TMTB: Morning Wrap

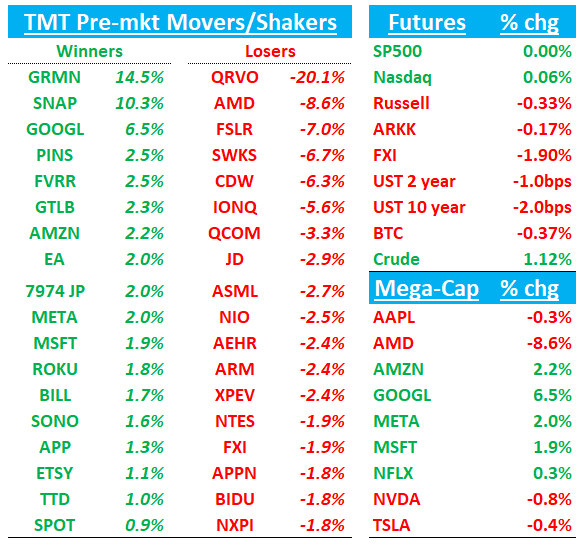

Good morning. QQQs flattish as yields tick lower. China -2%; BTC - 70bps. Market continues to price in 44bps worth of cuts throughout the end of the year. DXY dn 30bps vs EUR on some better eco data of europe (better GCP pin France, Germany, Spain). We get META and MSFT among others this afternoon.

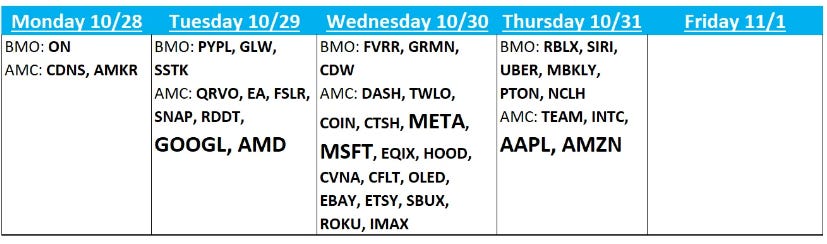

Main thing to go over this morning is earnings: GOOGL, RDDT, SNAP, RDDT, QRVO, GRMN, FVRR. Not a ton on the research/3p side other than that. Let’s get to it…

GOOGL +6%: Great print with 2% rev beat despite 1%+ fx headwind; search 12.2% inline vs bogeys of 12% and street at 11.5%; GCP 6ppt accel; OI with the big 7% beat

YT was inline. Capex inline at $13B.

I thought the call went well, particularly with it being the first call with new CFO who mentioned efficiency being priority #1, saying that opex savings will help offset increased capital spend:

“Now all of that will go against substantial increases in capital investment that I've mentioned going into 2025. And again, I'll give more color when we are on the Q4 call. So hopefully, we'll be able to drive efficiencies to work towards offsetting some or all of that increase.”

Lots of talk of AI innovation and Waymo as well.

Cloud grew 35%, a 6ppt accel with incremental margins of 50%+. Cloud now makes up 13% of the total biz, which means 4ppt+ of growth is being driven by cloud and that # likely only increases going forward.

In terms of capex, GOOG guided Q4 to be flat to Q3 and said 2025 will see substantial increases with the growth rate not being same step up between 23 and 24, which is going to grow 55%. So let’s call it somewhere between 30-45%, which means the capex # likely to land somewhere between ~$60-$70B.

Search was only inline and close to a 1.6% decel on a 6ppt tougher comp. The comp only gets 1.7ppts tougher next q, so that would point to potential accel next q, which bodes well for the multiple.

Buyside numbers for 2025 moving up to $9.25+ and ‘26 looking closer to $10.50+

Stock ug to buy at Seaport.

TMTB’s take: We were long into the print and we are taking some profits this morning but also keeping a portion on as we think the stock can continue to work (although it’s not a super exciting long for us). Our view on GOOGL’s stock has boiled down to this over the last year and a half: When search is tracking ahead, bears face an up hill battle to prove that GOOGL faces structural search issues and headlines around AI competition like Perplexity/ChatGPT/META matter less. Well, 3p search data currently tracking a couple ppts ahead so far in Q4. In addition, as mentioned above, we think GOOGL has the potential to accelerate search growth next q and is showing that AI innovation in search (better ROAS, AI overviews, PMax, etc.) can add enough contribution to offset any current share loss. Add on to that more of a focus on efficiency, GCP accel’ing and becoming a bigger part of the biz with 50%+ incremental margins and an increasing focus on Waymo in ‘25, we think 20x ‘26 EPS of $10.50 = $210 is a good base case, with something closer to 22-23x in a more bullish case. Regulatory issues are an overhang but unlikely to get any incremental news on that until early 2025. If search data changes we’ll change our mind as we definitely view the structural fears around search as real, but for now we think path of least resistance is up.

In terms of read-through, GCP #s look good for AMZN AWS and MSFT’s Azure.

Search was inline so neutral read for META, PINS, etc. SNAP did call out softness in brand advertising and retail which doesn’t read great for PINS. Also called out weakness in Entertainment (potentially -ve ROKU)

Flat capex in Q4 neutral for AI semis, but bigger 2025 capex # good.

RDDT +22%: Amazing print beating bullish buyside bogeys definitively

We didn’t find much to nitpick here…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.