance and Alibaba and strength in auto, recurring revenue, better buybacks, and a conservative guide which doesn’t include much for China despite beat this q or ARM Artisan IP acquisition

Next Catalyst: CadenceLive 2025 on 5/7

NXPI -7%: Revenue guide ok, but GM in Q1/Q2 missed, Autos weak, channel inventory high and CEO is leaving

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.